The Consumer Financial Protection Bureau (CFPB) recently issued a final rule § 1033.121(c) supporting open banking and personal financial data rights. Under this ruling, banks, credit unions, credit card issuers, and other financial service providers must enhance consumer access to personal financial data.

The first compliance deadline of April 1, 2026, impacts the largest organizations.

- The ruling demands action from all non-depository firms (e.g., institutions that issue credit cards, hold transaction accounts, issue devices to access an account, or provide other types of payment facilitation products or services). The compliance deadline, however, depends on the firm’s total receipts from calendar years 2023 and 2024.

- April 1, 2026: $10B+ total receipts in either calendar year

- April 1, 2027: <$10B total receipts in both calendar years

- The ruling also impacts depository institutions that hold at least $850 million in total assets. Compliance deadlines follow a staggered rollout based on total assets.

- April 1, 2026: $250B+ total assets

- April 1, 2027: $10B to <$250B total assets

- April 1, 2028: $3B to <$10B total assets

- April 1, 2029: $1.5B to <$3B total assets

- April 1, 2030: $850M to <$1.5B total assets

Accelerating the shift to open banking with 1033

Open banking changes how financial data is shared and accessed, giving customers more control of their information. The 1033 Personal Financial Data Rights rule ensures that:

- Personal financial data is made available to consumers and agents at no charge

- Data is exchanged through a safe, secure, and reliable digital interface

- Consumers aren’t surprised with hidden or unexpected charges when accessing their personal financial data

- Consumers can walk away from bad financial services and products

- Safeguards protect consumers and financial firms from surveillance, data misuse, and risky data practices

Open banking is going to do for the banking industry what the introduction of the Apple smart phone did for cell phones.

CFPB 1033 open banking requires financial firms to ease personal financial data access for consumers

CFPB first proposed the rule in the Federal Register on October 31, 2023, accepted public comments on the regulation though December 29, 2023, then issued its final rule November 18, 2024. This effort carries out the personal financial data rights established by the Consumer Financial Protection Act of 2010 (CFPA).

The final rule § 1033.121(c) “requires banks, credit unions, and other financial service providers to make consumers’ data available upon request to consumers and authorized third parties in a secure and reliable manner; defines obligations for third parties accessing consumers’ data, including important privacy protections; and promotes fair, open, and inclusive industry standards.”

The implications of the CFPB’s regulation on open banking will be enormous for consumers, banks, and data providers.

Impact on consumers

Without open banking, consumers struggle to switch between bank deposit and lending offerings. For example, switching checking accounts to one with a better interest rate involves resetting direct deposits and recurring bill-paying, printing new checks, and obtaining a new ATM card. Mistakes resulting in overdrafts are costly, both financially and to one’s credit score and reputation.

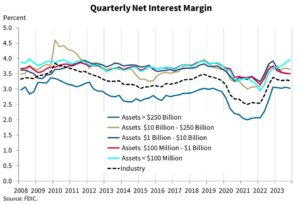

As a result, larger banks have a much smaller net interest margin, as shown in the chart below:

In addition, the stickiness of deposits causes a considerable lag between when a bank raises deposit rates and when deposit balances increase proportionately.

As open banking, mandated by Rule 1033, takes effect, consumers will be able to:

- Switch credit cards within seconds while retaining terms and rewards of their current account

- Transfer deposits and multiple years of transaction history into a new checking account

Impact on data providers

Data providers, including digital wallet providers, will be able to move on from “screen scraping” and instead provide API-driven real-time balances, transaction history, and reward balances to their retail customers. Of course, providing this “new and improved” service will require re-writing front ends and processing engines to provide the necessary data in a timely manner.

Impact on banks

Banks and their affiliates must look toward building an open, larger ecosystem as part of continued digital transformation efforts.

While challenging, this work is necessary for banks that aim to grow revenue through collaboration and cooperation. Ultimately, banks that don’t satisfy their borrowers or lenders will be hard-pressed to compete in the ever-challenging financial landscape.

Navigate 1033 open banking compliance deadlines with confidence

We encourage leaders to identify mandates’ silver lining opportunities. After all, to remain competitive and compliant, financial services firms must innovate in ways that add business value, meet consumers’ evolving expectations, and build trust. Achieving transformative outcomes and experiences requires a digital strategy that not only satisfies mandates but also aligns the enterprise around a shared vision and actionable KPIs, ultimately keeping customers at the heart of progress.

A holistic approach could include:

- Strategy + Transformation: current-state assessment, future-state roadmap, change management

- Platforms + Technology: pragmatically scalable, composable architecture and automations to accelerate progress

- Data + Intelligence: well-governed “golden source of truth” data and secure integrations/orchestration

- Innovation + Product Development: engineering and design for what’s now, new, and next

- Customer Experience + Digital Marketing: human-centered, journey-based engagement

- Optimized Delivery: Agile methodologies, deep domain expertise, and scalable global teams

Our financial services experts continuously monitor the regulatory landscape and deliver pragmatic, scalable solutions that meet the mandate and more. Discover why we’ve been trusted by 18 of the top 20 banks, 16 of the 20 largest wealth and asset management firms, and are regularly recognized by leading analyst firms.

Ready to explore your firm’s compliance with Rule 1033? Contact us to discuss your specific risk and regulatory challenges.