Many of Monday’s sessions at Money20/20 focused on the retail and commerce space. From demos of new payment platforms and systems, the use of BLE and beacon technology, the future of gift cards and prepaid to research on consumer shopping behaviors, its evident that the emerging trends and innovations in these areas are spilling over into the financial services and banking industry. Many of the attendees that stopped by our booth or that we talked to during sessions were here for two primary reasons. One, to look for answers and solutions to deal with current challenges. Two, to find out what’s next in payments in order to keep pace or move ahead of the pack.

In reflecting back on those sessions, opening remarks and Monday’s keynotes, I’d group most of the insights shared, business discussions had, and technology innovations we saw into three primary areas: those that are driving convergence and those that are disrupting the industry. Similarly, here are some Money20/20 highlights and emerging trends from Day 2 presented in a similar manner:

Payments Disruption Escalates

Bitcoin is everywhere at Money20/20! In fact, as of the end of September there were $5 billion worth of bitcoins in circulation. However, there still seems to be a lot of uncertainty around digital currency and how compatible the traditional financial system is with the new online and digital world people are shopping and transacting in. While banks are more heavily focused on digital banking services in other areas such as online and mobile banking, some banks are starting to experiment with this payment network in their innovation labs. Bank Systems & Technology offers some advice for development on the Bitcoin Blockchain and where banks should start.

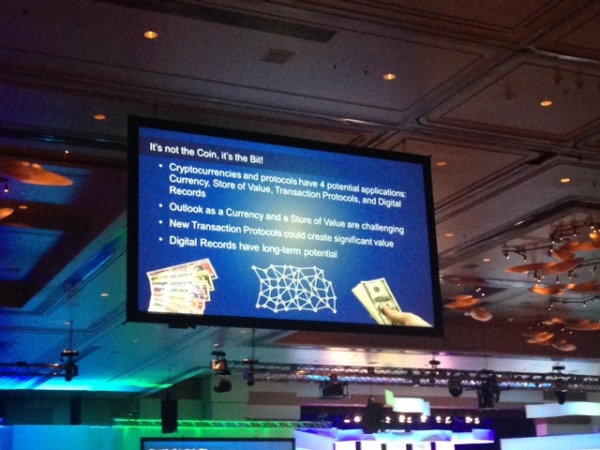

During McKinsey’s keynote they highlighted six major payments “themes” and cryptocurrency was one of them. They identified four potential applications:

- Currency

- Store of Value

- Transaction Protocols

- Digital Records

Bitcoin is indeed a departure from existing payment vehicles and is breaking barriers to traditional financial services. While there is support from PayPal and appeal from merchants, many believe there is far-reaching potential with Bitcoin but a lot needs to happen in terms of development and regulations before it truly disrupts the financial system at its core. During a session with Circle founder, Jeremy Allaire, said he believed banks were a few years away from integrating Bitcoin stating, “banks are reluctant to get into this market until they have a better understanding of the obligations under existing laws and regulations. I think they are reluctant to work with other companies if they are directly involved until they have that clarity.”

Opening the Doors for Digital Convergence

For the most part, a large number of new services and products we’re seeing at Money20/20 are bringing the payments, retail and financial services industries together. This technology convergence is happening in a number of different areas throughout the payments ecosystem: at the cash register, in bank branches, on the web, and even in consumers’ wallets with traditional debit and credit cards. What is driving this trend in the industry? Consumers’ appetite and demand for simplification, personalization and a more seamless user experience across channels. As a result, retailers, banks and payment brands are taking on digital transformations of all kinds enabled by emerging technologies such as mobile, cloud computing and APIs.

Banks and traditional financial institutions have traditionally been consumers of technology, not developers of technology but that mindset is changing. Banks are starting to have to think more and more like software companies and technology start-ups to keep pace with the digital demands of consumers and clients. I had a chance to chat with JP Nichols from the Bank Innovators Council about the interest from banks (both large and small) to roll up their sleeves, and work through ideation, design thinking and creative problem solving techniques to further innovation and combat disruption. Santander Bank’s hiring of Brad Leimer, is a perfect example of the digital transformation many banks are taking on. His attendance at Money20/20 will enable him to foster relationships with new partners, payments startups and even others outside the industry to help connect customers to the bank digitally.

While we’re starting to see more of this from banks, others companies at Money20/20 are also helping to more quickly facilitate digital transformation and ultimately bring payment networks, banks and retailers closer together. During Ryan McInerney’s keynote, Visa shared three key things they’re doing that will help build customer experiences that are intuitive, instinctive and inherently safe – reinventing the card through tokenization, moving services to the cloud, and opening up their payment network to developers. By tapping into the more than 10 billion connected devices in use today they’re able to build better relationships with customers. Startups are also changing the game for the industry. We’re hearing from companies like Plaid that are putting the tools in banks’ developers hands to integrate with their infrastructure to access financial data from credit and debit accounts.

Evolution in the Customer Experience

Ultimately, the core existence of Money20/20 has been around the rapid pace of innovation and learning from how others in the industry are evolving or helping others to evolve. Citi’s CEO of US Consumer and Commercial Banking openly discussed their plans for testing out a new operating model centered around its bank branch network. They’ve realized that branch banking today has changed and their clients expect more from their interactions with the bank through digital experiences. As a result, Citi is focusing on testing out a “branch of the future” in US test markets that brings in many aspects of the retail in-store experience with digital and mobile experiences.

On the merchant side, we got to experience first-hand Osama Bedier’s new startup Poynt, a payment platform for merchants, with a live demo. Not only are they getting backing from Chase Paymentech and Vantiv, the product also has partnered with a number of other products like Kabbage, Swarm, Vend, Bigcommerce, and others. They’re challenging and redefining industry boundaries with their “smart terminal”. Poynt accepts magnetic stripe, EMV, NFC, Bluetooth and QR code payment technologies. They’ve also already incorporated Apple Pay, and other payment methods including chip-and-pin, mobile apps, and whatever else the future brings. Their demo really was one of the top highlights of the day (and probably the show).

We’re experiencing some exciting and adventurous times ahead and Money20/20 is here to showcase it all.