Introduction

Insured domestic financial institutions operating in the United States with total consolidated assets between $10 billion and $100 billion face a complex and multi-layered regulatory reporting landscape. These mid-sized banking organizations occupy a critical position in the financial system—large enough to pose potential systemic risks yet distinct from the very largest global systemically important banks. As a result, federal regulators have established a comprehensive framework of periodic reporting requirements designed to monitor capital adequacy, liquidity positions, credit concentrations, operational risks, and overall financial condition.

This article provides an in-depth examination of the major federal regulatory reports that banks in this asset category must file with the Federal Reserve System, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC). Understanding these reporting obligations is essential for Chief Compliance Officers, Chief Financial Officers, and regulatory reporting teams responsible for producing timely and accurate submissions to federal banking agencies.

The Regulatory Framework

Banks with assets exceeding $10 billion but remaining below $100 billion are subject to enhanced prudential standards under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Section 165 of the Act requires the Federal Reserve Board to establish risk-based capital requirements, leverage limits, liquidity requirements, and stress testing protocols for bank holding companies and savings and loan holding companies with total consolidated assets of $10 billion or more. These enhanced standards are implemented through a series of regular reporting requirements that provide regulators with detailed, timely information about each institution’s financial condition, risk exposures, and capital planning processes.

The regulatory reporting regime serves multiple supervisory purposes. First, it enables regulators to monitor individual institutions’ safety and soundness on an ongoing basis, identifying emerging risks before they threaten financial stability. Second, aggregate data from these reports inform broader systemic risk assessments and macroeconomic policy decisions. Third, the information collected supports the Federal Reserve’s supervisory stress testing framework, including the Dodd-Frank Act Stress Test (DFAST) and Comprehensive Capital Analysis and Review (CCAR) processes. Finally, certain reporting data are used to calculate regulatory capital ratios, liquidity coverage ratios, and other key prudential metrics that determine whether institutions meet minimum regulatory standards. Providing regulators each of those measures are the following reports:

Major Reporting Requirements

1. Consolidated Reports of Condition and Income (Call Report)

The cornerstone of bank regulatory reporting is the quarterly Call Report, formally known as the Consolidated Reports of Condition and Income. Every national bank, state member bank, insured state nonmember bank, and savings association must file a consolidated Call Report as of the close of business on the last calendar day of each calendar quarter.

Purpose and Scope

The Call Report collects comprehensive financial data in the form of a balance sheet, income statement, and supporting schedules that detail a bank’s condition and performance. The information is used by the FDIC, OCC, and Federal Reserve for bank supervision and examination, deposit insurance assessment, monetary policy analysis, and public disclosure. Supervisory agencies use Call Report data to monitor individual bank risk profiles, identify troubled institutions, assess the impact of economic and policy changes on the banking system, and prepare reports to Congress and the public.

Banks between $10 and $100 billion in total consolidated assets file one of two primary Call Report forms depending on their office structure. Banks with any foreign offices—including International Banking Facilities (“IBFs”), foreign branches or subsidiaries, or majority-owned Edge or Agreement subsidiaries—must file the FFIEC 031 form quarterly. Bank’s with only domestic offices file the FFIEC 041 form.

Reporting Frequency and Timing

The Call Report is due quarterly as of March 31, June 30, September 30, and December 31. While the core report is required quarterly, specific schedules have varying frequencies. Schedule RC-T (Fiduciary and Related Services) is filed quarterly only by banks with more than $250 million in fiduciary assets or with fiduciary income exceeding 10% of total revenue; otherwise it is filed annually on December 31. Several memorandum items are reported semiannually on June 30 and December 31, including data on held-to-maturity securities transfers and purchased credit-impaired loans. Other items such as preferred deposits, reverse mortgage data, internet transaction capability, and captive insurance/reinsurance assets are reported only annually on December 31.

