“Retailers are light years ahead of Wall Street in analyzing their data to find out what their customers want,” said to Peter Giordano, managing director at Oppenheimer & Co. “Instead of analyzing customer data, the industry still relies on salespeople, relationships and actual trades to tell us what clients want.”

Big data might be a fun buzz word at the moment, but it’s an actual business imperative. The opportunity for organizations to extract value from the data they collect and store has never been greater.

If you look at Giordano’s comment above, you would think that financial services firms would easily be able to leverage the data they have on client behaviors to recommend great products to their clients at the right times. Certainly, executives in this industry are talking about it.

IBM conducted a study called “Analytics: the real world use of big data (PDF).” The study accurately identifies the big data opportunity that financial institutions face as they work toward transforming into customer-centric organizations:

“By improving their ability to anticipate changing markets conditions and customer preferences, banks and financial markets organizations can deliver new customer-centric products and services to quickly seize markets opportunities while improving customer service and loyalty.”

In this study, they found that financial services executives are acknowledging big data and talking about it, but the extent that they are currently using it to benefit their businesses varies greatly. “With no physical products to manufacture,” says the report, “data – the source of information – is one of arguably their most important assets.”

And they know it. But why aren’t financial services firms leveraging big data to drive business results?

- Lack of easy access to the data – “Big data is dependent upon a scalable and extensible information foundation.” Much of the data that exists in financial services organizations, especially the very large firms who have acquired and continue to acquire many other firms at a fast clip, is unstructured and – even more problematic – extremely siloed in disparate systems. Mergers and acquisitions have created countless and costly silos of data.

- Difficulty of analyzing it and turning it into actionable business decisions quickly. Firms need “strong analytics capabilities that include not only the tools, but the requisite skills to use them.”

- The challenge of achieving ready access to detailed product and customer data while still meeting compliance and regulatory requirements.

The report continues by describing a process for developing a road map to structuring, organizing, and leveraging data from disparate systems, and this aligns closely to the approach we take with many of our clients to help them achieve their goals.

- Define a big data technology strategy

- Identify and define existing and newly available internal sources of information

- Extract new insights

- Extend the sources of data and infrastructures over time.

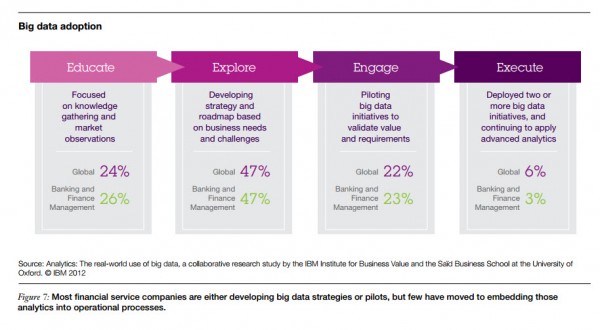

They take this a step further with a four-stage approach to adopting and leveraging “Big data” in financial services: