How are Federal Credit Unions Regulated?

Banking professionals are aware that the Federal Reserve Bank (Fed), the Office of the Comptroller of the Currency (OCC), or for state-chartered banks, the Federal Deposit Insurance Corporation (FDIC) serves as their primary federal regulator. For those whose deposits are insured, the FDIC acts as a secondary federal regulator, while the Fed or OCC remains the as the primary regulator.

Conversely, credit union executives know that their primary federal regulator is always the National Credit Union Administration (NCUA). Established by Congress in 1970, the NCUA operates as an independent federal agency within the executive branch, fulfilling multiple roles including deposit insurance for federally insured credit unions, safeguarding the interests of credit union members, and overseeing the chartering and regulation of federal credit unions.

Capital Requirements

Capital requirements play a pivotal role in the success of both banks and credit unions. While maintaining higher capital reserves enhances a credit union’s resilience against economic downturns, the aim is to strike a balance and avoid being excessively capitalized to optimize deposit funding and earnings.

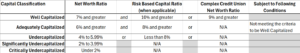

Until December 31, 2021, all credit unions were required to compute the Net Worth Ratio (NWR), while credit unions with total assets exceeding $50 million also had to calculate the Risk-Based Net Worth (RBNW) ratio. However, starting on January 1, 2022, the definition of a complex credit union shifted to those with quarter-end total assets surpassing $500 million on its most recent Call Report.

While all credit unions must still compute their NWR, only complex credit unions are mandated to perform an additional capital calculation, adhering to either the Risk-Based Capital (RBC) framework or, if eligible, the Complex Credit Union Leverage Ratio (CCULR) framework.

Net Worth Ratio

The formula for the Net Worth Ratio now reads as follows, referencing the reporting cell on the current NCUA call report:

- [(997 – NW004) / (NW0010 – NW004)] x 100

The numerator begins with Total Net Worth, encompassing undivided earnings, other reserves, undistributed income, the Current Expected Credit Loss Transition Provision (CECL) and subordinated debt. Subsequently, NW004, representing the CECL Transition Provision, is deducted from the numerator.

In the denominator, NW0010 factors in and considers and excludes Small Business Administration Paycheck Protection Program loans pledged as collateral to the Federal Reserve Bank Paycheck Protection Program Lending Facility. NW004, representing the Current Expected Credit Loss Transition Provision, is included in the denominator, and the formula deducts the CECL Loss Transition Provision, thereby excluding the CECL from the denominator and the asset class from the overall ratio.

Risk-Based Capital Ratio

The Risk-Based Capital Ratio, (RBC) involves a more intricate calculation of a credit union’s capital, aiming to adjust for the risk associated with the union’s assets. The formula, again referencing the cells in the NCUA’s call reports, is:

- RB0012/RB0171 x 100

The numerator starts with the same Net Worth calculation used in the Net Worth Ratio, but additionally incorporates the allowance for credit losses and subordinated debt. It then subtracts the National Credit Union Share Insurance Fund (NCUSIF) Capital Deposit, goodwill and other intangibles, identified losses not previously recognized in the numerator, and mortgage servicing assets exceeding 25% of other total capital.

The denominator, RB0171, represents the sum of all risk-based equivalents of both on-balance sheet and off-balance sheet assets. For on-balance sheet assets, each asset category, such as cash, loans, and securities, is assigned to a risk category, where the balance is multiplied by the respective risk category percentage.

The standard risk categories include 0%, 20%, 50%, 75%, and 100%, 150%, 250%, 300%, 400%, and 1,250%. As the capital elements in the numerator increase, the ratio improves; however, an increase in risk-weighted assets in the denominator leads to a decrease in the ratio.

For off-balance sheet assets, the contingent asset is multiplied by a credit equivalent amount (0%, 2%, 4%, 20%, 50%, 75%, 100%), reflecting the likelihood of the contingent asset being funded. This result is then multiplied by a credit conversion factor (10%, 20%, 50%, 100%), indicating the riskiness of the asset once it appears on the balance sheet.

Complex Credit Union Leverage (CCULR) Ratio

CCULR, pronounced cooler, represents the third capital calculation option for credit unions. Credit unions may opt for CCULR if they meet specific requirements including:

- Being a complex credit union (>$500 million total assets)

- NWR of 9 percent or more

- Off-balance sheet exposures totaling less than 25 percent of total assets

- Trading assets and liabilities that comprise less than 5 percent of total assets

- Goodwill and intangible assets that are less than 2 percent of total assets

By choosing CCULR, qualifying complex credit unions are relieved from calculating the challenging risk-based capital ratio discussed earlier. However, in exchange, they must uphold a higher Net Worth Ratio (9% vs 7%) than is otherwise required for the well-capitalized classification.

For those interested in reviewing the detailed 37-page credit calculation directions prepared by the NCUA, the Financial Performance Report Ratio and Formula Guide is linked below:

Learn More: Financial Performance Report Ratio and Formula Guide (ncua.gov)

Your Expert Partner

Contact us to discuss your specific risk and regulatory challenges. While many consulting firms have their experience limited to strictly banking, Perficient is a firm with more than 70 completed projects within the credit union industry.

Our financial services expertise, blended with our digital leadership across platforms and business needs, equips the largest organizations to solve complex challenges and compliantly drive growth.