What is ServiceNow Financial Services Operations (FSO):

Financial Services Operations (FSO) is an offering by ServiceNow utilizing its existing platform custom-tailored to the use cases for Financial Institutions providing a comprehensive solution for managing operations end-to-end. ServiceNow’s FSO allows financial institutions to automate core operational processes, through pre-built applications and workflows that streamline operations across all departments from front to back office, in a more efficient manner.

ServiceNow was named a Leader in The Forrester Wave: Value Stream Management Solutions, Q4 2022. Vendors were evaluated against 25 categories of current offering, strategy, and market presence, which aligned ServiceNow to meeting enterprise needs. According to the report, “ServiceNow is well-known for its IT Service Management (ITSM) offering that powers many teams’ change management processes and is one of the largest players in the VSM market.

With ServiceNow’s value stream management capabilities embedded throughout its IT service management and strategic portfolio management solutions, Perficient believes ServiceNow Financial Service Operations (FSO) is well positioned completely transform your organization. With ServiceNow your company could achieve accelerated development, greater speed to market, and increased team execution and delivery for Financial Institutions while adhering to compliance and risks.

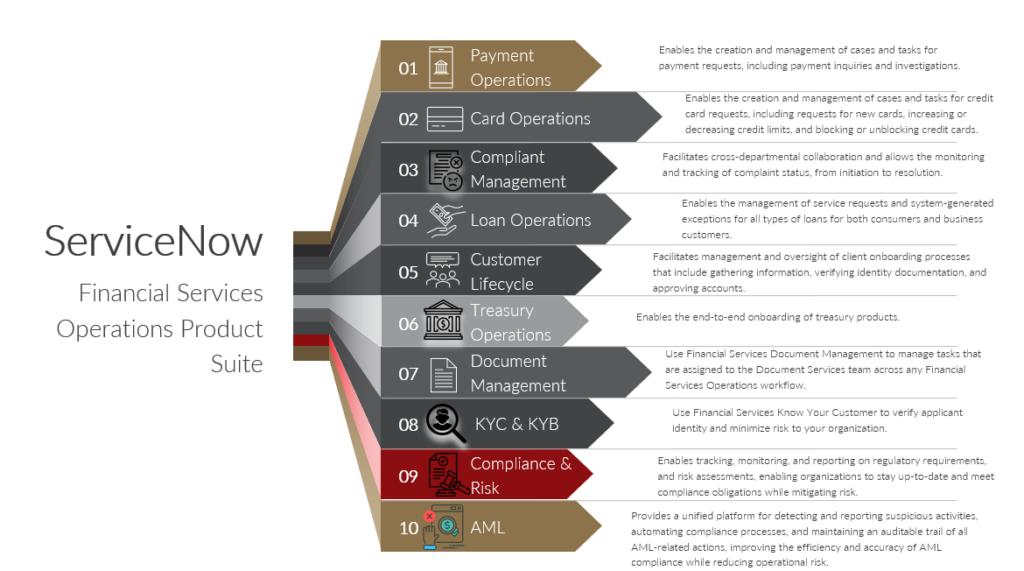

ServiceNow Financial Services Operations (FSO) Product Suite:

Below are the products suites ServiceNow Financial Operations (FSO) currently caters to:

- Payment Operations:

Financial Institutions can use ServiceNow Payment Operations solution to manage requests for payment inquiries, claims, or debit approvals related to their day-to-day operations. This feature helps resolve inquiries related to Beneficiary Claim Non-Receipt (BCNR) and Payment in Error (PiE) quickly and efficiently and keeps track of the status of debit approval cases. With preconfigured dashboards containing actionable data visualizations, financial institutions can improve its business processes and measure the value of its services.

- Card Operations:

The ServiceNow Card Operations provides a unified platform for creating and management of cases related to credit card inquiries, including new cards being requested, increasing, or decreasing credit limits, blocking, or unblocking cards, and closing down a card account. This makes it easy for companies to comply with all relevant regulations and keep their customers happy.

- Complaint Management:

The ServiceNow Complaint Management product can be used to swiftly address complaints within the complaint servicing team or routed to internal business units to provide a streamlined and prompt decision experience. This allows for cross-departmental collaboration and tracking of complaint status, from initiation to resolution.

By using automated workflows and response templates, ServiceNow FSO platform can route cases to specific business units for review and approval. This allows for a faster resolution time as responses are gathered quickly and reviewed in a guided playbook kind of experience using configurable response templates based on complaint types. It also provides a performance analytics dashboard with pre-configured reports that can highlight risks and potential regulatory issues.

- Loan Operations:

ServiceNow Loan Operations provide a single platform solution to manage service requests and system-generated exceptions for all types of consumer and business loans. Also, this includes an automated workflow that routes cases across various departmental functions, such as loan, document, and credit assessment departments. Additionally, the platform provides a role-specific customized agent workspace with performance metrics dashboards to help managers understand team efficiency and business performance.

- Customer Lifecycle:

The Customer Lifecycle Operations platform helps manage and oversee client onboarding processes, by gathering information, verifying identity documentation, and orchestrating the approval process. Also, key benefits include an account opening and onboarding process providing a unified playbook experience that focuses on specific tasks, as well as custom workspaces and roles in helping the officers complete them in the right order.

- Treasury Operations:

ServiceNow Treasury Operations product provides an easy solution for financial institutions to manage treasury product onboarding processes. This is made available with workflows that are specifically designed for crucial services, such as wire transfers and Remote Deposit Capture (RDC). It provides a single platform to manage new requests in real-time, which makes the process more streamlined and simplified. Additionally, it provides a unified experience across the company’s treasury products, reducing bottlenecks and complexity during the onboarding process.

- Document Management:

ServiceNow Document Management product can be integrated into the existing ECM platforms to manage tasks assigned to the Document Services team across any onboarding and renewal workflows. This includes onboarding customers, assets, and products, and issuing approvals for documents. It enables service owners to set up document categories, document types, and rules for inbound and outbound communication (including deferring or approving certain documents) and approval rules for a unified document management experience.

- Know-Your-Customer:

Using ServiceNow FSO offering, Financial Institutions can verify the identity of applicants and prevent fraudulent activities by eliminating potential problems early on in the process. This system helps to coordinate verification efforts between front-office KYC analysts, relationship managers, and AML officers to determine eligibility for banking accounts and products.

- Compliance & Risk:

ServiceNow GRC (Governance, Risk, and Compliance) is a solution designed to help organizations manage compliance and risk by providing assessment tools, policy management, incident management, and reporting tools. ServiceNow GRC can streamline compliance processes and reduce risk by automating manual tasks, standardizing procedures, and providing real-time visibility into compliance status. Additionally, it integrates with other ServiceNow products to provide a comprehensive view of risk and compliance across the entire organization. With ServiceNow GRC, organizations can ensure that they meet regulatory requirements, manage risks effectively, and make informed decisions to improve their overall compliance posture.

If you’re interested in learning more about Perficient’s ServiceNow capabilities and how ServiceNow FSO can benefit your organization, reach out!