GoBank has been in the news a lot lately with the launch of their new mobile-first banking app. Their no overdraft and “pay what you want” fee structure prove to be rather compelling for potential customers to switch banks. GoBank’s single-touch onboarding process and creative design are also indicative of good user experience design and smart marketing. Throughout the launch of GoBank Green Dot has been very cognizant of two key elements that will steer the direction of mobile development and digital marketing for their banking competitors:

- Making customer engagement payoff.

- Creating a mobile-centric customer experience.

So where’s the proof Green Dot is doing it right with GoBank? Yesterday, our team discovered that their mobile app was listed as the #9 most popular Android app last week by Android and Me readers. The app also has 5 stars on Google Play with more than 58 reviews already and acquired 10,000 customers by invitation only before going live.

GoBank’s Equivalent for “Branch” Engagement

From a marketing perspective, the shift toward omni-channel banking is having a direct impact on how financial marketers are approaching interactions with their customer. GoBank does this very well on a number of levels and across multiple channels. Just yesterday, Bank Innovation published an article on Green Dot’s alternative for marketing its products and services in a traditional branch. Green Dot’s “in-store” promotions through store partners play a sizable role. Reason being, financial service providers and marketers are having to think more and more like retailers to be where their customers are making purchasing decisions. In this case, for GoBank it happens to be in Rite Aid retail locations. Similar to Green Dot’s GPR cards, the ability to add a bank account while doing your grocery shopping demonstrates the convenience factor for mobile-only users, and potentially increasing marketshare among the underbanked or even “debanked” consumers, as Ron Shevlin of Snarketing 2.0 often calls it.

Customer Onboarding – A Critical Aspect of Engagement

On the digital side, GoBank also makes customer engagement a positive and fun experience for both potential and new banking customers. Since Jim Marous did such a wonderful job explaining GoBank’s onboarding process I encourage you to read his detailed post on the Financial Brand. However, I thought I’d reiterate the importance of the points he makes because it supports my perspectives on digital distribution and marketing enabling consumer adoption of the mobile platform. I love their referral tactic of “gifting” a $1 to friends to try the app – word-of-mouth referrals (also leveraging the app’s P2P feature) add up and this is a nice touch! Their down-to-earth, consumer approach and use of social channels like Twitter, Facebook and Flickr feeds are also nice touches in my opinion.

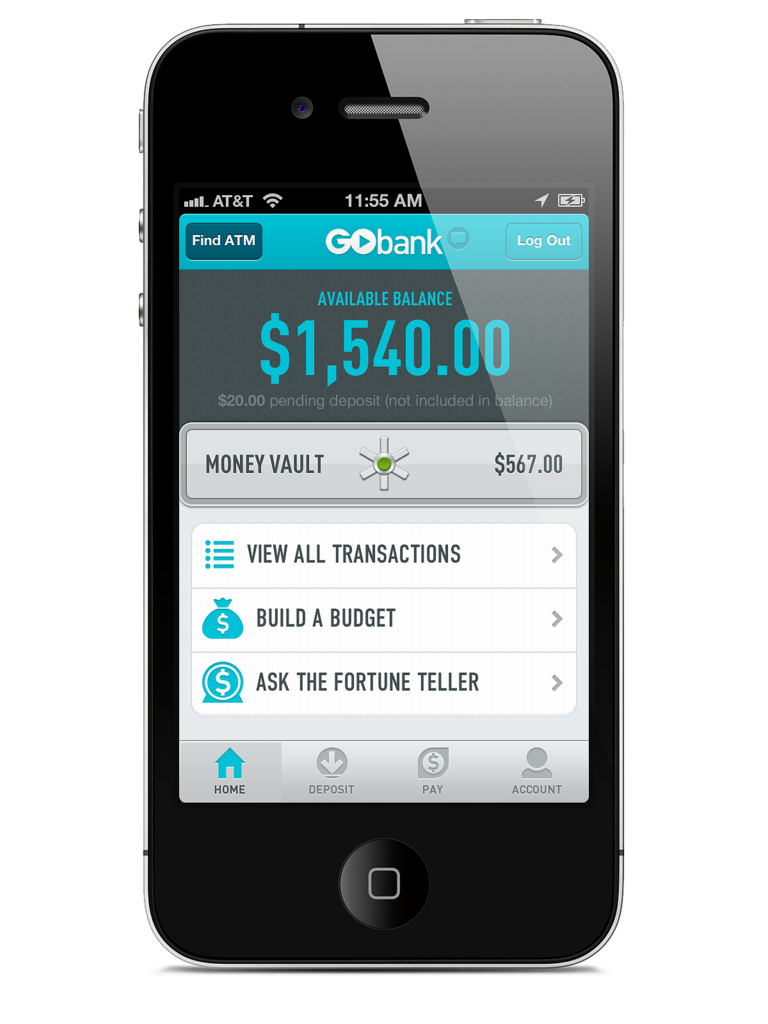

As part of Steve Streit’s “customer-centric” philosophy GoBank satisfies customers on two accounts. Keeping in mind where customers not only open up accounts but how they interact with the app is critical to success for mobile banking apps. GoBank’s online user experience supports mobile and tablet devices with a clear and concise design. As I mentioned earlier and as GoBank claims, the account opening process takes just a few minutes and can be done via mobile device. For new GoBankers, communications with users convey similar digital experiences by providing access to online resources for product information, customer service, and more. The in-app experience and its stand-out mobile features, create a simplistic customer experience. In an effort to further enable an mobile-centric banking experience, I’d look for Green Dot to continue to do more with its app to leverage the platform. For banks that have a more omni-channel focus GoBank use of digital channels is still a great example for others to live up to.A Stand-out Mobile Customer Experience

Despite the recent negative buzz around GoBank’s 10-day deposit holds, I don’t believe this policy will alienate mobile customers. Consumer trust and security are indeed critical success factors for mobile adoption. We’re seeing this particularly true with non-bank providers offering mobile payment solutions. Similar to GoBank, American Express’s Bluebird accounts are prone to fraud and abuse and likely face similar issues. A vast majority of financial institutions using mobile remote deposit capture (RDC) also have similar policies in place. Over time with more customer data to draw insights from, a vast majority of consumer deposits can be handled in a much shorter time frame. As the product matures Green Dot will be able to refine its anti-fraud processes and policy to meet (or exceed) industry standards.

Proof in the Numbers

In summary, they’re getting great visibility for their app using retail and digital channels, executing on a well thought-out marketing strategy, and have focused on defining and developing the critical “value-add” mobile-centric features that consumers look for in a mobile banking app. Not only do I expect to see their app continue to climb the ranks on the Google Play Store and iTunes, but I anticipate seeing supporting stats that show revenue generated from their “pay what you want” app fee.

I know a number of fintech enthusiasts and industry peers that have GoBank accounts. I’d love to hear your perspectives on how GoBank stacks up against the mobile banking competition!