If you have the need to defer recognition of incurred expense across multiple GL periods, you can use the Multiple Period Accounting (MPA) feature. Good business application scenario would be expenses incurred for a yearly subscription for a software license, semiannual contract for janitorial services, rental lease paid in advance, etc.

Oracle MPA supports PO Matching and expense Prepayment business process as well.

What do you need?

- No set up required!

- Start Date – Date when the accounting for MPA.

- End Date – Date for MPA accounting

- MPA Accrual Account – Holding account for the expense until they are recognized.

What to do:

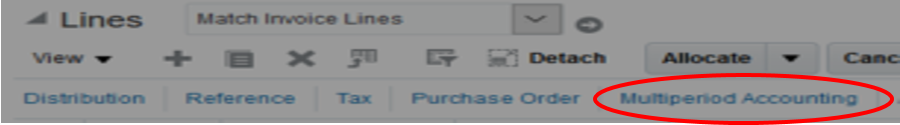

- Create a Payables invoice. Additionally, enter the values for Start Date, End Date and Accrual Account columns under the Multi Period Accounting tab.

2. Validate the invoice

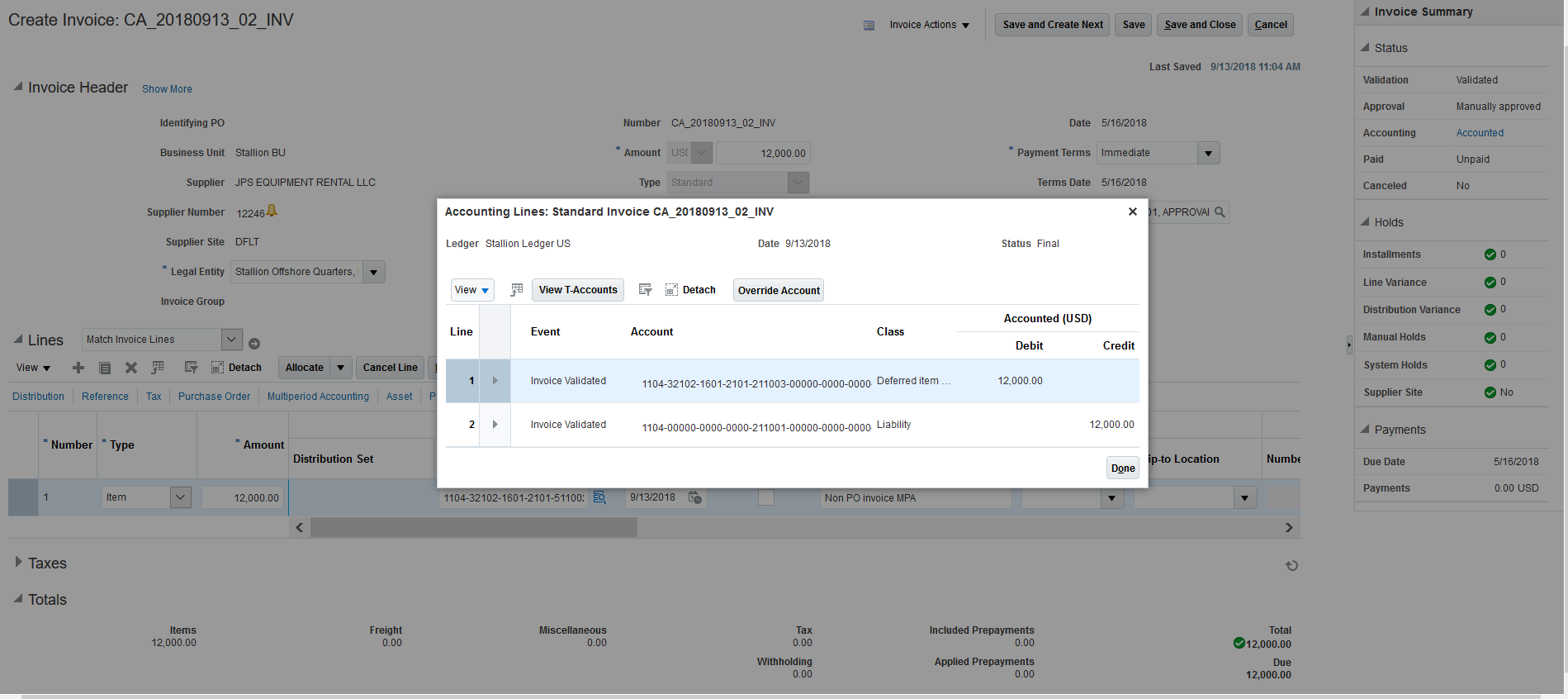

3. Create accounting for the Invoice

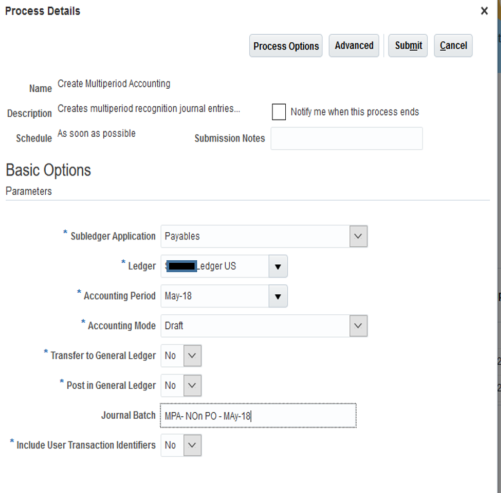

4. Run Multi Period Accounting Program as part of your Month End Close Task

5. Verify the MPA accounting entries

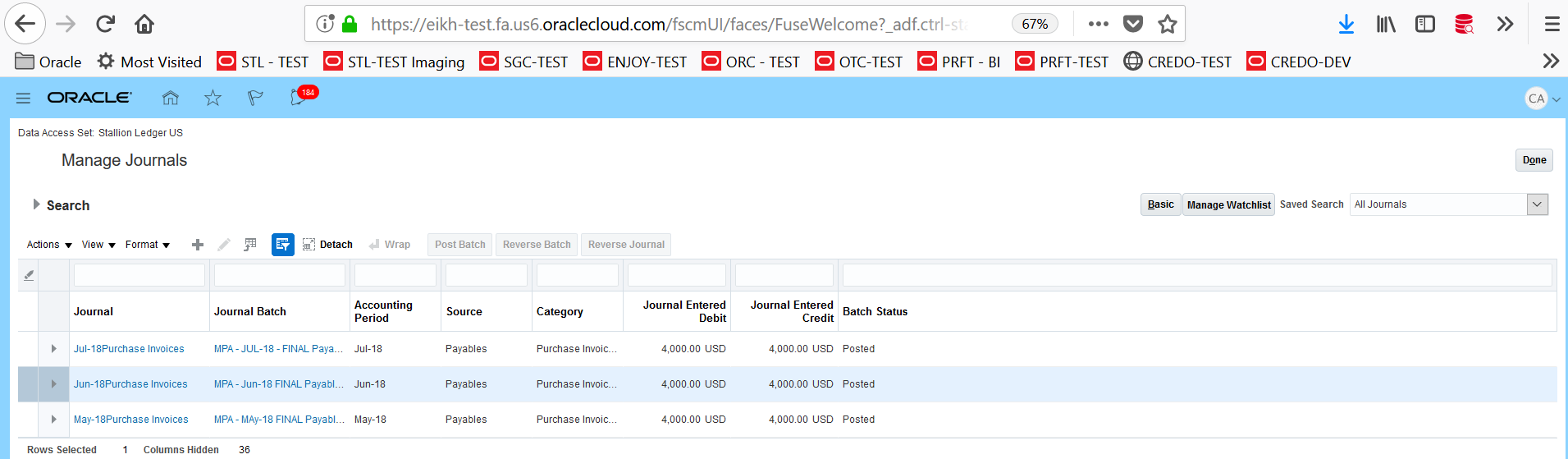

6. General Ledger Entries for Each period

Now you know how to use the Multi Period Accounting feature to create accounting entries across more than one accounting period. I hope you found this tip useful.

Look for future blog posts where I’ll share other time-saving tricks of the trade I have learned over the course of various client engagements.

Thank you for your explanation on MPA.

Just curious if same can be set up in Salesforce for a Software company that wish to defer revenue from subscriptions revenue over multiple periods.