As a marketer, you’re used to things moving quickly. But, with the entire world undergoing unprecedented change, it can be overwhelming for you, your business, and your customers. So, how do you identify what your customers need and how you can help? Now more than ever, audience intelligence is the key.

Audience intelligence is about understanding your target customers, their needs, what resonates with them, and how you can reach them. Many of us think we know our customers, yet the more we need to reach new audiences or serve existing ones whose priorities change (as they certainly are now), the more we struggle.

On May 7th, 2020, Eric Enge (Digital Marketing Principal, Perficient) and Rand Fishkin (Co-Founder & CEO, SparkToro) got together to discuss the critical role of audience intelligence.

Watch and read the transcriptions below to learn:

- New and traditional methods for gathering information about your target customers

- Tactics for gaining a better understanding of their changing needs

- How to use audience intelligence to optimize your marketing

- Tools to help you be successful

- And more!

Access the full slide presentation from the webinar here.

Transcript:

Eric: Hey, everybody. Eric Enge here. I’m the Principal with the Digital Marketing Solutions Business unit. With me today is my longtime friend and true industry rock star, Mr. Rand Fishkin. He’s the founder of Moz, founder and CEO of SparkToro, which will get some mention in today’s discussion, for sure, and is the author of “Lost and Founder.” Your head is slightly hiding the book there, Rand, behind you on the bookshelf.

Rand: Yes, you’re right.

Eric: It’s a really heartfelt story of an entrepreneur’s journey to, well, success. Although I think it shares a lot of the real heartache of that whole experience, but it’s a great book. All that said, thanks for coming in today, Rand.

Rand: Great to be with you, Eric, and great to have everyone joining us. I’m excited about this webinar. I have been a researcher and a proponent of audience intelligence for a long time, and the last couple years of my career have been very focused on that specifically. But this is the first time I’ve ever given a formal presentation on the topic. Eric, thank you so much for this invitation, and thanks to Perficient, as well.

Eric: Yeah, it’s great. I think it’s an awesome topic, a really important topic. The more you can understand about your customers and prospects, the better. I don’t think there’s any doubt about that. So just in general for the audience, please keep in mind that we are going to have a Q&A section at the end. So, as you have questions, queue them up. You can even submit them. We have people here helping to accumulate those, and Rand and I will address them toward the end of the presentation. With that, why don’t we jump right into this first-ever presentation on audience intelligence. Rand, you’re going to lead us off, here.

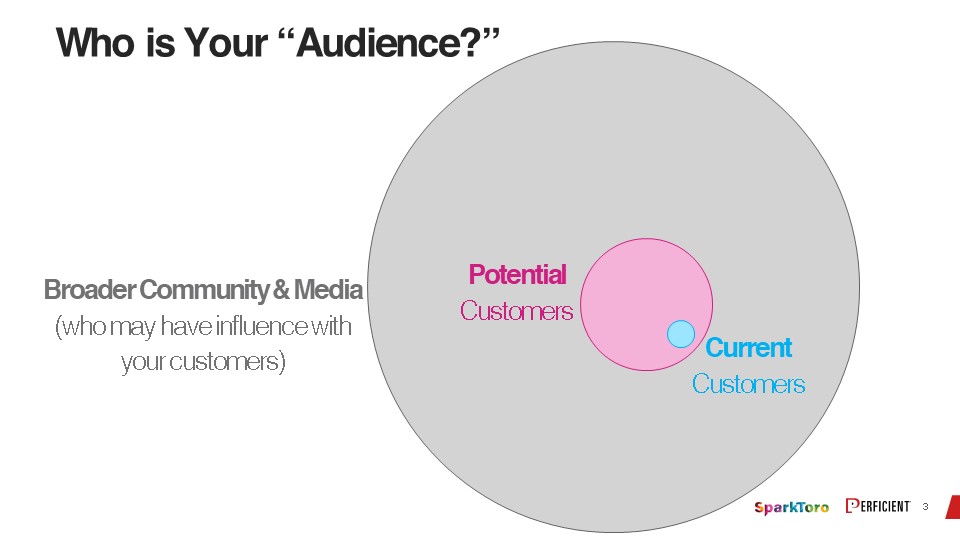

Rand: Let’s talk about audience intelligence and why this actually matters. I’m going to do kind of an intro. My co-partner Casey and I have been doing a bunch of research into this trying to understand, why is this so important? So, “audience…” When we say “audience,” we don’t just mean this one group of current customers, right?

We actually mean a broader group of people — potential customers, people you could reach who might become customers, who could be customer targets.

