Thanks Liza Sisler and Elizabeth Dias for pointing to the source articles. The flip side of Digital Transformation must be Digital Disruption. Probably no better example of that disruption exists than the Financial Services Industry where so much of the friction can be smoothed by digital technologies. On example of this is the UK first digital bank. Information Age has a short article on the new Charter Bank and what it may mean against older competition.

Consumers are increasingly valuing what these ‘non-bank banks’ have to offer: Accenture has found that one in five consumers would be happy to bank with PayPal – a firm born in Silicon Valley, not in the Square Mile.

There is increasing pressure on banks to remain relevant. But there are those making waves. Lloyds Banking Group recently announced its intention to double-down on digital banking, closing branches and cutting costs. In the US, BBVA Compass announced that its agreement with startup Dwolla to offer real-time payment facilities to customers makes it the first mainstream bank to open its technology platform to digital developers like Dwolla. Such bold moves, even a couple of years ago, would have invited ridicule and a fair amount of controversy.

– See more at: http://www.information-age.com/it-management/strategy-and-innovation/123458848/digital-transformation-how-banks-are-cashing#sthash.KozBPxEM.dpuf

Other Examples

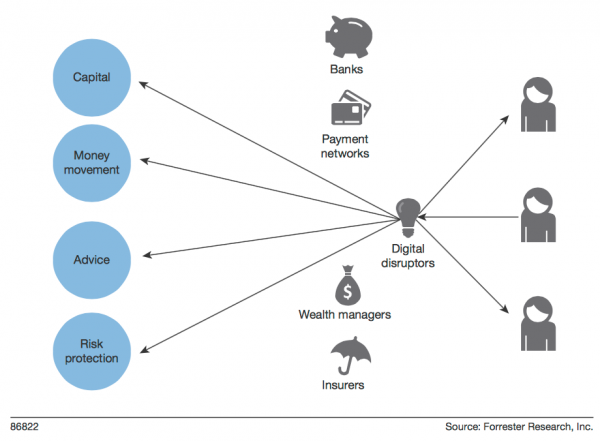

But Charter Bank isn’t the first in the world. The United States has many examples of these digital disruptors. Forrester’s article, “Digital Disruption Hits Financial Services” (Behind a paywal) It’s very informative on the types of companies starting up to transform the way the industry does business. Of the 18 categories of disruption, Digital Banking has 11 examples including Fidor Bank, Go Bank, and Smarty Pig (best name so far).

What’s perhaps the most interesting is the concept Forrester pounds home that the disruption works because they disinter-mediate incumbents.

Digital Disruption Via Disinter-mediation

There Will Be Blood

Yet another article with a catchy title and compelling content comes from Bradley Leimer at American Banker. His basic premise is that trouble looms on the horizon for many banks.

The industry feels uneven, the business model itself for the vast majority of players a bit muddled. David Kerstein of Peak Performance Group projects that by the end of this decade there will be 40% fewer banks and 50% fewer credit unions.

…..

The banking industry has traditionally thrived on these areas of friction. It is, of course, where we make much of our profit. Historical friction complicates our customer journeys. New fees and constraints on evolving forms of money movement and management, elongated processes to validate and verify identity and account ownership, non-contextual evaluation of risk to extend credit – these are all cumbersome user experiences that fail to leverage data and associated knowledge in our systems. Friction in the financial system comes from the industry’s strong aversion to risk and attachment to historical centers of profit, its less-than-innovative reaction to regulation, as well as organizational structures focused around inflexible systems and processes.

Our model simply must change to reduce this embedded friction, whether it is in the form of fees or complicated processes. We must keep up with the simplicity, usability and transparency customers now demand.

If we return to the flip side of the coin, digital transformation drives disruption. A few years ago I spoke to a few directors at a bank who reaped nice fees from international transfers. They faced something we even more today. The service that provided for international transfers had revamped itself and was now a competitor undercutting the fees. It’s a perfect example of disinter-mediation. At that time they had two choices:

- Keep going with their current business model and do whatever they could do to keep their profitable customers for as long as possible

- Accept that lower fees would happen, jump on board, revamp their international transfer business, and make up in volume what they would lose in profit from individual transactions. This of course implied that they would take business from other banks not ready to deal with the disruption.

I won’t tell you the outcome but I will tell you this happens everyday here. To quote Bradley again, “There will be blood”

As much of traditional banking services become a utility, those that leverage personalized banking experiences for their profitable customer niche segments will thrive. As we move further into digital experience, the next decade will be even more incredibly disruptive than what we saw in the recent economic downturn.

There will be blood.

Bottom Line

Like many other industries, there exists both opportunity and disaster in the changes brought by digital transformation. It’s up to each company whether they grasp the opportunity or sit tight and wait for the disruption to occur.