2. Complex Institution Liquidity Monitoring Report (FR 2052a)

The FR 2052a is one of the newer but also one of the most detailed and data-intensive regulatory reports in the banking system. It collects granular, transaction-level information on assets, liabilities, funding activities, and contingent liabilities to enable the Federal Reserve to monitor liquidity risks at large, complex banking organizations. Perficient has previously offered a free guide to the 2052a report available here – Breaking Down the FR 2052a Complex Institution Liquidity Monitoring Report, a Guide / Perficient

Purpose and Scope

The Federal Reserve uses the FR 2052a to monitor the overall liquidity profile of supervised institutions, including detailed information on liquidity risks within different business lines such as securities financing, prime brokerage activities, and derivative exposures. These data points as part of the Board’s supervisory surveillance program in liquidity risk management and provide timely information on firm-specific liquidity risks during periods of stress. Analyses of systemic and idiosyncratic liquidity risk issues inform supervisory processes and the preparation of analytical reports detailing funding vulnerabilities.

The report is used to monitor compliance with the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) requirements established under Basel III and implemented by U.S. banking agencies. The FR 2052a collects data across ten distinct tables covering 115 product types, 14 counterparty types, 72 asset classes, and 75 maturity buckets extending out to five-plus years.

Reporting Frequency and Timing

U.S. banking organizations that are subject to Category III standards with average weighted short-term wholesale funding of $75 billion or more must submit the FR 2052a on each business day. Daily filers must submit reports by 3:00 p.m. ET each business day. U.S. banking organizations subject to Category III standards with average weighted short-term wholesale funding of less than $75 billion, or subject to Category IV standards, must submit the report monthly.

When a banking organization’s required reporting frequency increases from monthly to daily, it may continue to report monthly until the first day of the second calendar quarter after the change in category becomes effective. Conversely, when frequency decreases from daily to monthly, the reduction takes effect immediately on the first day of the first quarter in which the change is effective.

3. Country Exposure Report (FFIEC 009)

The FFIEC 009 Country Exposure Report provides regulators with detailed information on the geographic distribution of U.S. banks’ claims on foreign residents, enabling assessment of country-specific and transfer risks in bank portfolios.

Purpose and Scope

The report is used to monitor country exposures of banks to determine the degree of country risk and transfer risk in their portfolios and assess the potential impact on U.S. banks of adverse developments in particular countries. The International Lending Supervision Act mandates quarterly reporting to obtain more frequent and timely data on changes in the composition and maturity of banks’ loan portfolios subject to transfer risk.

Data collected includes detailed information on claims by country, sector, and maturity, as well as risk transfers through guarantees and other credit enhancements. The Interagency Country Exposure Review Committee (ICERC) uses this information to conduct periodic reviews of country exposures and assign transfer risk ratings to specific countries.

Reporting Frequency and Timing

The FFIEC 009 must be filed quarterly as of the last business day of March, June, September, and December, with submissions due within 45 calendar days after the reporting date (50 calendar days after the December 31 reporting date).

The report is required of every U.S.-chartered commercial bank that holds aggregate foreign claims of $30 million or more and maintains a foreign branch, international banking facility, majority-owned foreign subsidiary, or similar foreign office. Bank holding companies must also file under certain conditions, and Edge and agreement corporations with foreign claims exceeding $30 million must file unless consolidated under a reporting bank.

4. Weekly Report of Selected Assets and Liabilities (FR 2644)

The FR 2644 provides the Federal Reserve with high-frequency data on selected balance sheet items from a sample of commercial banks, serving as the primary source for weekly banking statistics.

Purpose and Scope

The FR 2644 collects sample data that are used to estimate universe levels for the entire commercial banking sector when combined with quarterly Call Report data. Data from the FR 2644, together with other sources, are used to construct weekly estimates of bank credit, balance sheet data for the U.S. banking industry, sources and uses of banks’ funds, and current banking developments.

These weekly statistics are published in the Federal Reserve’s H.8 statistical release “Assets and Liabilities of Commercial Banks in the United States” and are routinely monitored by Federal Reserve staff, included in materials prepared for the Board of Governors and the Federal Open Market Committee, and incorporated into the semiannual Monetary Policy Report to Congress.