And even broader than that, when we’re using the term “audience intelligence,” we also mean your broader community and the media that impacts your audience — people and publications, sources of influence — those could be big media outlets, right? This could be Bloomberg and “Wall Street Journal” and “New York Times” and “Washington Post.” Or it could be a tiny blog, industry trade publication, a podcast, a webinar, like the one we’re on right now. That’s the broader community that impacts your potential customers and your current customers.

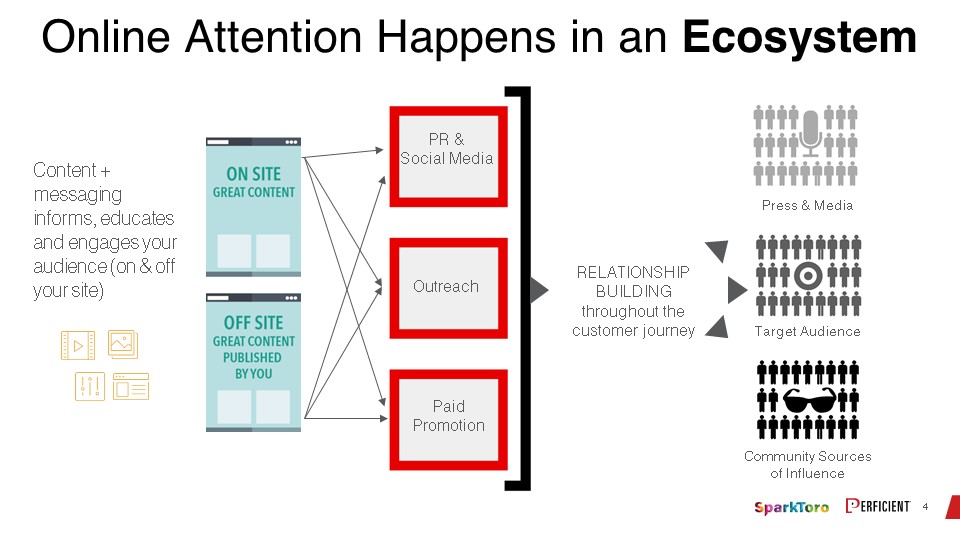

And there’s sort of an ecosystem that happens around this.

You’ve got content and messaging that you produce and, hopefully, that you are relatively in control of, as you get bigger. Sometimes, that can get out of your control, in positive and negative ways. And that impacts the public relations, the social media, the outreach that you do, all of your paid messaging — which, generally speaking, you do control. And that creates these relationships. It’s sort of a connecting web between press, media, community sources of influence, your target audience, the people who are already customers, and people who might be in the future.

And from this group, you need information so that you can do effective kinds of marketing.

If I don’t understand my audience — think classic SEO, right? Many people who are on this webinar are probably familiar with SEO. Perficient and Eric and I obviously have a deep background in SEO. And in the SEO world, if you don’t know what words and phrases your audience is searching for, you can’t do good SEO. And if you don’t understand the intent behind those searches — why do they search for them, what did they hope to get from that — then you can’t possibly serve them well.

