Part 2 of 3 Part Series

FCCS IFRS 16 schedules

This is the second blog in a three part series reviewing Oracle’s Financial Consolidation and Close Cloud (FCCS) with their IFRS 16 solution for lease reporting and management. All screen shots included in this blog post are from an Oracle provided demo. In Part 1, I reviewed the benefits of using FCCS and the IFRS 16 solution evaluating how Oracle assembled the leasing requirements within FCCS and Supplemental Data Management (SDM). In this review, I will look at some of the calculation details.

Scenario Similarities

IFRS 16 solution has multiple scenarios; the three most helpful are: Actual, WhatIf and Simulation. Actual is actual data based on a year on year calculation. WhatIf calculates contract events. Simulation models the same leases based on a month on month calculation.

All three scenarios utilize the same schedules and reports. The system can accommodate multiple leases for one entity and multiple currencies. All data is loaded into one year (2018) and one period (Jan).

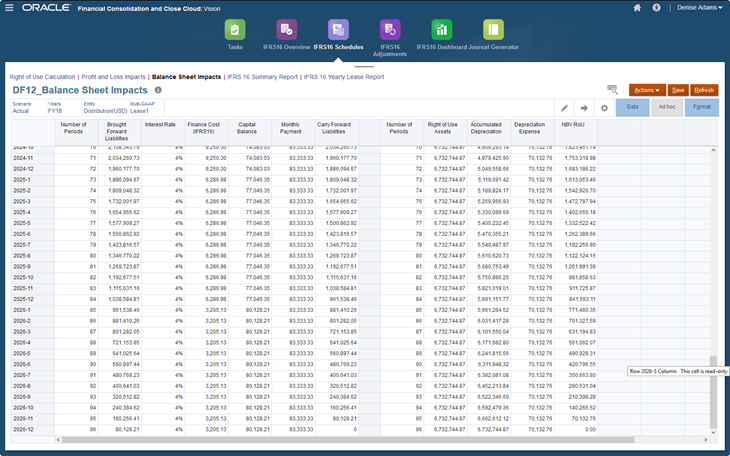

Oracle leverages a custom dimension to include all the contract periods. Notice in the next screen shot the contract periods are listed on the left side and the point of view for the screen is for Jan 2018. Translations are based on the rates loaded to Jan 2018. This screen also shows the three schedules of Right of Use Calculation, P&L Impacts, and the Balance Sheet Impacts. Here is an example of the Balance Sheet Impacts.

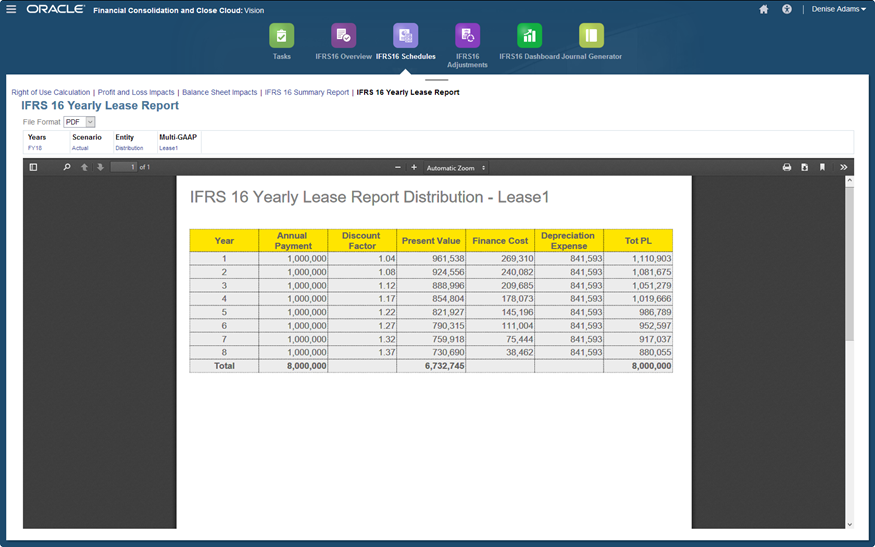

The IFRS 16 Summary Report provides one report containing all the three schedules. Finally, the IFRS 16 Yearly Lease Report provides a one line per year summary of the lease. Below is an example of the IFRS 16 Yearly Lease Report.

