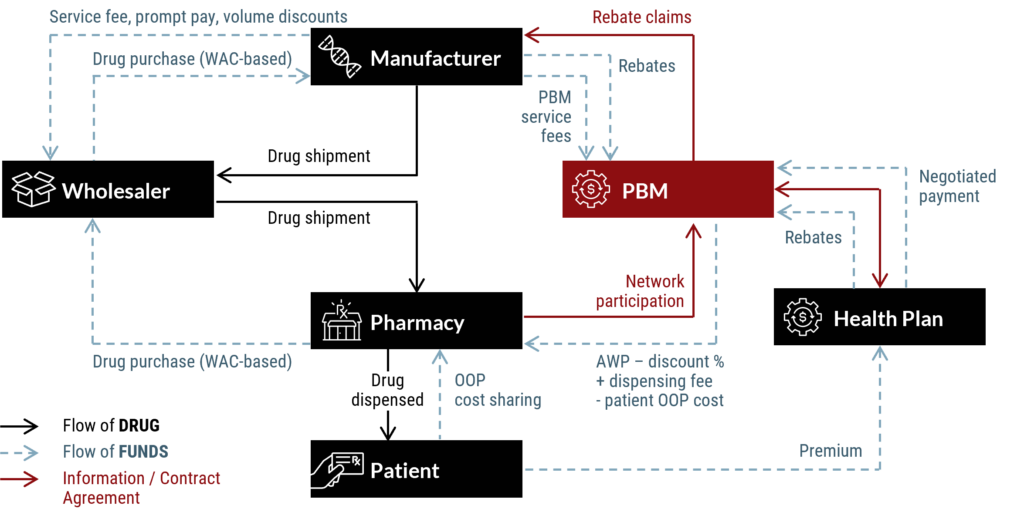

Prescription drugs reach patients through a complex web of entities. Among these, pharmacy benefit managers (PBMs) play a crucial role, handling reimbursements and negotiations with drug manufacturers and pharmacies.

Three major PBM players – CVS Caremark, Express Scripts, and OptumRx – collectively command a significant 79% market share, orchestrating much of the industry’s dynamics.

This concentrated influence has given rise to mounting unease, prompting a diverse array of stakeholders, including patients, doctors, pharmacists, large employers, and even health plans, to express concerns regarding the practices of these industry giants.

As a result, stakeholders’ interest in partnerships with smaller, more transparent vendors, as an alternative to the dominant big three, is increasing.

Unpacking Concerns in the PBM Landscape: The Catalysts

The PBM landscape is rife with tension. Key players, including drug manufacturers, independent pharmacies, and physicians, find themselves navigating an intricate web of issues, and the repercussions ultimately impact the most vulnerable stakeholders: patients.

Four key concerns – each with far-reaching implications across the industry – sit at the heart of these challenges:

- Escalating Rebate Demands: Drug manufacturers, often criticized for their perceived exorbitance, face mounting rebate demands from pharmacy benefit managers (PBMs). This ongoing struggle contributes to the broader atmosphere of tension within the pharmaceutical sector.

- Ethical Dilemmas for Physicians: Physicians find themselves wrestling with ethical dilemmas, questioning the driving forces behind prescribing decisions. Concerns arise as to whether these decisions genuinely prioritize patient needs or are influenced by veiled profit motives, highlighting the delicate balance between medical ethics and financial considerations.

- Impact on Patients: Amidst these industry tensions, the impact on the most vulnerable stakeholders—the patients—is significant. Patients bear the financial burden of decisions made behind closed doors, emphasizing the need for a more transparent and patient-centered approach in the pharmaceutical ecosystem.

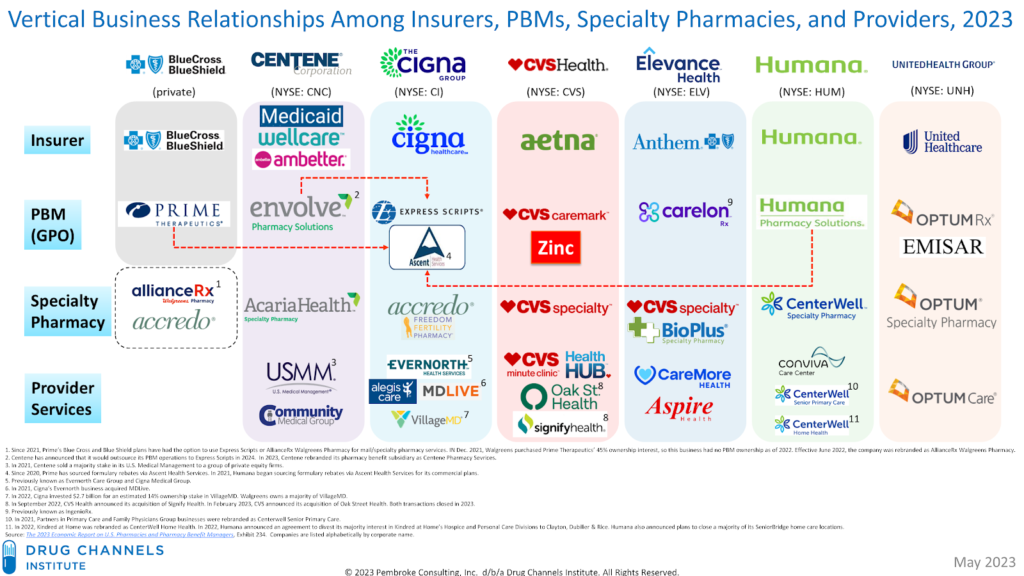

- PBM-Insurer Integration and Concerns: PBMs have increasingly integrated with health insurers, forming a vertically integrated ecosystem. This integration raises critical questions about reduced competition, increased market power for industry giants, and a lack of transparency in cost control and profit distribution. Ethical concerns regarding potential conflicts of interest are also prevalent, as PBM-insurer relationships could potentially allow insurers to circumvent Medical Loss Ratio (MLR) requirements.

Addressing Cost and Transparency: Initiatives By the Big Three PBMs

In response to mounting calls for enhanced transparency and increased competition, the major pharmacy benefit managers (PBMs) – CVS Caremark, Express Scripts, and OptumRx – have introduced various initiatives to tackle affordability and foster cost awareness.

Recent initiatives by the big three PBMs include:

- Cigna’s Express Scripts Copay Assurance Plan (CAP): Cigna’s Express Scripts has launched the Copay Assurance Plan (CAP), designed to alleviate patient out-of-pocket costs for specific medications. This program caps co-pays at a predetermined level, mitigating the impact of price fluctuations on patients.

- Drug Pricing Tools from CVS Caremark and Express Scripts: Both CVS Caremark and Express Scripts have implemented online tools to empower patients. These tools enable individuals to compare the prices of different medications at local pharmacies, providing them with valuable information to make informed choices.

- Price Edge by Optum: OptumRx introduced Price Edge, an initiative that automatically provides members with the best available prescription drug price. This innovative approach aims to optimize cost savings for members while ensuring access to necessary medications.

These initiatives align with the broader shift in healthcare towards greater transparency and cost control.

The ongoing commitment of the big three PBMs to such initiatives reflects a shared industry goal of creating a more transparent and affordable healthcare system. While these steps are a positive response, their long-term impact and overall effectiveness are yet to be fully realized.

In my next blog, I explore the rising competitive developments that could potentially disrupt existing PBM business models.

Need help navigating your most complex digital challenges? We’re here to help. Contact us to get started.