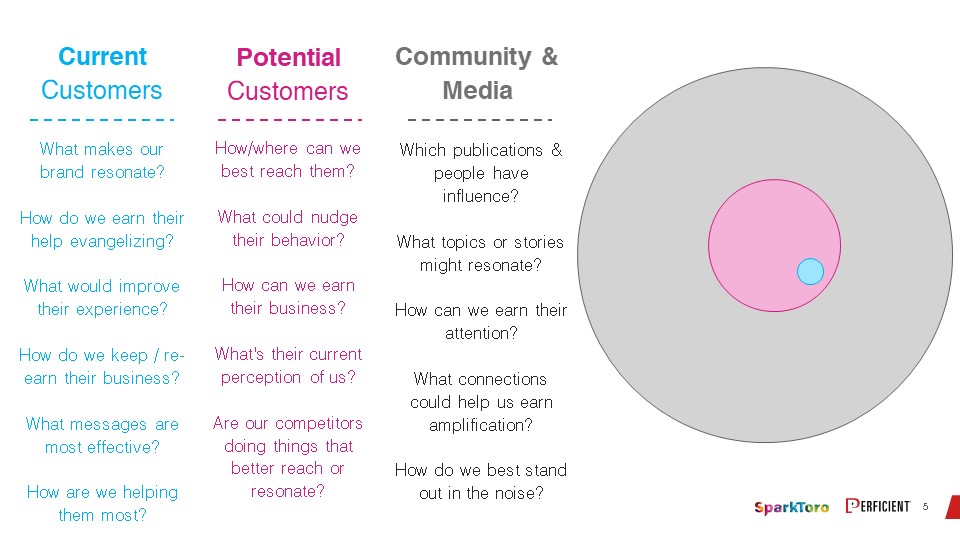

And so, audience intelligence is designed to answer questions like these from current customers. “What made our brand resonate with them?” “How do we earn their help, evangelizing what we’re doing?” “What would improve their experience?” “How do we keep their business or re-earn it in the future?” “What messages are effective to them?” For potential customers, we might have questions like, “How can we reach them?” “What could nudge them to become current customers?” “How can we earn their business that’s different from how we earned our existing customers’ business? Or is it just more of that?” “What’s current perception?” “What are our competitors doing — competitive intel?”

And then, community and media. “Which publications and people have influence?” “What are the topics and stories that might resonate?” We use this gray group, the community and media group here, to impact the potential customers and our current customers. And our current customers and potential customers also influence community and media. This is an ecosystem, like we talked about. So, what is audience intelligence? We understand the groups we’re trying to get to, we know what our audience is. We understand, basically, why we want to reach them, we have all these questions, so we can do good marketing. But what is it?

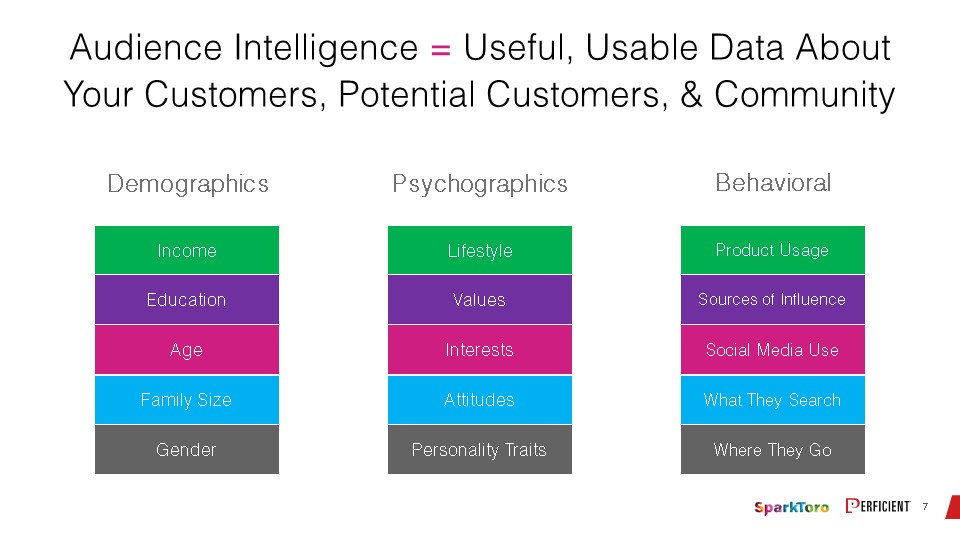

A succinct definition is, “Useful, usable data about your customers, potential customers, and the community.” Useful, usable data. There’s a lot of data that personally, I think — well, we’ll get into personas and demographics and all that kind of stuff later — it’s really useful to have, in certain senses.

So, you have this useful, usable data. Some data is useful for some applications and not so useful for others. I don’t want to suggest that all of these data sources are what everyone needs to collect. You take the bits that matter to you for the strategies and tactics that you need to implement. If a data piece isn’t useful, why bother getting it? What we want to do is start with a question, how are we going to reach this audience? How are we going to grow our market share? How are we going to talk about this new product launch?

And then, you say, “Well, I want to know more about the audience demographics.” Things like income and education, age, family size. Or, maybe I want to know more about lifestyle, values, interests, attitudes. Personally, I don’t find lifestyle and personality traits all that valuable. But I often find, for the people that I help, interests and attitudes are really, really useful for the marketing, especially the messaging side. Behavioral, product usage. How are our existing customers using the product? How are potential pre-users who aren’t yet customers using it? What are their sources of influence? That’s hugely useful to any marketer, of course. What social media did they use, what do they search for — like SEO — where do they go? All that kind of data.

