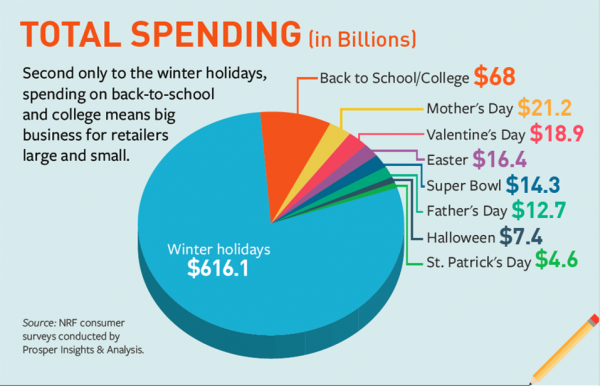

Back-to-school shopping season struggled in 2014 with the slowest sales growth since 2009 and with retail sales dipping .3% last month (Commerce Department report), the industry is off to a challenging start for 2015. With families spending about 5.8% less on BTS items this year, NRF projects that 2015 BTS spending will drop from last year. Other researchers projections, such as the International Council of Shopping centers expects to see 67% of parents to spend more on BTS shopping than last year. NRF’s projects seem daunting for the retail industry with the BTS season often indicating holiday sales.

Omni-channel

As we talked about in previous posts, consumers will utilize the web for just more than discounted offers. Consumers will be looking for deals, free shipping, expedited delivery, pick-up-in-store options, and much more.

“That’s the trend we’re seeing this year – this omni-chanel trend where customers are using both the site and the store” Demos Parneros, President, Staples Inc.

NRF asked shoppers about how they plan to use retailer’s omni-channel offerings this 2015 BTS shopping season and found the following results:

Planning to shop online:

- 4% plan to BOPUS

- 3% look for expedited shipping

- 1% take advantage of free shipping offers

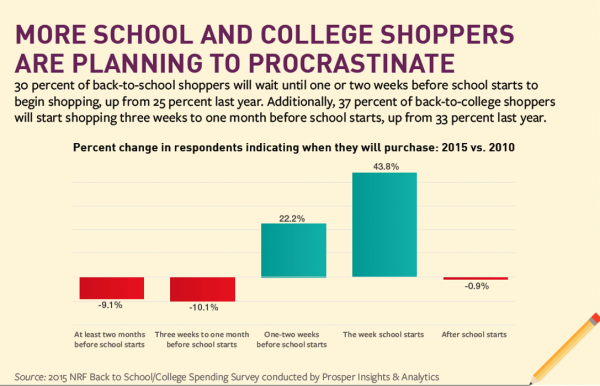

Parents and teenagers are constantly on the go and look to any possibly way they can ease their chaotic schedules. With long shopping lists, its only natural that they will seek out the best deals, convenience of online search and shopping, free shipping and even same-day delivery. These options allow shoppers to also procrastinate in shopping so we may see an increase in sales later in the BTS shopping season.

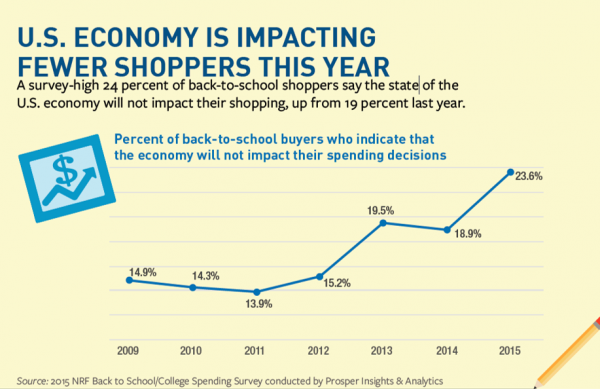

Economy

The economy has a lot to do with consumer spending and as the economy improves, the lower the impact on consumer spending habits. As the economy has improved with growth in jobs and consumer confidence, the impact on consumer spending could be very positive. A NRF survey found that 40.6% of consumers that believe the economy is impacting the way they shop will look for sales more often, down from 6% from 2014, the lowest since 2009.

Back-to-college

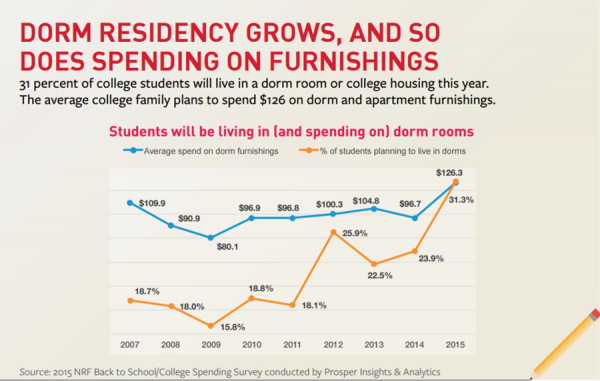

With a lot of college shoppers and parents investing money in electronics and supplies in 2014, NRF reports that families will spend slightly less this season with an average of $899 spent down from $916 last year. But college students and families tend to spend money on a lot of different things when shopping for college. Retailers will provide offers on items such as decor, apparel, furniture – all items that college studens utilize in a dorm room. NRF’s survey reports that 51% of college shoppers will buy apartment or dorm furnishings spending 30% more than last year.

NRF and the International Council of Shopping Centers are reporting contrasting predictions. ICSC expects 67% of parents to spend more on BTS shopping while NRF reports that families splurged last year and we should see about a 5.8% decrease this season. With conflicting reports, only time will tell to see if consumers end up spending more or less than last year in the BTS shopping season. We will check back in September once sales are in!