My previous blog analyzed customer intelligence and the benefits it provides. This blog will show the benefits of personalization and outline what’s required to implement a personalization program.

Financial services companies that have implemented personalization report positive results, including:

- 60% increase in revenue per customer

- 81% increase in customer retention

- 87% increase in customer engagement

- 75% increase in sales conversions

Those are significant figures! So much so that 60% of financial services companies are implementing a personalization strategy, 70% expect to increase personalization budgets, over 70% will invest in personalization technology, and 70% are getting a positive ROI.

These companies are experimenting aggressively with personalized search experiences, attribute-based contact routing, custom call scripting, and social media text analysis to know when and what to communicate to consumers, predict actions, optimize offers, and identify when they are ready to buy.

Challenges Require an Overhaul of Systems, Processes, and Leadership

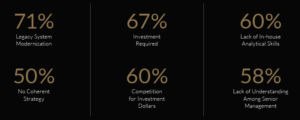

Financial services companies report the following challenges to implementing personalization, which will require overhauling systems, processes, and leadership.

As mentioned earlier, it’s all about the data and how it is managed and analyzed. It’s complex and challenging, and most financial services companies know this. In fact, only 7% feel they offer advanced levels of personalization within their digital applications, 75% consider themselves “not adept” at using AI to provide next-best-action recommendations, and 51% consider data analytics a significant challenge.

The challenges financial services companies face in building a customer intelligence ecosystem are broad-based, encompassing technology, skills, strategy, investment, and education.

Data typically resides in multiple siloed environments. Because data is not meaningfully connected across these silos, it is less accessible and thus compromises insight into customers, partners, products, and sales channels.

Data silos often are reinforced by organizational silos. Different groups manage different data, and teams use different tools and, in many cases, rarely interact with one another. Fragmented databases make it difficult to organize information and create 360-degree customer profiles.

Legacy IT systems are often unable to measure responses or recommend next-best actions, while complex organizational structures and silos undermine coherence and focus.

The traditional business intelligence infrastructure that most financial services companies have built can no longer keep up with analytics needs. These solutions cannot handle the growth of new data types like images, audio, and video, and they do not give users insight into data origins or transformations applied. There are also an increasing number of business processes and analytics solutions that require real-time data access to support decision making.

Financial services companies want to develop more personalized marketing capabilities, but those not taking a customer intelligence approach and building an appropriate analytics ecosystem are missing a strategic opportunity for real differentiation. Because it is an ecosystem, it is comprised of many different solutions that need to be seamlessly integrated. This makes it imperative that all stakeholders are educated on the benefits, as well as the investments required, to build this ecosystem.

To learn more about the state of personalization in financial services and how you can begin to leverage customer intelligence to champion personalization and win over customers, download our guide here.