In Part 1, and Part 2 of “The Return of Direct-to-Consumer” series I discussed WHAT direct-to-consumer looks like in 2021, how the definition and opportunities have evolved, and what brands are leading and lagging in the DTC world. In Part 3 of this series I outlined WHY a business might consider a direct-to-consumer model and the benefits to both the business and consumer when a brand goes direct.

Part 4 of this series answers the HOW; high-level capabilities you may need to develop and considerations before diving in to the direct-to-consumer pool.

How to Get Started with a Direct-to-Consumer Strategy

Commerce success takes more than just a technology or platform. It requires adopting a consumer-centered mindset so teams can enable meaningful consumer relationships. For many organizations, this means transforming their culture — from siloed, manual, and transactional ways of working to insight-led practices that can deliver the experience-driven, omni-channel experiences customers demand.

“We listen to our customers so closely every week, and now we have six years of data on recipe preferences, culinary preferences, ingredient preferences, seasonal preferences, and we’re using that to make the product better and more customizable, to lead to stronger personalization in the future.”

Truer words have never been spoken when it comes to the first ‘HOW‘ of going direct-to-consumer. Listen to your customers. At the core of any direct-to-consumer model is the consumer. Your customers have a wealth of qualitative and quantitive feedback ready for mining. Insights gained from this data can help form the basis of your DTC gap analysis and maturity model. If you find yourself lacking in qualitative customer feedback, a good first-step to help shape your DTC vision is to begin a customer research program. This can run parallel to other strategic and planning activities and can help inform and course correct as your strategy becomes more defined.

Customer-centricity isn’t a new notion but part of the new rise of DTC brands is a re-focus on experience first, or ‘experience-driven commerce’. Experience-driven commerce isn’t a particular platform, technology or capability, it starts with transforming an organization’s culture and operating model. A robust ‘voice of the customer’ program is imperative and central to a successful DTC business

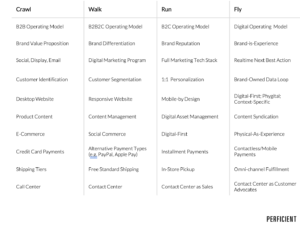

A Macro DTC Capability Continuum

In working with clients to understand what their DTC vision is and how to get there we start with evaluating their position and maturity across a series of macro capabilities. This allows us to begin to understand not only what exists within the organization that might be leveraged to support the new business model, but where there might be deep gaps, particularly in culture and processes, that might throttle DTC success. Once we establish where an organization generally sits across the macro Crawl/Walk/Run/Fly capabilities and where they aspire to be we develop a more traditional, detailed DTC capability maturity model that is rooted in supporting the needed cultural changes intersected with voice-of-the-customer findings. Any new technology or enabling platform needs come last in our considerations and only once we fully understand how technology needs to support customer experience and business capabilities.

High-Level Direct to Consumer Capabilities Continuum

Key Direct-to-Consumer Model Considerations – Transforming or Remodeling?

The macro capability continuum represents the tip of the iceberg in beginning to develop your DTC strategy. As we start digging in to macro capabilities positioning we quickly have to volley the conversation between capabilities and tactical considerations. In other words, is this a transformational opportunity for the organization where most capabilities, including the brand itself, need to be developed from the ground up? Or is this more of a ‘remodeling’ opportunity where you have considered many of the aspects of DTC and just need to tweak some parts of the people/process/technology triangle to thrive?

Once again, thinking back to Part 1 and Part 2 of this series, we always start our ‘considerations’ conversation with Customer Experience needs. Once we’ve address the Customer experience needs and mapped back to capabilities, we move on to discussing the Operational support needs, and finally enabling Technologies. There are no right answers; only alignment to the DTC vision and desired capabilities via Customer need analysis. For example, if you’ve already determined, through market research and Voice-of-Customer input, the right product assortment for your DTC play you must determine whether you have a team of merchandisers who understand how to represent those products digitally. The answer to that consideration may mean re-skilling or hiring into the existing merchandising group, or given other DTC considerations, the creation of an entirely new business team and operating model. In the event the answer is a new team and operating model, that opens the door to a plethora of net new enabling process and technology possibilities to the organization that aren’t mired in legacy complications and concerns.

Another example of a critical consideration is channel conflict concern. This is still a very real concern for traditional B2B organizations and their distribution partners, so thinking through the ‘Why’ and the ‘What’ before you get to ‘How’ will be key in communicating mutual DTC benefits to channel and distribution partners.

Key DTC Considerations

Thinking about a Direct-to-Consumer play? Perficient can help work through the Whys, Whats, and Hows

Perficient has helped brands like CAT, Electrify America, and Benchmade achieve their direct-to-consumer visions. While their individual organizational journeys were different, the business outcomes were the same – happy customers and a growing business rooted the principles of experience-driven commerce. The offers below are meant to help guide organizations in developing achievable, measurable, successful DTC strategies.

- Emerging Business Model Strategies

- Digital Strategy

- Visioning and Planning

- Strategic Frameworks and Customer Needs