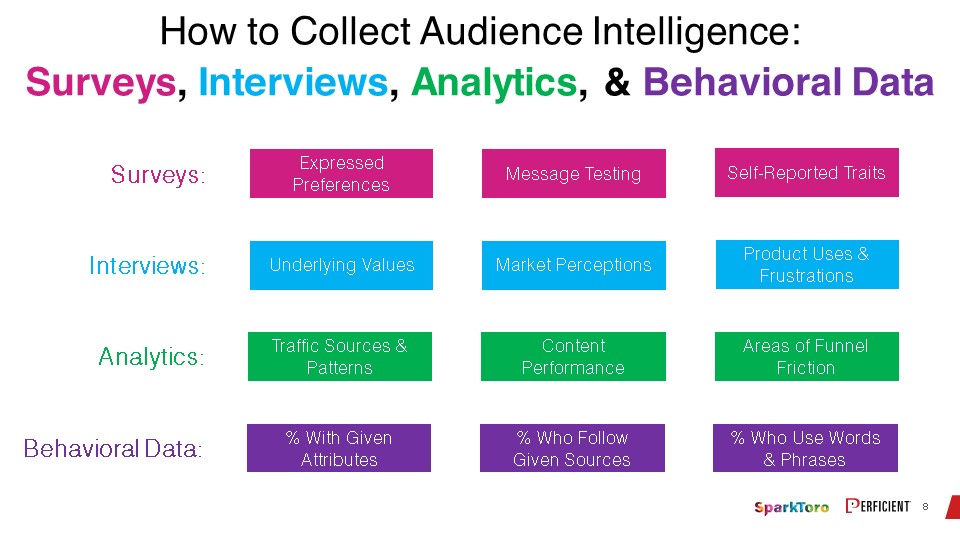

And there are four ways to collect these types of data.

There are surveys, which can collect things like express preferences. You’re surveying your audience and saying, “How do you feel about X?” You can test messaging. “Do you like this better, or that better?” “Does this resonate with you or does that resonate with you?” And self-reporting traits. Things like geography are self-important traits that are pretty accurate. Things like behavior are less accurate. If I say, “Eric, what podcasts do you regularly subscribe to?” You might give me three. Those might be the three you listen to most, but they might not be.

Interviews. When I do surveys, I really like also doing some interviews of those people, because I feel like it gives me the color and depth and personal connection that sits behind the data, so you can get to underlying values, market perceptions, why people say the things they do, product uses and frustrations.

Analytics data. Of course, every technical marketer gets data like this, and it can be incredibly valuable for helping to see the differences between, “People said they wanted X. When we offered X, they actually used Y in the product.”

And I have seen this many, many times, that self-recorded data is very different than real data usage, real areas of funnel friction. “Why didn’t you sign up?” “Well, it was price.” It turns out, when we made the product checkout faster, or allowed people to continue as a guest instead of having to create a login, they got through the funnel much faster. That suggests it wasn’t just price, it was also ease of use.

And then, of course, there’s behavioral data. So, what are the percentage of people who have given attributes, who follow given sources, who use particular words and phrases? All very, very useful, to understand a group in a way that you couldn’t get from self-prescribed data. We’ll talk about some of that.

All right, now for some core components. I really, really recommend that if you are going to understand your audience, you want to have real relationships with real people in that audience.

These are some people who happen to be in my audience. This is Wil Reynolds, the founder of Seer Interactive, and Ross Simmonds, who’s an independent marketer up in Canada. And both Ross and Wil, at least Wil Reynolds’ teams, use the product that Casey and I made, SparkToro. But I also brought up this slide to illustrate something else. Anyone notice something strange about this slide? It’s true, we are at the Philadelphia Eagles stadium in Philadelphia. This is pre-coronavirus, obviously.

Out of the 47,000 people pictured, Rand Fishkin is the only one not wearing an Eagles jersey in the entire crowd. This is illustrative of the fact that I did not understand my audience, so I did not behave correctly. And I got a lot of looks from people who, if I hadn’t been with other Eagles fans, might have been very skeptical. “What is this person who’s clearly going to brunch doing at an Eagles game?” But I do highly recommend real relationships. I think that makes a huge difference in how you understand your audience.

