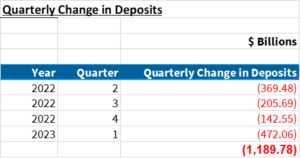

On May 31, the Federal Deposit Insurance Corporation (FDIC) reported to the public what many banks already knew and had been experiencing for the past year – that deposits are declining in the American banking sector.

There has almost been $1.2 Trillion removed from the banking system over the past year. In addition, the recent banking stress, which resulted in several large bank failures, has amplified the outflow of deposits from the banking system, causing total deposits to decline for the fourth consecutive quarter at a faster rate than in prior quarters. Although not substantiated by published figures in their report, the FDIC did state that deposit outflows have moderated since the end of the quarter.

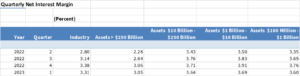

Of course, one reason that deposits have left the banking system is that while the Federal Reserve raised rates throughout the four quarters shown above, banks have lagged in raising deposit rates. However, the difference began to wane in the first quarter of 2023. As interest rates that banks earned on their loans increased, the interest rates they paid on deposits increased by a larger amount in the first quarter of 2023, which contributed to lower quarterly net interest margins for the industry as shown below:

Note that while Net Margin shrank by only 1 basis point for the largest financial institutions, mid-sized and smaller banks had their margins whittled away in the first quarter by far larger amounts.

Positives (Or Less Negative Than Before)

Unrealized losses on held-to-maturity securities totaled $284.0 billion in the first quarter. Unrealized losses on available-for-sale securities totaled $231.6 billion in the first quarter. While more than $.5 Trillion of unrealized losses lurking on the bank industry’s balance sheet is certainly bad news (except for in the eyes of analysts who have been kept busy trying to determine which institutions are at-risk) the positive spin is that the amount of unrealized losses actually declined by $102.2 billion (16.5%) in the first quarter of 2023.

Perficient’s Response

At the request and urging of several significant bank clients, Perficient is now offering a cross-functional Banking Crisis Service Offering, combining financial analysis, social media monitoring, and IT changes including artificial intelligence offerings that:

- Automates the orchestration of data mining, reporting, and generation of actionable insights to replace labor-intensive, manual reporting and analysis using discrete data from multiple sources.

- Uses social media and market sentiment analytics to assess market sentiment and generate prescriptive insights on threats to brand reputation.

- Conducts continuous assessments of key customers for deposit outflow risks and 360° customer value to direct targeted campaigns to those customers and/or specific market segments.

- Coordinates multi-channel campaigns with personalized, targeted messaging for social media influencers, analysts, key customers, and employees.

- Enables automated and on-demand reporting to provide more timely and granular information to investors such as deposit details, customer concentrations, liquidity immediately available vs contingent liquidity sources, and loans by collateral and CRE segment to better evaluate risk and boost institution responsiveness.

Contact Perficient’s financial services team today to learn more about this product offering.