There are essentially two types of cash flow statements – Direct and Indirect. In the indirect method, Cash flow is derived from Net Income plus changes in balance sheet accounts that are categorized as Operating Cash flow account, Investing account and Financing accounts.

In the direct method only true cash activities are accounted for whereas indirect method works on accruals. Most of our projects deal with Indirect method of cash flow accounting as it is easier to record and reconcile. In FCCS, you can select to create an out of box Indirect cash flow statement.

FCCS uses movement dimension to calculate roll forwards and generates an automated indirect cash flow statement. As part of the application set up it is required to map each account with the right movement member. Then FCCS calculates the periodic changes in the balance sheet accounts to come up with the corresponding cash flow line. However, a lot of times customers don’t necessarily have all the underlying Balance Sheet accounts identified or broken down into the exact roll ups as needed by the Cash flow statement. Essentially the out-of-box Cash flow satisfies probably 80% of what the customer needs, but they still want to be able to make top side adjustments to the FCCS calculated Cash flow.

In such a scenario, there are two options

1) Either change the accounts to record each transaction the way it impacts cash flow line.

2) Or allow top side adjustments to the calculated cash flow in FCCS

Option 1 requires the customers to change the way they are currently recording the transactions in the ERP system. Option 2 seems to require fewer changes from the back end. In this blog, we’ll talk more about option 2.

Business Case – Create a cash flow statement that is built using indirect method in FCCS and also allows for top side adjustments to the cash flow without impacting the underlying Balance sheet/P&L Accounts.

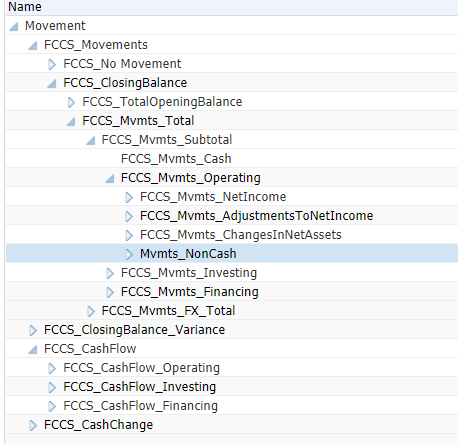

Design – Identify the accounts that need to impact the cash flow lines. All these accounts should be mapped to the regular movement members that are either created manually or out of box. For all other BS/P&L accounts that should not impact the Cash flow, create a member under Movement dimension that is part of FCCS_Movements Subtotal, but does not roll under FCCS_Cashflow. See below a snapshot of the member we created – Mvmts_NonCash. In this way, Opening Balance can be calculated for these accounts without affecting the CashFlow statement.

Movement

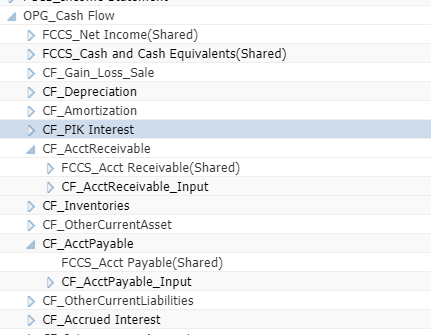

Now create your Cash flow hierarchy as shown below : You can add input statistical type of accounts for each category that will allow for adjustment on top of what FCCS Calculates as shown below.

Next create a form to allow users to adjust the cash impacting lines like the CF_AcctPayable_Input. The form should allow for input at these statistical input accounts and Mvmts_NonCash member. Now when we pull CF_AcctPayable account, it will show the total of what FCCS calculated based on movements of the accounts that were tagged with mvmt_AccountPayable plus the adjustment that was made.

Now on the cash flow report, pull this cash flow account rollup along with the Movement cash flow hierarchy to display a Cash flow report that has calculated indirect cash flow along with topside adjustment.