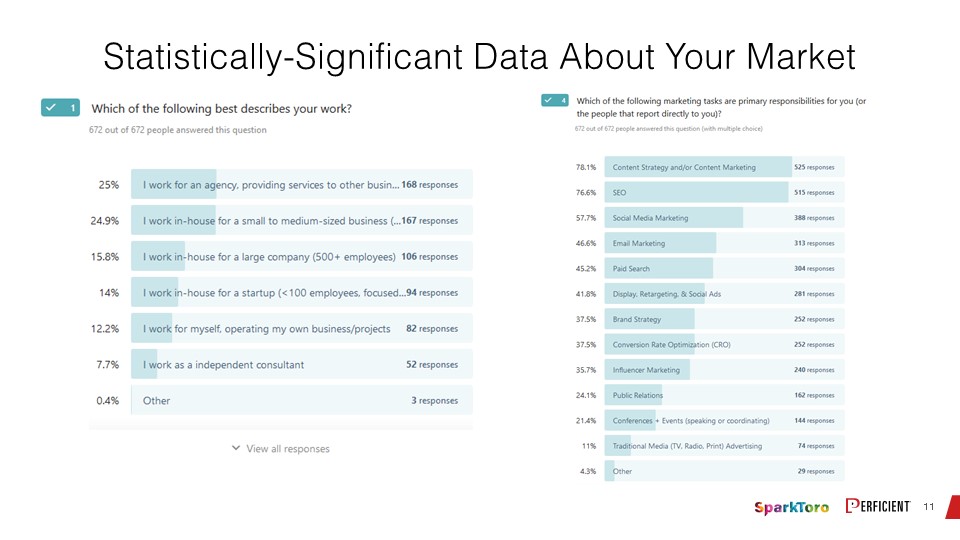

You also want statistically-significant data. Anytime you are gathering data, you need not just a big enough group, but you need to understand them, right?

When you collect data, there’s variance in the data. And that variance will indicate to you how large an audience you want. So, if you’ve ever seen election-polling data from anywhere, it’ll say, “Confidence interval, plus or minus two percent.” And obviously, in the 2016 presidential election in the United States, the plus or minus two percent turned out to be very significant, right? It meant that a lot of poll predictions ended up being incorrect. But it was still within the margin of error. And so, you are looking for the same thing in your data. You want margin of error that is relatively low, so that you can have high confidence in your data.

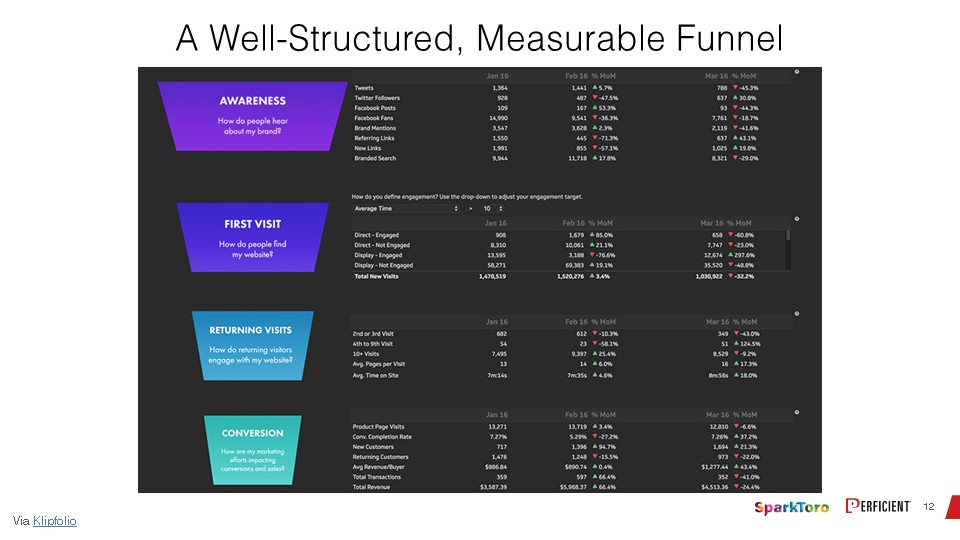

You also need a well-structured, measurable funnel. I like to think about a funnel in these four steps.

Awareness — how do people know about, hear about my brand? First visit — how did they get to the website? Returning visits — how do they come back? Why? And then, conversion — how do they make something happen on the site: sign up an email address, try a free tool, buy something, whatever it is.

