The Federal Reserve released in late June the results of its annual bank stress tests. The Fed’s Comprehensive Capital Analysis and Review (“CCAR”) stress tests are designed to ensure that large banks can lend to households and businesses even in a severe recession. The annual exercise evaluates large banks’ resilience by estimating their loan losses, revenue, and capital levels—which provide a cushion against losses—under hypothetical recession scenarios that extend nine quarters into the future. The Federal Reserve has both a Baseline Scenario and a Severely Adverse Scenario.

This year’s Severely Adverse Scenario includes a hypothetical recession that begins in the first quarter of 2021 and features a severe global downturn with substantial stress in commercial real estate and corporate debt markets. The U.S. unemployment rate in the “Severely Adverse” scenario rises by four percentage points from its starting point, reaching a nadir of 10.75% in the third quarter of 2022. GDP falls four percent from the fourth quarter of 2020 through the third quarter of 2022, with asset prices dropping sharply, including a severe bear market with a 55% decline in equity prices.

Test Results

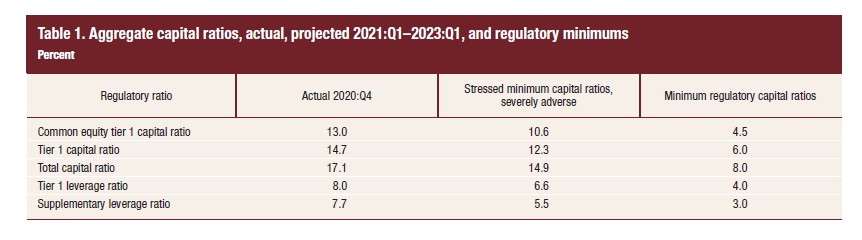

The 23 large banks tested remained well above their risk-based minimum capital requirements. As laid out previously by the Federal Reserve, the additional restrictions put in place during COVID will conclude. All large banks will once again be subject to the usual restrictions of the Board’s stress capital buffer, or SCB, framework.

The SCB framework was finalized in 2020 and increases capital requirements in the aggregate for large banks, increasing requirements for the largest and most complex banks. It sets capital requirements via the stress tests, and as a result, banks are required to hold enough capital to survive a severe recession. If a bank does not stay above its capital requirements, including the SCB, it is subject to automatic restrictions on capital distributions and discretionary bonus payments.

Under that scenario, the 23 large banks would collectively lose more than $470 billion, with nearly $160 billion in commercial real estate and corporate loans. However, as shown in the table above, their capital ratios would decline to 10.6 percent, still more than double regulatory minimum requirements.