Last Friday, February 12, while many bankers were preparing for a long 3-day weekend or perhaps making preparations for Valentine’s Day celebrations, the Federal Reserve Board released the hypothetical scenarios for its 2021 bank stress tests. In 2020, the Federal Reserve found that large banks were generally well-capitalized under a range of hypothetical events.

The Fed’s Comprehensive Capital Analysis and Review (“CCAR”) stress tests are designed to ensure that large banks are able to lend to households and businesses even in a severe recession. The annual exercise evaluates large banks’ resilience by estimating their loan losses and capital levels—which provide a cushion against losses—under hypothetical recession scenarios that extend nine quarters into the future. The Federal Reserve has both a Baseline Scenario and a Severely Adverse Scenario.

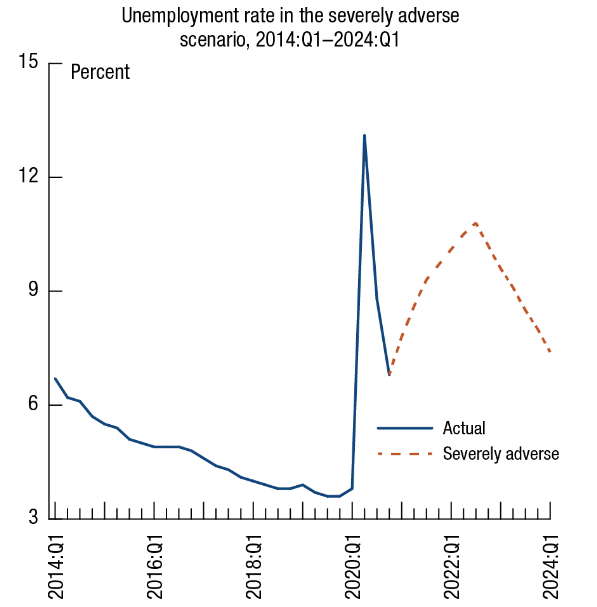

This year’s Severely Adverse Scenario includes a hypothetical recession that begins in the first quarter of 2021 and features a severe global downturn with substantial stress in commercial real estate and corporate debt markets. The U.S. unemployment rate in the “Severely Adverse” scenario rises by four percentage points from its starting point, reaching a nadir of 10.75% in the third quarter of 2022. GDP falls four percent from the fourth quarter of 2020 through the third quarter of 2022, with asset prices dropping sharply, including a severe bear market with a 55% decline in equity prices.

In its announcement, the Federal Reserve provided the following chart of actual and hypothetical unemployment under the Severely Adverse Scenario:

In 2021, 19 Strategically Important Financial Institutions (“SIFI”) will be subject to the CCAR stress test. Banks with large trading operations will be tested against a global market shock component that stresses their trading, private equity, and other fair value positions. Also, banks with substantial trading or processing operations will be tested against the default of their largest counterparty.