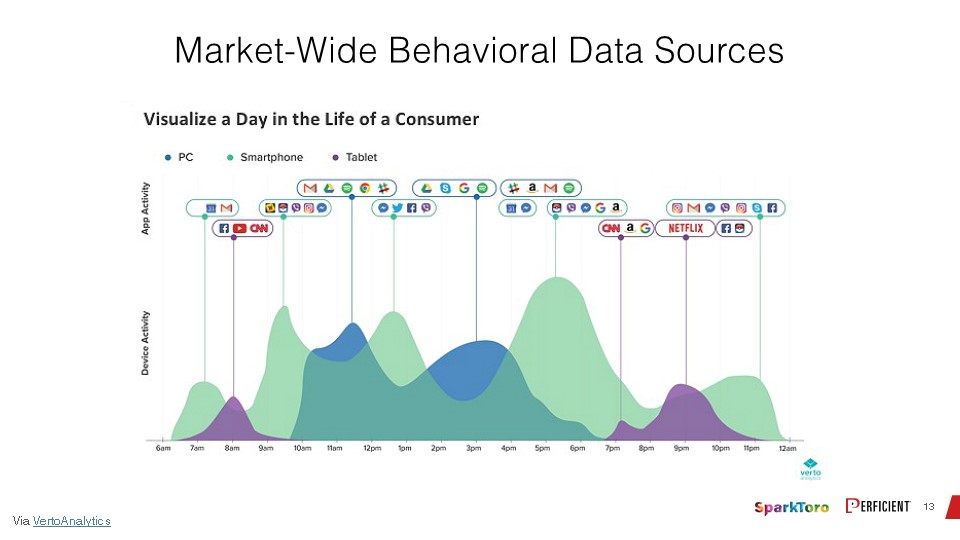

And then, the market-wide behavioral data sources.

We’ll talk about some of these in the future. Verto Analytics, here, is one that I’m actually newly investigating. But this is sort of competitive, overarching market data.

I love this type of data, because it lets me get to real behavior of tens of thousands, hundreds of thousands, and millions of real users in ways that is directly observable rather than self-reported. All right, Eric, you want to take it over?

Eric: So, I’m going to take this over for the next few slides here. I’m going to talk a little bit about why all this matters now. Let’s flip the slide again, here.

So, why does this matter now?

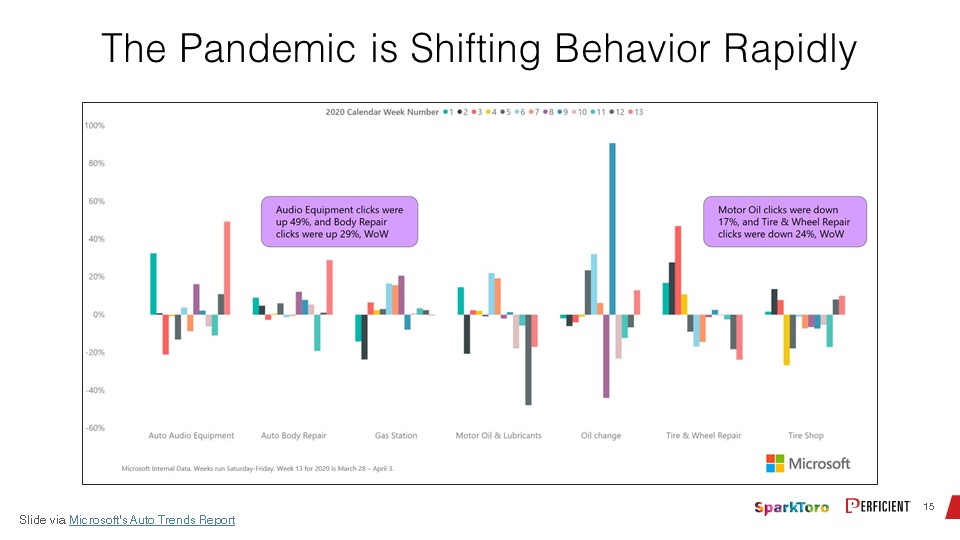

It’s a really good question. It’s not even just now. This matters all the time. You always need this kind of information. But the current situation we have with the COVID-19 pandemic is a spectacular example of why you want to be able to get behavioral data really rapidly. There are some huge changes. I have some examples here, of queries that are up and down. And there are so many more. Did you ever hear about virtual happy hours prior to this? In my family, we have two different games nights a week with friends that we didn’t even get together with prior to the COVID-19 on a regular basis. And we’ll probably keep doing them after it’s long gone. But the reality of all of this is that your product and marketing strategies need to keep up.

