This guest blog post was authored by Alfresco’s Raphael Allegre

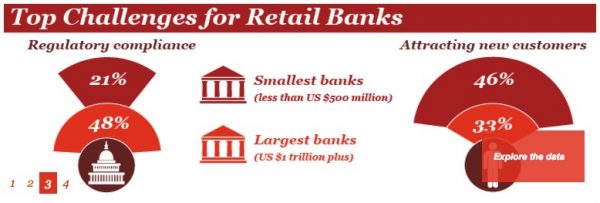

Complying with regulations and acquiring new customers were identified as the top 2 challenges facing the retail banking industry in a recent global survey conducted by PwC.

Regulatory Compliance

Anti-Money Laundering (AML), Basel II, Sarbanes-Oxley Act (SOx), OMB A-123, Data Privacy, Consumer Privacy, Check 21, SAS 70, BSA, PATRIOT Act, MiFID and Reg NMS are just a few of today’s existing fsi regulations. New or revised regulations are coming fast. The EU data protection laws (GDPR) coming in May 2018 and affect all organizations holding information on EU citizens. The potential penalties are severe ($20m or 4% of global annual turnover). It is estimated that the direct financial impact of regulations on European and US banks In 2014 alone, was US$65 billion in fines and penalties.

And that’s before you’ve even thought about the (possibly greater) indirect costs of hiring the required skills, transforming operations and continuously investing in new technologies to meet current and future regulatory compliance in ever-changing environments.

Attracting New Customers

The second reported top challenge for global banks is responding to a new threat from the emergence of non-traditional digital disruptors. These are challenging the established order by leading with customer-centric innovations delivering better service and greater value. Given the cost and competition pressure levels in the financial sector, banks are hungry for growth, and finding new customers is the first response for many bankers. Also knowing the higher cost of getting new customers versus keeping existing ones, transforming the customer experience is usually the ultimate answer for both keeping and attracting new clients.

How Do These Challenges Impact Day-To-Day Operations?

As new regulations were introduced over time, banks adopted point solutions to manage compliance activities in silos by separate lines of business (LOBs) of the bank. This has led to creation of duplicate efforts and disparate data sets, documentation processes for risk reporting and testing. As a consequence of multiple disparate systems, employees are struggling to find the right information at the right time resulting in lower operational efficiency. Jumping back and forth between applications, emails, and local Excel spreadsheets, and scattered information creates an error-prone environment. In classical investor services back office operations such as account opening, customer onboarding and account maintenance, meeting regulatory standards means being able to prove you followed the right procedure with the history of all completed operations. When these multiple systems are not integrated it is costly and impossible to generate a comprehensive audit trail of end-to-end operations.

The capability of rapidly acquiring new customers relies on greater on the efficiency level of the key business process efficiency across all customer touch points (i.e onboarding, contract management, customer service etc.). Unfortunately, the flow of information is often slowed down or stopped by labor-intensive operations, lack of process visibility, poor integration between systems, lack of contextual information to take decisions and difficult collaboration across LOBs.

Transforming the Customer Onboarding Process

What are the capabilities that banks needs to meet compliance with minimum intervention and deliver a greater experience for onboarding customers?

Seamless process automation & orchestration

The first critical need is to automate all the manual and error-prone tasks and orchestrate the entire flow of interactions from end-to-end. An automated digital onboarding process would act as the glue that connects multiple LOBs, content and systems together. From a customer point of view, digital process automation is making the entire experience more engaging with self-service data entry, real-time visibility & communication as well as fast delivery of service. From a banking perspective, process automation not only brings speed but also better oversight on business operations with the ability to identify bottlenecks in real-time and fix them fast. It also brings full historical data on past operations to serve intelligent analytics and process optimization. Finally, digital process automation also helps improve employee satisfaction by reducing frictions due to operational inefficiencies and manual errors.

Content management plus process automation

All documents collected during the onboarding need to be gathered in a single place, searchable, secured and contextually accessible anytime throughout the process. Information captured during the process or pulled from any LOBs application should be convertible as a document providing contextual insights for decision-making activities or being part of the process outcome.

Low-effort Compliance

Meeting regulatory compliance for the onboarding process requires being able to demonstrate that collected customer information has been securely stored and managed along the entire process. The flow of completed transactions driven by the process engine needs to be automatically converted as a record ready for third-party regulators and long-term retention. Documents needed for regulatory compliance need to be handled automatically during the process to avoid extra effort after onboarding.

The Open Digital Platform to Help You with These Challenges

The Alfresco Digital Business Platform (DPB) is purpose-built to move beyond what traditional packaged applications provide. It accelerates development of digital solutions where processes flow seamlessly, content is presented in context, and regulatory compliance is met. Instead of focusing on BPM or ECM or Record Management (RM) in isolation, the Alfresco Digital Business Platform is the only platform on the market today that brings these core capabilities together.

What’s Unique?

By simplifying business operations process flows, by integrating content with business processes across physical, virtual, cloud and hybrid cloud environments, the Alfresco Digital Business Platform is helping organizations deliver business and customer benefits in days or weeks rather than months. Organizations are leveraging Alfresco’s open platform to take business processes that used to require expensive and lengthy one-off IT projects and are now engineering them into a model-driven platform. Kyle Pause, director of SaaS Platform Development at Pitney Bowes declared in a recent article “as Pitney Bowes develops and brings to market new SaaS offerings for our clients, we can now wire them to our customer onboarding business processes in a matter of hours instead of days or weeks.”

Adding Perficient’s Trex to Complete the Solution

Working in combination with Alfrresco’s Digital Business platform, Perficient’s Trex provides a highly configurable and extensible user interface layer with a template designed specifically for the financial services industry. Trex addresses pain points in the financial services industry by:

- Streamlining manual processes by automating workflows and business rules.

- Working in combination with Alfresco to reduce and/or eliminate paper documents

- Ensure regulatory compliance by making sure that a consistent process is followed every time for every customer account

- Providing a modern digital experience which meets the needs of evolving investors.

For more information, go to www.alfresco.com, https://www.alfresco.com/partners/perficient-inc, and www.perficient.com