In today’s financial landscape, personalization is no longer a luxury; it’s a customer expectation. Yet, according to Adobe’s latest State of Customer Experience in Financial Services in an AI-Driven World report, only 36% of the customer journey is currently personalized, despite 74% of financial services executives acknowledging that their customers expect tailored interactions.

This gap isn’t just a missed opportunity; it’s a trust breaker.

Why Personalization Matters More Than Ever

Financial decisions are deeply personal. Whether a customer is exploring mortgage options, planning for retirement, or managing small business finances, they expect advice and experiences that reflect their unique goals and life stage. Generic nudges and one-size-fits-all messaging simply don’t cut it anymore.

Early-stage interactions—like product discovery or financial education—are especially critical. These are high-value moments where relevance builds trust and guides decision-making. Yet many institutions fall short, lacking the orchestration needed to deliver personalized engagement across these initial touchpoints.

What’s Holding Institutions Back?

The report highlights several barriers:

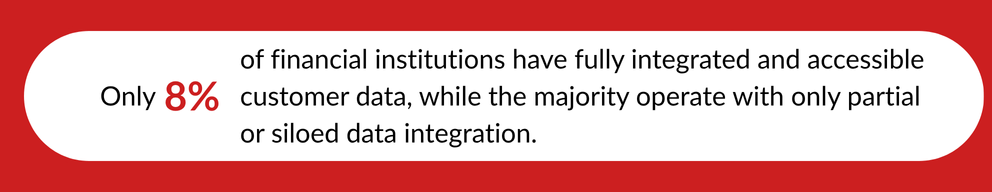

- Fragmented data systems that prevent a unified view of the customer

- Legacy operating models that prioritize product silos over customer journeys

- Compliance concerns that limit personalization efforts, even when customers expect it

These challenges are compounded by the rise of AI-powered experiences, which demand real-time, context-aware personalization across channels.

The Path Forward: Adaptive, Lifecycle Personalization

To close the gap, financial institutions must evolve from episodic personalization to adaptive, full-lifecycle engagement. That means:

- Investing in unified customer profiles and behavioral insights

- Building real-time content engines that respond to customer signals

- Designing personalization strategies that grow with the relationship and not just the transaction

Download the full Adobe report to explore the top 10 insights shaping the future of financial services, and discover how your organization can lead with intelligence, responsibility, and trust.

Learn About Perficient and Adobe’s Partnership

Are you looking for a partner to help you transform and modernize your technology strategy? Perficient and Adobe bring together deep industry expertise and powerful experience technologies to help financial services organizations unify data, orchestrate journeys, and deliver customer-centric experiences that build trust and drive growth.