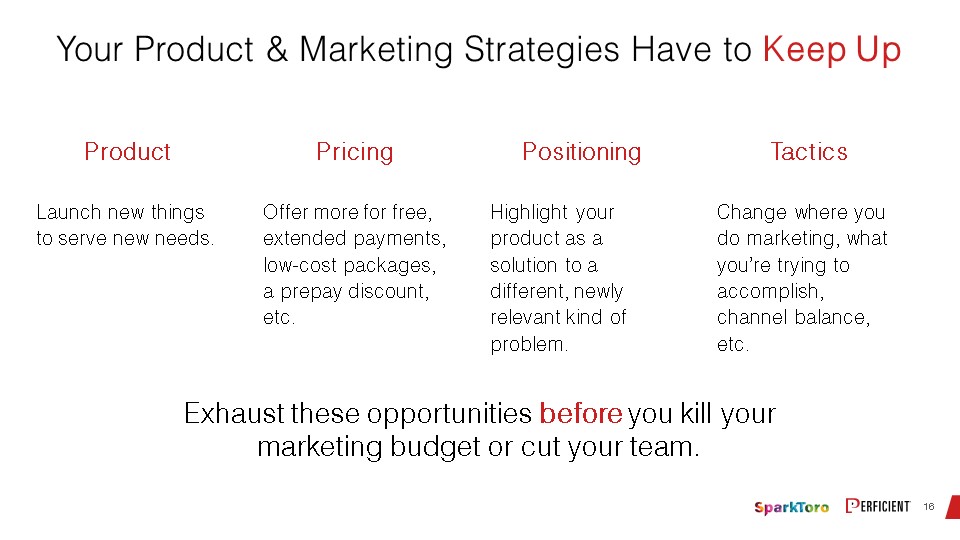

So, you might need to adapt what you’re doing with your products to meet new needs, emerging needs. We’ve seen people do that. I gave the example of virtual happy hours.

Pricing. There are a lot of businesses that are under a lot of stress right now. We’ve seen a lot of companies offering better payment terms. That’s another important kind of thing to do. And then, change your positioning a little bit. So maybe your product was already capable of doing the thing that they’re looking for now. But if you don’t change your positioning and tell the customer that it’s able to do that — I’m going to stay with my example. You have the ability to do a virtual happy hour kind of thing, but you just didn’t call it that before. And that’s just adapting your positioning to the market condition.

And then there’s the tactics, too. The channels might change. So, you have situations where behavior in all these areas can change in a significant way, due to the market conditions.

Rand: Do you see that Desktop is on the rise for the first time in 15 years, instead of shrinking?

Eric: Absolutely, because people aren’t out and about, so they’re not doing it on their phone. They’re sitting at their desk. And by the way, yes, the larger screen and the larger keyboards do still matter. And this is a perfect example of something that changed dramatically. And since we are using the pandemic as an example here, obviously, companies had to lay people off and cut their marketing budget and cut their spend. But I really do think a lot of people did it too quickly, without actually being thoughtful and seeing if there was a way to reposition themselves. And I’ve seen some companies do that, where I thought they actually had the opportunity to do something different.

So, let’s talk about some traditional marketing approaches to understanding your audience. Rand, you mentioned earlier how much you love persona. We’re going get to talk about that in a second. But first of all, who is your target audience, and what makes them tick?

So, if you’re selling party supplies, you’re probably addressing people who are extraverted in nature. Whereas, if you’re selling video games, you’re probably addressing an audience that’s introverted in nature. And that’s a pretty simplistic way. You also have level of income, and many different kinds of preferences that can define what your audience is.

And then, just what market are we really in?

I always loved the famous example of — I’m going way back in history here, turn of the 1900s — when the railroads ultimately got hugely damaged and went out of business, because they thought themselves to be in the railroad business and not the transportation business. So, they weren’t able to morph with changing times. And if they had understood the changing behaviors and the consumer set, they might have been able to adapt more quickly.

And then, how do you address that audience?

That’s your brand promise. Now you know who you’re trying to address and what business you’re in. But how do you get across what makes you special and different? Are you the cheap option, are you the expensive option, are you the best value? And there are many other ways of talking about this.

And how do you showcase these differences?

It’s all great to know who your target audience is, and what business you’re in, and what makes you different. But if you don’t do a good job getting that across, you could really fail because of that. So, it’s really important to get that messaging down and to get that out to the audience.

And then, ultimately, what’s the experience that you want to deliver?

Are you high customer service or self-service? That’s a very simplistic way of talking about it, but also the personality you have, the tone of voice. I always love this example. There’s a restaurant here in Boston, where the experience you go for is that the waitstaff is hostile to you. And people do it because it’s funny. And it’s actually the reverse of what you would normally want, the kind of experience that people thrive in. And it actually works for them, that they go out of their way to deliver this seemingly negative experience.

Rand: Perfect example. So, the slides we’re presenting. You remember, a few days ago, I sent over a version of the slide deck. And Victoria wrote back and said, “Those fonts you sent me are really fun, but that is not the Perficient brand.” And so we’re changing because the tone didn’t suggest the right sort of brand and branding that Perficient has. And you can almost feel it, right? If you look down at the bottom right-hand corner of the slide, the two logos suggest…

Eric: Very different things.

Rand: Look. Eric is wearing gray and red, and Rand’s wearing all these different crazy colors. Eric has a single background and Rand has all these crazy toys behind him. Different tones, different brands. Obviously, Perficient is very B2B and full-service, and SparkToro is very self-service. So, it’s exactly what you’re talking about.

