Our financial services team spent the past few days at Bank Innovation 2013. The conference was jam-packed with some great information, some amazing people, and some awesome conversations. Over the course of the next few days, Perficient’s blog will feature our thoughts and highlights from a number of the panels.

First up, a recap from the personal finance management (PFM) session. I think it is safe to say that PFM is still evolving in the banking industry as technology providers continue to expand on the capabilities and potential for financial institutions. The lack of a clear definition and strategic direction for some banks facilitated a lot of questions at the conference. The session was also accompanied by some humor from Deva Annamalai and Matt West, plus some challenging and innovative ideas from Kristoffer Lawson of Holvi.

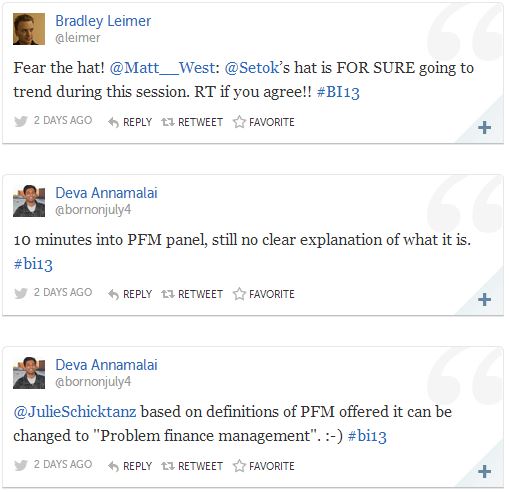

Here are some Twitter highlights from the “Future of PFM” panel at Bank Innovation.

Here is my two cents on PFM (and I think others share the same opinion). We’re aware of the benefits of PFM and have heard some success stories from banks. As others commented in the session, I feel that “PFM 2.0” needs to be tightly integrated into a bank’s online banking platform, not just an extension of their online services. PFM has the potential to leverage personal data, glean insights, and provide the ability to have more conversations with the banking customer at different points in time. This could be achieved with alerts through social, online banking or mobile devices. This could even be internal triggers or notifications to financial advisors and bank branches to bring staff into the conversation with the customer.

Are there any new revenue sources banks could uncover? Should banks open up their APIs to third parties making the service a more valuable platform for their users? PFM could be extended even further to analyze transactional data, incorporate loyalty programs and deliver more personalized rewards and offers to help customers realize how they can manage their spending. PFM could even include some gamification elements to further adoption and encourage social sharing of their banking services. Maybe some PFM tools already have some of these elements and I just haven’t seen them yet, but hopefully we see more growth in PFM because I believe it will help banks develop trust and brand loyalty.

I’d love to hear your thoughts on the future of PFM. Feel free to leave any feedback/comments you might have!