Reporting Frequency and Timing

The FR 2644 is submitted weekly as of the close of business each Wednesday by an authorized stratified sample of approximately 850-875 domestically chartered commercial banks and U.S. branches and agencies of foreign banks. This sample accounts for approximately 88% of domestic assets of commercial banks and U.S. branches and agencies of foreign banks. Small banks (those with assets less than $5 billion) have an option to report monthly rather than weekly, helping to reduce burden for community banks while maintaining adequate sample coverage.

5. Single-Counterparty Credit Limits (FR 2590)

The FR 2590 report enables the Federal Reserve to monitor compliance with the Single-Counterparty Credit Limits (SCCL) rule, which prohibits covered companies from having aggregate net credit exposure to any unaffiliated counterparty exceeding 25% of Tier 1 Capital.

Purpose and Scope

The SCCL rule, adopted pursuant to Section 165(e) of the Dodd-Frank Act, is designed to limit the exposure of large banking organizations to single counterparties, thereby reducing the risk that the failure of a counterparty could cause significant losses to a covered bank and threaten financial stability. The FR 2590 reporting form collects comprehensive information on a respondent organization’s credit exposures to its counterparties, including detailed data on gross exposures, securities financing transactions, derivative exposures, risk-shifting arrangements, eligible collateral and mitigants, and the presence of relationships requiring aggregation under economic interdependence or control tests.

Reporting Frequency and Timing

Respondents must file the FR 2590 quarterly as of the close of business on March 31, June 30, September 30, and December 31. Submissions are due 40 calendar days after the first three quarters and 45 calendar days after the December 31 reporting date.

All U.S. bank holding companies, savings and loan holding companies, and foreign banking organizations that are subject to Category I, II, or III standards must file the report. For foreign banking organizations, the requirement applies to those subject to Category II or III standards or those with total global consolidated assets of $250 billion or more. The estimated average hours per response for the FR 2590 is approximately 254 hours per quarterly submission, reflecting the detailed counterparty-level information and complex risk calculations required. The report requires respondents to identify and report data for their top 50 counterparties. Respondents must retain one exact copy of each completed FR 2590 in electronic form for at least three years.

6. Capital Assessments and Stress Testing Report – Annual (FR Y-14A)

The FR Y-14A is the annual component of the Capital Assessments and Stress Testing information collection that supports the Federal Reserve’s supervisory stress testing and capital planning framework.

Purpose and Scope

The FR Y-14A collects detailed quantitative projections of balance sheet assets and liabilities, income, losses, and capital across a range of macroeconomic scenarios, as well as qualitative information on methodologies used to develop internal projections of capital across scenarios. The report comprises Summary, Scenario, Regulatory Capital Instruments, Operational Risk, and Business Plan Changes schedules.

Respondents report projections across supervisory scenarios provided by the Federal Reserve as well as firm-defined scenarios where applicable. The data are used to assess capital adequacy of large firms using forward-looking projections of revenue and losses, to support supervisory stress test models, for continuous monitoring efforts, and to inform the Federal Reserve’s operational decision-making under the Dodd-Frank Act.

Reporting Frequency and Timing

The FR Y-14A is filed annually with an as-of date of December 31. Submissions are due 52 calendar days after the calendar quarter-end (typically early February). The annual submission must be accompanied by an attestation signed by the CFO or equivalent senior officer.

Bank Holding Companies, Intermediate Holding Companies, and Savings and Loan Holding Companies with $100 billion or more in total consolidated assets are required to file. The specific schedules required depend on whether the institution is subject to Category I-III standards or Category IV standards.

The FR Y-14A reporting burden is substantial, reflecting the comprehensive forward-looking projections and detailed scenario analysis required. The current estimated average burden is approximately 1,330 hours per annual response. This includes both the preparation of quantitative projections across multiple scenarios and the development of supporting qualitative documentation describing methodologies and assumptions.

