In my iReceivables blog series, I’ll give a high level overview of iReceivables, its pros and cons and will also provide some tips for a successful implementation based on experience I’ve gained over the years.

Overview

iReceivables, is part of Oracle’s Credit to Cash software solution, its main purpose is to provide a portal where customers can login and view their account activity, pay bills, run statements etc.

iReceivables would be a good fit for organizations that have a large number of customers and/or for those who spend a lot of time and money on billing and billing-related tasks such as statement printing and mailing, handling billing-related customer service calls etc. If your accounts receivable department is overwhelmed with receiving customer payments or remediating customer disputes, the application is a good fit for you. iReceivables will help significantly reduce your load by passing on most of the laborious tasks to the customer.

Since security is a concern nowadays, features in iReceivables enable the customer to securely login to their personal portal using their own unique credentials. There is a locking mechanism in place to prevent hackers from accessing the system or customer data. The external portal is outside the ‘DMZ’ (Demilitarized Zone), which means that it’s located outside your internal network, therefore your internal network and business data is secured from outside traffic.

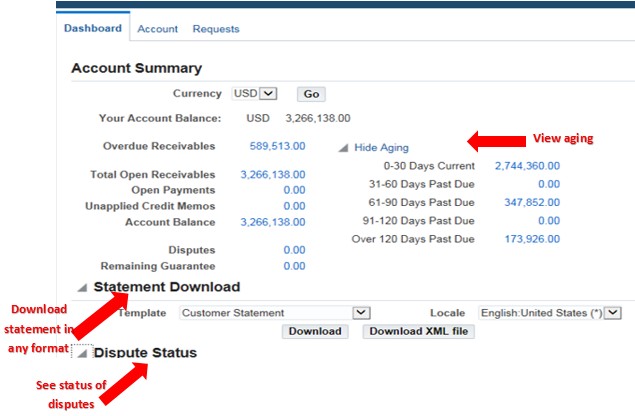

There’s a self-registration process whereby customers register themselves. Once a customer has registered and logged in to what Oracle calls the self-service portal, the pages and functions are user friendly. Customers will be able to view their own statements, balances that are due, aging on their invoices and any other details related to their account in real time.

iReceivables Dashboard

A very popular feature with customers is the ability to download almost all activity (statements, open transactions etc.) in Excel format, another is the ability to print copies of their invoices on their own. What the application does is give the customer control over managing their account while relieving you of attending to these tasks.

Other cool features include:

– ‘Internal’ access that enables personnel in your company access to the full customer search capability to display customer information.

– Drill-down capabilities on invoice activity, open and overdue balances, payments, credit memos, adjustments, payments and disputes.

-Attachment function that enables customers to view attachments on their invoices and also attach their own.

In Part 2 of this blog series, I’ll dive deeper into some of the functionality, talk of a few ‘cons’ I’ve run into and give tips for a successful implementation.