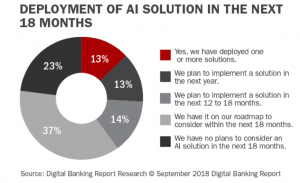

Recent research from the Digital Banking Report found that only 13% of financial organizations globally have deployed at least one artificial intelligence (AI) solution. 27% believe they will have an AI solution in place in the next 18 months. 37% say they will consider an AI solution within the next 18 months, and close to a quarter of organizations surveyed have no plans to implement any artificial intelligence solution in the next 18 months.

It seems like 60% of financial services organizations are doing nothing regarding strategic planning or implementation around AI.

Most banking executives we speak with believe AI is a critical component of their digital transformation efforts, so the research results above may appear contradictory. But it makes sense. AI is new, and the most appropriate uses for AI in banking are still in the experimental stages as banks figure out which use cases actually deliver improved business results.

Right now, we know AI is very good for certain banking applications (like fraud and anomaly detection), but not so good for others (like dealing with the complexities and nuances of personal finance decisions). AI is a disruptive technology – because most use cases envision using AI as part of the customer interface (and thus part of the customer experience), implementation decisions require careful design and management.

The decisions banks make will affect the all-important and delicate “moments of truth” they have with their customers.

We do, however, think there are ways for banks to manage disruptive innovation in a way that provides strategic value and not distraction. The basic idea is that disruptive innovation can be funded only if incremental and evolutionary innovations succeed in generating new value.

Perficient’s Now, New, Next framework (N3) enables banks to compare capabilities of a product or service with those offered by other banks, categorize those capabilities and suggest the level of focus leadership should commit to the capabilities in each category.

One incremental innovation we see more of in our work with our customers, and that was highlighted very nicely in a recent Forbes article citing APQC research, is robotic process automation (RPA). RPA is software that can be easily programmed to do basic tasks across applications just as human workers do. Unlike AI, RPA doesn’t learn on its own or seek to tweak out new efficiencies or new insights. It’s more like a digital assistant for workers, integrates easily with most legacy systems, and is simpler and less expensive to implement than AI. It’s an attractive solution for banks.

We know there is no shortage of clunky, manual, error-prone business processes in banking (think KYC, credit checks, and loan applications), the industry is hungry for rapid ROIs and operational excellence is a key component in building trust in more esoteric technologies like AI. This makes RPA, as Forbes pointed out, “The Gateway Drug to AI and Digital Transformation.”

Perficient can help you plan for and manage the transformation to a digitally-enabled bank. We have the industry and delivery experience in process efficiency improvement, content management, process automation, and the end-to-end services encompassing discovery, identifying candidates for automation, piloting and implementation. RPA POCs can be set up in as little as 1 to 2 weeks to test immediate and tangible value, implementation cycles can be as little as six to 10 weeks, and ROI can be realized in as little as eight to 12 weeks.

RPA can be a reasonable, low cost and lower risk entry into the world of AI and can lay the foundation for more intelligent applications later. If you continue to ask yourself why so many people are required to enter data into your systems, to identify and key data for documents or to handle exceptions, then consider RPA as part of your AI roadmap.

We can help you manage innovation from a portfolio perspective, determine the potential impact of different types of innovation and balance risk among incremental, evolutionary and revolutionary ideas.