Scenario Calculation Difference

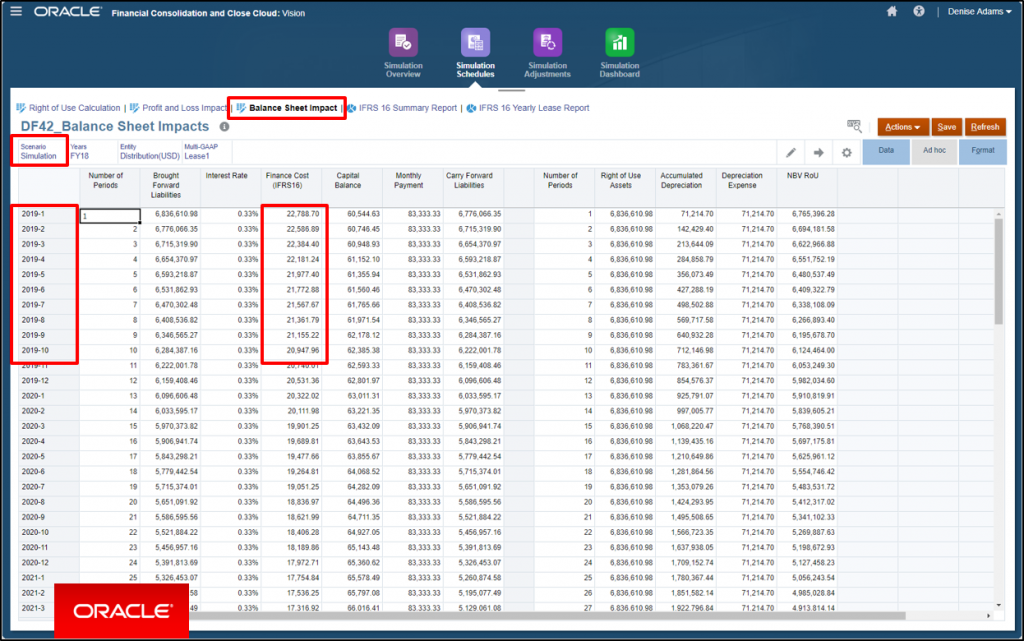

A difference between the scenarios with Oracle’s out-of-the-box solution is the interest calculation. The scenarios Actual and WhatIf calculates the schedule based on a year on year interest calculation. Simulation uses a month on month calculation for the interest. Oracle’s calculations are precise and accurate based on the calculation method used. These out-of-the-box calculations can be modified during implementation.

Actual scenario with year on year calculation.

Simulation scenario with month on month calculation. Notice how the Simulation scenario recalculates the interest every month.

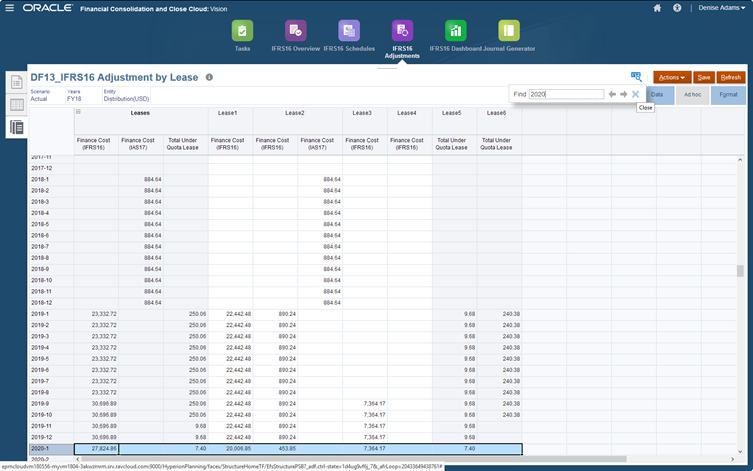

IAS 17 versus IFRS 16 Calculations

Another great feature to the product is that the Actual scenario can properly calculate the IAS 17 portion for leases that have contract periods starting before January 1, 2019. The system reviews and separates out the calculations. All leases can be entered regardless of their start date. Also note that the system can show the breakout of the total expense by lease as shown below.

Contract Events

The application out-of-the-box has pre-built contract events analyzed within the WhatIf scenario. The following list are the contract events. Note that some contact events are categorized as either Fixed or Variable Events. These too can be tailored to company’s requirements. The WhatIf scenario recreates the complete schedule beginning with contract period one as if that contract event was always known for the lease.

Fixed Contract Event Changes

- Free Rent Periods

- Purchase Option (yes/no) and Purchase Option Amount

- Escalation Index percentage

- Escalation Start Period

- Discount Rate Percentage Changes

- Termination Changes with Amount and Extension Date

Variable Contract Event Changes

- Payment Change Value by Contract Period

- Interest Rate Change Value

- Consumer Price Index

The final step is to evaluate the journal generator.