Are you using Oracle EBS Inventory? Do you struggle to determine and accrue the Consumers Use tax liability that is due on inventory removal transactions and transfers to other locations? If so, we may have a solution that can help you.

If you are reading this blog, you probably already know that Oracle EBS does not support tax calculation for Inventory transactions. Here at Perficient, we have a tax solution using Vertex O Series to calculate tax on inventory transactions. The tax calculation process is initiated by running a concurrent program inside of Oracle EBS. It can be run in preview mode, so you can run the process and review the results prior to calculating taxes and writing the results to Vertex. The solution includes a separate process to interface tax accruals to Oracle General Ledger. We have also developed a process to interface the applicable Use tax accrual expenses to Oracle Project costing.

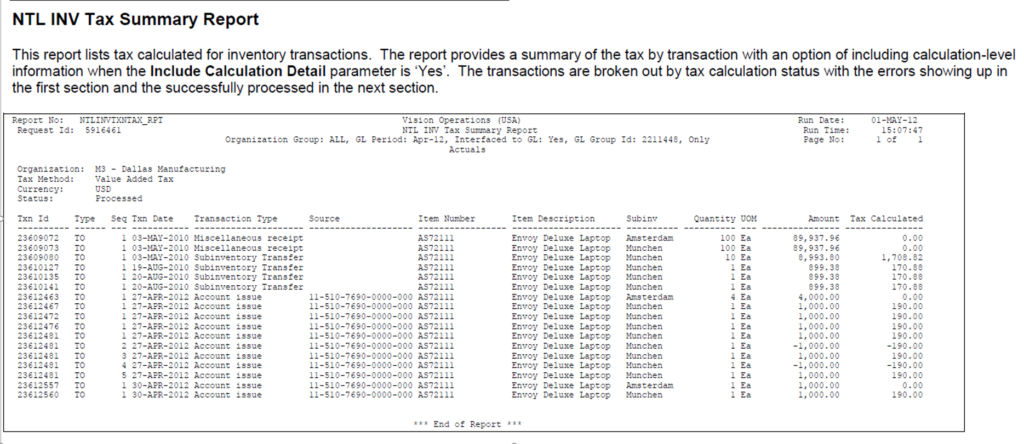

Below is one of the sample Reports.

If you need a tax solution for Inventory movements, please contact us. We would be happy to work with you to solve your Inventory tax issues.

If you need a tax solution for Inventory movements, please contact us. We would be happy to work with you to solve your Inventory tax issues.