Invoicing rules are available in each transaction, but are not required. They are ‘In Advance’ or ‘In Arrears’, which mean recognizing revenue at the beginning of the month or at the end of the month, respectively. When applying a revenue scheduling rule to a transaction, the most important step to remember is to assign the ‘In Advance’ invoicing rule because it ensures receivables are not touched, but will apply revenue according to what the chosen schedule has been set for. ‘In Arrears’ will apply the receivables at the end of the schedule along with revenue. I am not sure how often that scenario would come up, but it is an option that is available through Oracle Cloud ERP for AR if necessary.

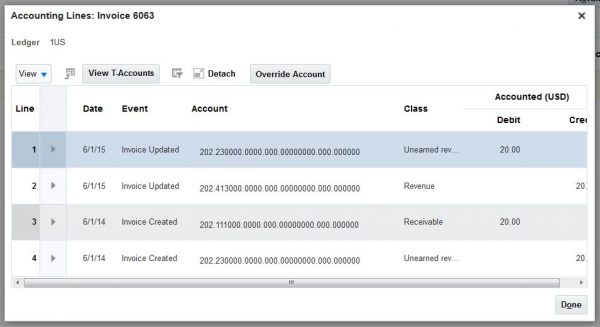

An example of what accounting looks like when using the ‘In Advance’ rule with a revenue recognition schedule is this:

An example of what accounting looks like when using the ‘In Arrears’ rule with a revenue recognition schedule is this:

In essence, it makes sense to choose the ‘In Advance’ option in order to keep accounting in line with revenue being captured on the transaction dates, but in case anyone runs into a situation where this is not the case, consider using these rules along with revenue recognition scheduling. Oracle has made the ability to create scheduling rules simplified enough that even memo lines can be attached to them, so why not take advantage of the functionality?