7. Capital Assessments and Stress Testing Report – Quarterly (FR Y-14Q)

The FR Y-14Q collects detailed quarterly data on Bank Holding Companies’, Intermediate Holding Companies’, and Savings and Loan Holding Companies’ various asset classes, capital components, and categories of pre-provision net revenue.

Purpose and Scope

The FR Y-14Q schedules collect firm-specific granular data on positions and exposures used as inputs to supervisory stress test models, to monitor actual versus forecast information on a quarterly basis, and for ongoing supervision. The report comprises Retail, Securities, Regulatory Capital Instruments, Regulatory Capital, Operational Risk, Trading, PPNR, Wholesale, Retail Fair Value Option/Held for Sale, Counterparty, Balances, and Supplemental schedules.

All schedules must be submitted for each reporting period unless materiality thresholds apply. For example, only firms subject to Category I, II, or III standards with aggregate trading assets and liabilities of $50 billion or more, or trading assets and liabilities equal to 10% or more of total consolidated assets, must submit the Trading and Counterparty schedules.

Reporting Frequency and Timing

The FR Y-14Q is filed quarterly as of March 31, June 30, September 30, and December 31. Submissions are due 45 calendar days after the end of the first three quarters and 52 calendar days after the December 31 quarter-end. For the fourth quarter Trading and Counterparty schedules, submissions may be due as early as March 15 if the Board selects an earlier as-of date for the global market shock component.

New reporters receive implementation relief, with the filing deadline extended to 90 days after quarter-end for the first two quarterly submissions. This allows institutions crossing the significant $100 billion asset threshold extra time to build necessary reporting infrastructure and processes.

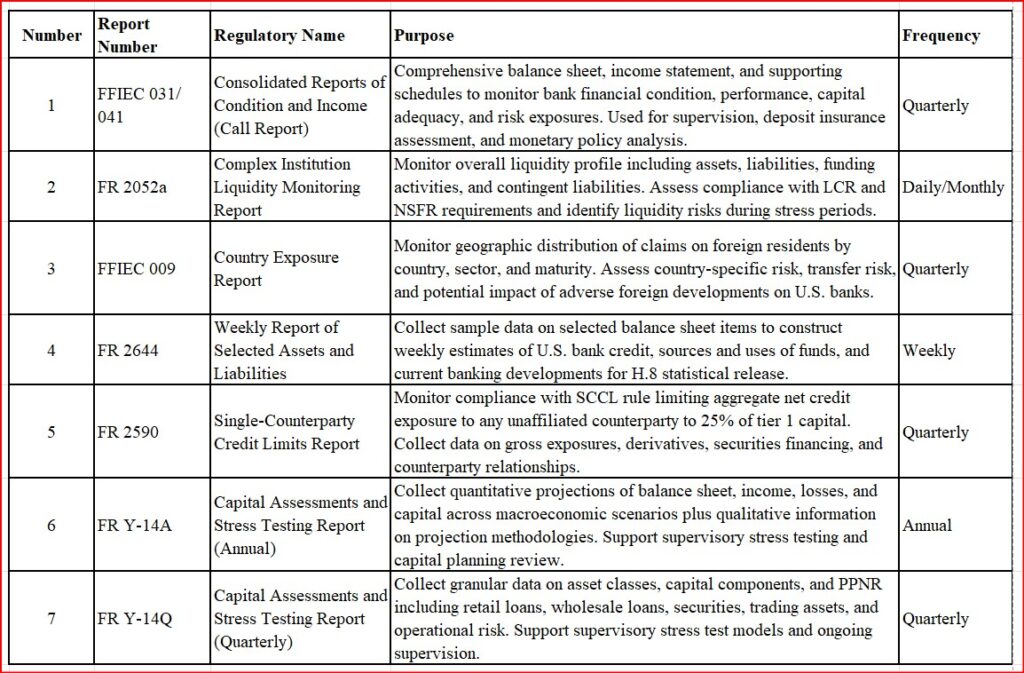

Table: Federal Reporting Requirements Summary

Additional Considerations

Data Governance and Quality Control

The volume, granularity, and frequency of these reporting requirements demand robust data governance frameworks and quality control processes. Financial institutions must establish clear data lineage documentation, implement automated validation checks, maintain comprehensive data dictionaries, and conduct regular reconciliation across reports.

