World Class Service, for Free! Those of us in the banking industry that have been around a little while can remember the days when customers routinely paid for the services they consumed. It seems shocking to the average banking consumer today, but checking wasn’t always free, paying bills meant buying stamps and writing checks(which they […]

Posts Tagged ‘Banking IT’

Time to Jump on the Mobile Payments Bandwagon

As of late, I can’t go a day scanning my Google Reader or social media where I don’t see an article about a new mobile payments startup, unique loyalty features, the possibility of retailers coming together to form their version of a mobile payments platform, acquisitions announced, or predictions on which competing technology will come […]

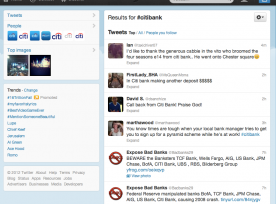

Social Banking: Understanding the Conversation

First let me describe the old world: Hire an ad agency and work with them on a campaign focused on television, radio, billboards, print, etc. You’ll focus the same message in all channels. It’s a mass market approach and you control what is said about your bank and your brand. If users have complaints, there […]

Social Governance’s Relevance to Social Banking

In most industries, governance represents a key and important part of the social world. I’ve lost track of the number of people whose companies disallowed social interaction of any kind because they fear the capabilities of this new generation of tools. Many executives fear what will be said about the company. They wish […]

The Convergence of Technology and the “Social Banking” Experience

As a technology marketer, I thought it was appropriate that I begin my blogging experience with a post about the role of both social media and technology in the financial services and banking industry. As mentioned in a recent HBR blog post, many traditional forms of marketing have been tossed to the wayside. In response […]

Where’s Waldo? The Case for Enterprise Content Management

To coopt a phrase from a popular children’s book and game series, “Where’s Waldo?” This simple question along with the ever present who, what, when and why, are often answered with inconsistent or incomplete responses in Enterprise data. As companies have merged, acquired and grown, many times it’s virtually impossible to get an answer to […]

Mobile Payments and the Importance of Critical Mass

I hear a lot of bloggers and pundits speak of the increasingly important target market for mobile payments. After all, the media coverage and social conversation around the topic of mobile payments has reached a fever pitch, and some wonder whether it’s worth all the hype. For example, I was reading the article “What’s missing in […]

Holding on to Banking Customers in the Mobile Wallet Age

According to a Carlisle & Gallagher Consulting Group survey, customers that are interested in mobile banking technology would consider an alternative to their primary bank for both mobile wallet and core banking services. The two largest consumer groups demonstrating this interest are young consumers and affluent consumers, both important demographics for the banking industry. 76% […]

Mortgaging Customer Goodwill

Almost every week we see another story in the national press about how “unfeeling banks” are foreclosing on a homeowner over an 80 cent payment error, or foreclosing on a house the bank doesn’t even own. After several social media blogs, several thousand tweets and retweets (with fiery commentary) and various news networks report the […]

Calling a Truce Between BPM and Six Sigma

I’ve heard a lot of operations folk talk shop over the years. My GE friends in B-School were the ultimate Six Sigma champions. I learned about kaizen and the art of lean while working in Japan. Then we have the tech champions of BPM technologies. These methods are often backed with an almost religious fervor. […]

Preparing a Bank for the Monumental Changes Ahead

The banking industry is in the state of flux. We have distruptive technologies in terms of mobile banking and payments that are creating siesmic shifts in the way business is done. We need to harness big data that is growing at exponential rates. It’s hard to keep up. As any CIO knows, any organizational change, […]

The Bold New World of Mobile Payments

Imagine a stressed out holiday shopper rushing to make last minute purchases in a busy suburban shopping mall. As the shopper reaches the final checkout of the day to buy the newest gaming console for her son, the total displayed on the register is over her budget. Determined to buy the item, the shopper lifts […]