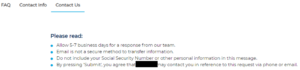

What’s the right amount of time a customer should wait to hear back from a financial services institution? Most people would agree that 5-7 business days is unacceptable. I recently came across the message below from a nationwide mortgage lender and servicer and was shocked to see this response:

Customer service isn’t new in financial services. In fact, massive customer service teams have played an essential role for decades. What’s changed are customer expectations. They’re significantly higher because of advancing technology and experiences consumers encounter with brands outside the industry.

These two reasons alone have created the need for instant gratification. Zendesk says 65% of customers expect service to be faster than it was five years ago. And when consumers don’t get this experience, they tend to produce negative feelings about the brands that can’t deliver.

COVID-19 has increasingly exacerbated customers’ expectations for quick response times, not to mention successful resolutions. Consumers point to “long wait times” and “no response at all” as the crux of the matter, according to research from Twilio. The impact is so significant that inadequate customer service and, therefore, bad customer experiences often push consumers to new brands.

How Financial Service Institutions Can Bridge the Gap

In banking and insurance, albeit not as significant in the airline and healthcare industries, there’s a big gap between customer expectations and the customer experience. It doesn’t have to be that way.

An incredible number of solutions exist—think AI-powered chatbots and self-service tools—that any company can stand up quickly. If small, local stores can embrace technology and offer wonderful digital experiences, so can the big FSIs.

Don’t get me wrong. Implementing a customer engagement platform that can humanize the experience (either through voice, text, chat, video, or email) can be complicated. For large financial services institutions, you have to cater to a large customer base and promote a broad portfolio of products and services. Still, there’s no reason in this day and age that companies can’t respond to customer requests quickly and on their terms.

Scott Albahary, who is Perficient’s Financial Services Chief Strategist, recently spoke with Arvind Murali, Perficient’s Data Chief Strategist, about the current state of affairs in financial services. Scott also knows a little something about the customer service space, having led CRM and call center solutions for Arthur Andersen in the late 1990s. For his perspective—from Covid-19’s impact to personalization to cybersecurity—listen to our newest podcast, and let us know what you think.