Many of these reports require data at transaction or contract levels (FR 2052a, FR-2590, FR Y-14Q), necessitating direct integration with core banking systems, loan origination platforms, treasury management systems, and risk management applications. Manual data gathering and spreadsheet-based processes for Inured Depository Institutions with greater than $10 billion of assets are insufficient for sustained compliance with these requirements, particularly for daily or weekly filings. At Perficient, we have seen and helped clients implement AI-enhanced reporting capabilities.

Systems and Technology Infrastructure

Implementing and maintaining compliance with these reporting requirements typically requires significant technology investments. Institutions may need to deploy specialized regulatory reporting platforms, develop custom data extraction and transformation tools, implement automated validation and reconciliation systems, and establish secure data transmission capabilities.

The FR 2052a, in particular, has driven substantial technology modernization at many institutions due to its granular cash flow reporting requirements and daily submission frequency for the largest banks. Similarly, the FR Y-14A and Q reports require sophisticated data aggregation capabilities to assemble loan-level detail from disparate systems across the enterprise.

Staffing and Expertise Requirements

Compliance with these reporting requirements necessitates dedicated teams with specialized expertise spanning regulatory reporting, financial accounting, risk management, data management, and systems analysis. Larger institutions typically maintain separate teams for different reporting families, with subject matter experts for capital, liquidity, credit risk, market risk, and operational risk reporting.

The attestation requirements for several reports—including the FR Y-14Q and FR 14A—place direct accountability on senior financial officers, underscoring the importance of robust internal controls, documentation, and review processes.

Coordination with Business Lines

Successful regulatory reporting requires close coordination between centralized reporting functions and business lines across the organization. Trading desks must provide transaction-level derivatives data, retail lending units must supply detailed loan-level information, treasury teams must furnish liquidity and funding details, and international operations must contribute country exposure data.

Establishing clear roles, responsibilities, and service level agreements between reporting teams and data providers is essential to ensure timely, accurate submissions.

Conclusion

Banks with total consolidated assets between $10 billion and $100 billion face a demanding federal regulatory reporting regime that reflects their significance to the financial system and the potential risks they pose. The seven major reporting requirements discussed in this article—Call Reports, FR 2052a, FFIEC 009, FR 2644, FR 2590, FR Y-14A, and FR Y-14Q—collectively require thousands of hours of effort annually and generate vast amounts of detailed financial, risk, and operational data.

Effective management of these reporting obligations requires substantial investments in data infrastructure, technology systems, specialized expertise, and governance processes. Institutions must balance the compliance imperative with considerations of cost, efficiency, and the need to leverage reporting data for internal management purposes. Those institutions that view regulatory reporting not merely as a compliance burden but as an opportunity to enhance data quality, strengthen risk management, and improve decision-making are best positioned to meet these obligations efficiently while deriving maximum value from their reporting investments.

As the regulatory landscape continues to evolve in response to emerging risks and changing market conditions, banking organizations in this asset range must maintain flexibility, invest in scalable reporting infrastructure, and cultivate deep regulatory expertise to navigate future reporting requirements successfully. The complexity and significance of federal bank reporting requirements underscore the critical role of compliance and regulatory reporting functions in maintaining the safety, soundness, and stability of individual institutions and the broader financial system.

Our financial services experts continuously monitor the regulatory landscape and deliver pragmatic, scalable solutions that meet the mandate and more. Reach out to Perficient’s BFSI team here – Contact Us / Perficient – and discover why we’ve been trusted by 18 of the top 20 banks, 16 of the 20 largest wealth and asset management firms, and are regularly recognized by leading analyst firms.