Managing Leases, Deposits, and Advances in Oracle Cloud

As is customary with contracts, legal fees, rentals, and construction projects, there is a need to pay deposits and retainers that may be deducted against future invoices. There are two types of prepayments and they are temporary (i.e. advancement for employee expenses) or permanent (i.e. lease deposit). Temporary prepayments can be used to apply against future invoice(s) whereas permanent may not be applied.

Entering Prepayments

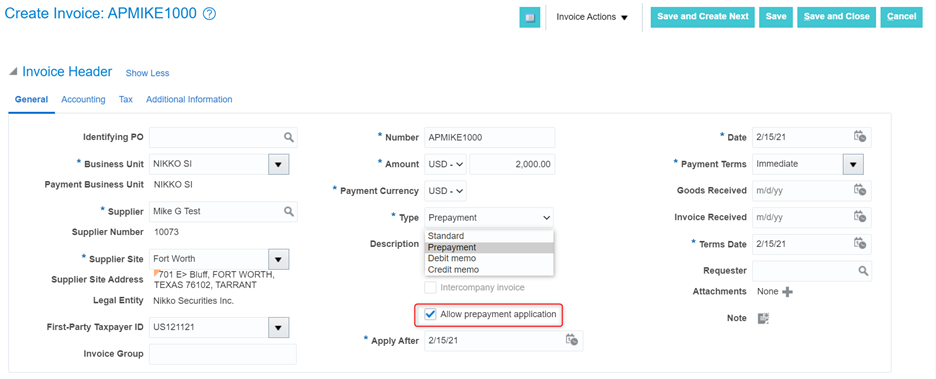

You will enter prepayments like any other invoice, but you will choose “Type” as “Prepayment”. Once prepayment has been selected you will then need to choose if this can be applied to future invoices by selecting the “Allow prepayment application” checkbox. Prepayments can be matched to a PO or you can manually enter in as many distributions as needed. Finally, you can apply holds to prepayments to prevent payment.

Paying Prepayments

Pay prepayments as you would any other invoice. These can be paid in a payment batch or as a one off payment.

Applying Prepayment to Standard Invoice

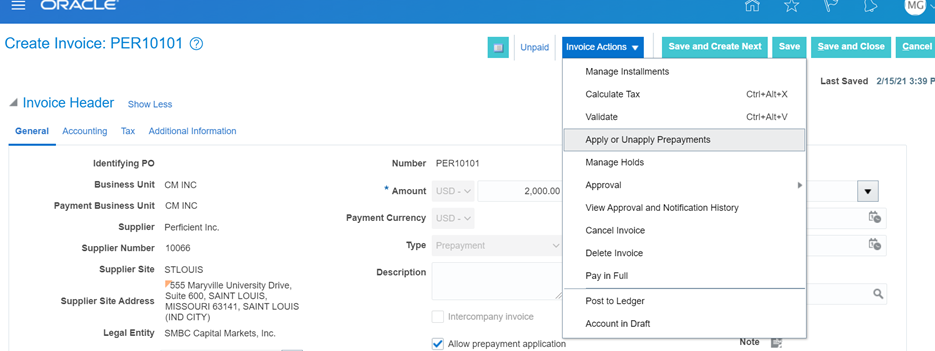

When the standard invoice is entered into the system you can then apply the prepayment. Query up the standard invoice and then in the “Invoice Actions” section select “Apply or Unapply Prepayments”. To apply the prepayment you must make sure the following fields are enabled:

- Allow Prepayment Application

- Apply After Date

- Prepayment is paid and is available

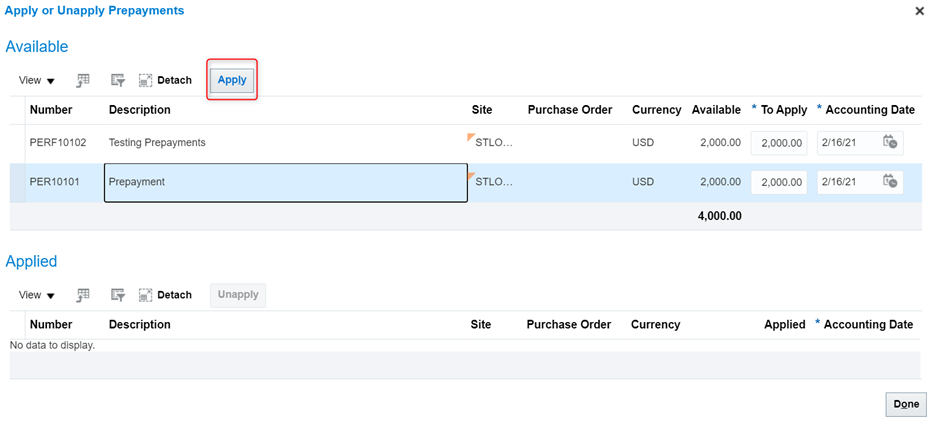

Choose the prepayment and click on apply.

After clicking on Apply and Done the prepayment is applied to the invoice and subsequently that invoice is now removed from any future payments. To Unapply simply do the same process but this time click on Unapply.

Accurate Accounting

Oracle creates the accounting each step of the way. Below is the accounting that Oracle generates for the full prepayment process.

- Create Prepayment Invoice

- Prepaid Expense Dr

- Liability Cr

- Pay Prepayment Invoice

- Liability Dr

- Cash Cr

- Create Standard Invoice

- Expense Dr

- Liability Cr

- Apply Prepayment to Standard Invoice

- Liability Dr

- Prepaid Expense Cr

Summary

Prepayment is a tool, which if used effectively, can help your business avoid duplicate payments and enable reconciliation to a supplier statement. Furthermore, it is key to GAAP accounting that the expense be recorded in the correct period. Oracle easily allows you to place the prepayment on the balance sheet and then, at one time, or over multiple periods move it to the income statement.