2024 is going to be a transformative year for the financial services sector, marked by technological strides and innovative trends. Perficient’s financial services experts helped to provide valuable insights that unveil a tapestry of trends that will reshape the industry in the upcoming year.

Client Retention and Personalization at Scale

Financial services institutions are increasingly recognizing the importance of understanding diverse client needs and fostering relationships across different age groups. Prioritizing client-centric approaches, such as tailoring services across generations and bolstering loyalty through personalized experiences, is crucial for maintaining a thriving client base.

Moving forward, institutions should focus on:

- Implementing advanced data analytics to gain deeper insights into client behavior

- Investing in robust customer relationship management (CRM) systems to centralize client data

- Embracing omnichannel engagement strategies to deliver seamless experiences

- Prioritizing customer education and financial literacy

- Adopting a human-centered design approach

- Regularly monitoring and measuring client satisfaction through feedback mechanisms

LEARN MORE: 6 Emerging Trends in Wealth and Asset Management for 2024

Regulatory Compliance and Operational Resilience

Thus far in 2024, institutions have observed an increased emphasis on regulatory compliance and operational resilience. With cybersecurity threats on the rise and regulatory requirements becoming more stringent, institutions are compelled to integrate advanced technologies and proactive measures into their operations.

To navigate this landscape effectively, institutions should consider the following action items:

- Adopt robust risk management frameworks

- Enhance regulatory reporting capabilities

- Conduct regular compliance audits and assessments

- Embrace RegTech solutions

- Foster a culture of compliance and accountability

- Collaborate with regulatory authorities and outsource risk and compliance experts

Our Expertise

Our client needed end-to-end risk and regulatory support, including business-as-usual activities, continuous risk and control assessment, and business continuity management. We embedded a team of experts to support operations in risk and control self-assessment, control testing, issue management, business continuity, and third-party risk management. Our continuous services equip the bank to proactively address and uphold regulatory compliance, manage vendor risk, and expedite key insights and reports.

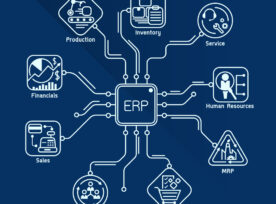

Data Analytics, Artificial Intelligence, and New Technologies

The financial services industry is undergoing a profound transformation driven by the widespread adoption of data analytics and artificial intelligence (AI). These technologies are revolutionizing traditional practices, enabling institutions to enhance efficiency, improve decision-making processes, and deliver more personalized services to customers.

With AI’s impact extending across critical areas such as credit scoring, embedded finance, debt collections, and fraud detection, financial institutions are increasingly leveraging these capabilities to stay competitive in the evolving landscape.

To effectively harness the potential of data analytics and AI, institutions should:

- Implement advanced data analytics and machine learning techniques to optimize operational processes and extract actionable insights from large datasets.

- Explore AI-driven credit scoring models to enhance risk assessment, improve lending decisions, and mitigate credit risk.

- Embrace embedded finance solutions by integrating financial services seamlessly into non-financial products and services, leveraging AI algorithms to personalize offerings and enhance customer experience.

- Adopt AI-powered debt collection strategies to optimize collection processes, prioritize accounts, and maximize recovery rates while minimizing operational costs and customer friction.

- Deploy advanced fraud detection systems leveraging AI and machine learning algorithms to detect and mitigate fraudulent activities in real-time, safeguarding against cyber threats and financial risks.

READ MORE: Top 6 Trends for the Banking Industry in 2024

Sustainable Business Model

There’s a noticeable shift towards sustainable and socially conscious business strategies within the financial industry. Recognizing the importance of sustainability for both investors and stakeholders, institutions are exploring ways to enhance their business models while mitigating environmental impact and promoting social responsibility.

To properly navigate this evolving business model, institutions should consider the following:

- Develop comprehensive sustainability strategies that align with organizational values and objectives.

- Offer sustainable investment products and services that meet the growing demand from socially conscious investors.

- Enhance transparency and disclosure practices to provide stakeholders with clear and accurate information on initiatives and performance.

- Engage with clients and stakeholders to understand their sustainability preferences and incorporate feedback into product development and service offerings.

- Foster a culture of sustainability throughout the organization by providing training and education on sustainability principles and encouraging employee participation in sustainability initiatives.

Discover Your Potential with Perficient

By embracing these themes, financial institutions can navigate complexities and unlock new opportunities for growth and resilience. Ultimately, staying ahead of these trends is imperative for those in the industry to meet evolving client needs and to continue thriving in the sector.

Contact Perficient today to learn how you can optimize your business, or visit our Financial Services Solutions landing page for more information.