I recently came across a book for bank and financial marketers written by Jay Kassing, one of the world’s most respected data analytics experts in the industry. The Financial Brand actually featured his book on its site last week along with some excerpts from the book (reinterpreted for the web). One of those excerpts stood out to me and I’ve shared it below:

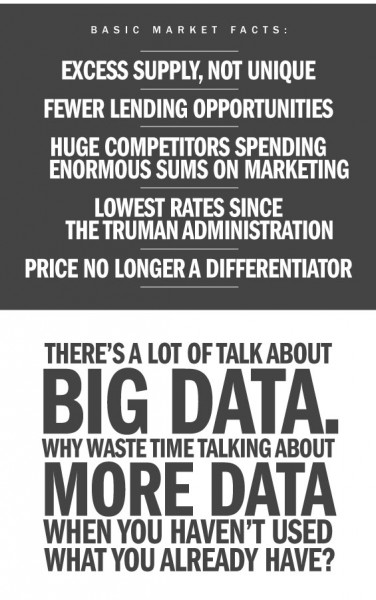

It’s planning season for most businesses and many financial marketers will be focusing efforts on formulating their 2014 marketing plans. One of the main premises of the book, as illustrated in this graphic, depicts the industry challenges faced by many as they not only try to differentiate but struggle with implementing marketing plans, projects and programs. Ron Shevlin blogged about the shortcomings of financial institutions’ strategic planning efforts last week.

2014 Will Be Led by Data-Driven Marketing

Another interesting fact from Kassing’s book, “In the next 30 minutes Bank of America will spend $225,000 on marketing.” That’s a staggering statistic if you ask me. Is your bank 100% committed to marketing execution to compete with the big banks?

Is your bank planning for or executing on an omni-channel strategy for banking customers?

Is your bank ready for Customer 3.0 (a customer whose behaviors are influenced by digital channels, is highly informed, and demands a personalized approach to customer service and banking)?

Does your bank have or seek to have a mobile-first mindset for application development?

Is your bank struggling with having a comprehensive view of your customer?

Will you be rethinking strategies for 2014 to improve marketing and sales effectiveness for your financial institution?

The answer to all of these questions will likely involve having a business-driven strategy for managing data and building a cohesive enterprise information platform.

A large part of our financial services clients are focusing their strategic planning and marketing investments on doing just that. Banks are finding ways to break down the barriers that exist between departments and eliminate information silos to extract value in the data that already exists behind bank doors and in data vaults. This requires meticulous planning, executive buy-in and sponsorship, proper execution and measurable performance metrics.

I’d encourage all of our readers to check out, “Big Data Planning Guide for Financial Services”, published earlier this year as you begin your strategic technology planning for next year. Data analytics (at various levels of maturity) will not only be a large part of planning for next year in financial services, but it will be influenced and driven by marketing leaders as businesses focus on where they want to be five years from now. Are you prepared to help guide your bank’s strategic planning process and lead this critical program?