The regulatory landscape for asset managers is shifting beneath our feet. It’s no longer just about filing forms; it’s about data granularity, frequency, and the speed at which you can deliver it. As we move into 2026, the Securities and Exchange Commission (SEC) has made its intentions clear: they want more data, they want it […]

Posts Tagged ‘Regulatory Reporting in Financial Services’

Seven Federal Regulatory Reports Banks and BHCs with $10 to $100 Billion in Assets Must Master

Introduction Insured domestic financial institutions operating in the United States with total consolidated assets between $10 billion and $100 billion face a complex and multi-layered regulatory reporting landscape. These mid-sized banking organizations occupy a critical position in the financial system—large enough to pose potential systemic risks yet distinct from the very largest global systemically important […]

Part 504 Compliance Deadline Fast Approaching for BFSI Firms in New York

This blog was co-authored by Perficient Project Manager: Alicia Lawrence As a global organization headquartered in St. Louis, Perficient is committed to supporting current and future clients by monitoring federal and state regulations and alerting them of changes that may impact them. In 2024, Perficient published a blog highlighting insights gathered through continuous monitoring a of the […]

Exploring Industry Shifts in Banking Compliance at XLoD

Our banking risk and regulatory experts are excited to attend the upcoming XLoD Global event in New York on June 11th. What is XLoD Global? The world’s leading financial institutions and regulators come together at XLoD to discuss the future of non-financial risk and control. Representatives from all three lines of defense—operational management, risk […]

A Review of Capital Ratio Requirements of Credit Unions

How are Federal Credit Unions Regulated? Banking professionals are aware that the Federal Reserve Bank (Fed), the Office of the Comptroller of the Currency (OCC), or for state-chartered banks, the Federal Deposit Insurance Corporation (FDIC) serves as their primary federal regulator. For those whose deposits are insured, the FDIC acts as a secondary federal regulator, […]

Carl Aridas Empowers Risk and Regulatory Compliance Excellence for Financial Services Leaders

At the core of our business’s successes lie the brilliant minds and unwavering dedication of our workforce—individuals who consistently prioritize delivering industry insights and pioneering digital solutions. Today, we’re spotlighting one exceptional individual: Carl Aridas. As the visionary leader of our Financial Services Risk and Regulatory Center of Excellence (CoE), Aridas personifies excellence and innovation […]

Ensuring Banking Compliance Through Project Management Expertise

A top-leading bank, grappling with business and regulatory challenges, faced scrutiny after failing the Federal Reserve’s annual stress test. Addressing these deficiencies required a comprehensive approach, leading to the establishment of critical programs like the US Bank Holding Company (BHC) regulatory and comprehensive capital analysis and review (CCAR) program. To bolster its capabilities and ensure […]

5 Tactics to Safeguard Institutions Against Senior-Level Embezzlement

Protecting financial institutions from the perils of high-level embezzlement requires a proactive approach rooted in ethical conduct and stringent compliance measures. To fortify defenses against such threats, financial entities must implement proactive measures aimed at ensuring ethical conduct and compliance within their organizations. This blog outlines five key strategies to safeguard your business and mitigate […]

NYSDFS Part 500 Cyber Amendments Finalized: What You Need to Know

This blog was co-authored by Perficient Risk and Regulatory CoE Member: Alicia Lawrence The announcement of significant amendments to the New York State Department of Financial Services (NYSDFS) regulations on December 1, 2023, represents a pivotal moment for entities operating within New York’s financial sector. The NYSDFS Part 500 amendments signal a crucial shift in […]

Resolution Plan Submission Period Extended by Key Financial Agencies

In discussions with financial services executives, Perficient consultants consistently explore the extension of the submission deadline for resolution plans among certain large financial institutions with assets exceeding $250 billion. Moving forward, these institutions will need to submit their resolution plans by March 31, 2025. Guidance For Institutions This guidance applies to institutions with assets exceeding […]

Driving Innovation: Inside Perficient’s Risk and Regulatory Center of Excellence

Our success at Perficient emanates from the dedication of our team. We take immense pride in recognizing that our committed individuals propel innovation and drive change within our industry. Every voice within our organization holds significance, none more so than Carolyn Lee, a Project Manager (PM) in our Financial Services business unit and a leader […]

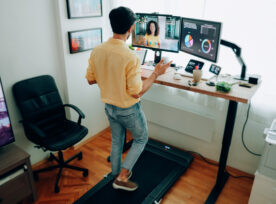

Future-Proofing Financial Services: Rule 3110 Updates Empower Brokers

This post has been updated to reflect FINRA Regulatory Notice 24-02, issued January 23, 2024. The COVID-19 pandemic prompted several unprecedented shifts in society, notably impacting the workplace and necessitating the adoption of innovative technologies that facilitate collaboration and efficiency in a work-from-home (WFH) environment. For brokers, in the financial services sector, remote work became […]