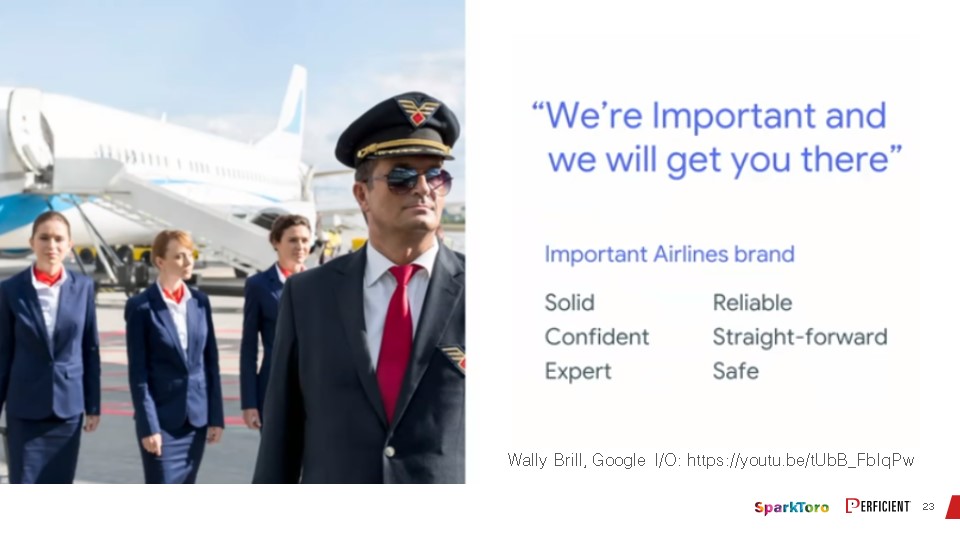

Eric: Perfect example. But let’s go ahead and step ahead. So, I wanted to give an example of two different fictitious brands.

And these slides actually are credited to Google. I should emphasize that. We’ll get that added before we send the slides out, or make the slides available to people. So, imagine that your target customer audience are business travelers. They need high reliability and they need to make sure that they’re going to get there. They want to be very confident. They also want you to respect their space and allow them to do what they want to do on the plane.

So, imagine that your brand name and your company name is Important Airlines. And the messaging is very important. “We’ll get you there. You can depend on us. It’s going to happen. You’re going to make your meeting on time.” There’s a note that the slide is from Google I/O. Sorry, I didn’t see it there, so the credit is there. And you should watch that video, if you’re interested in this kind of stuff, by the way. So this is the one kind of thing an airline could be.

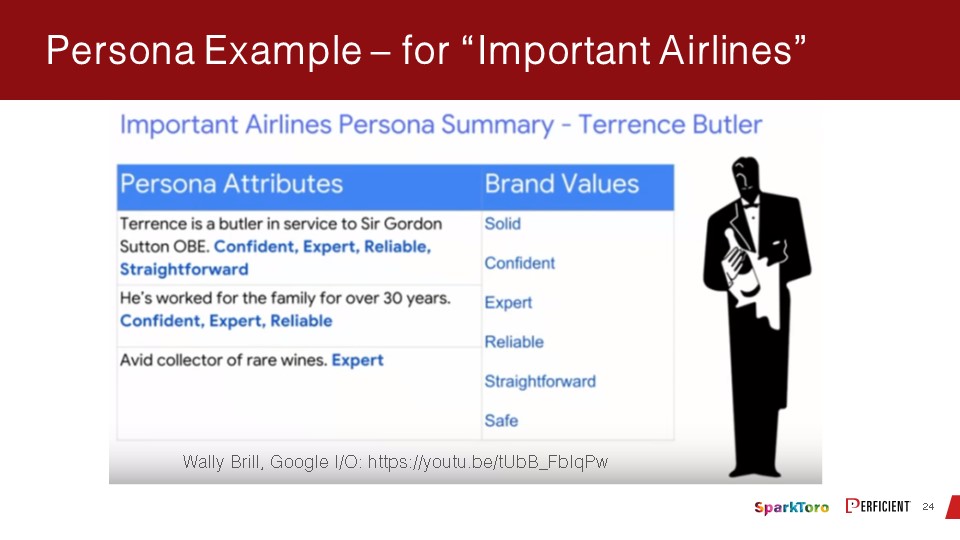

And if we look at what that would mean for how the airline would put together its persona, you might imagine that adopting a persona like the butler, which is very solid and confident, that expert in the things that they know, very reliable.

You know exactly what to expect, a very straightforward kind of personality.

Your interactions with them are very safe. It’s not going to be risqué or anything along those lines.

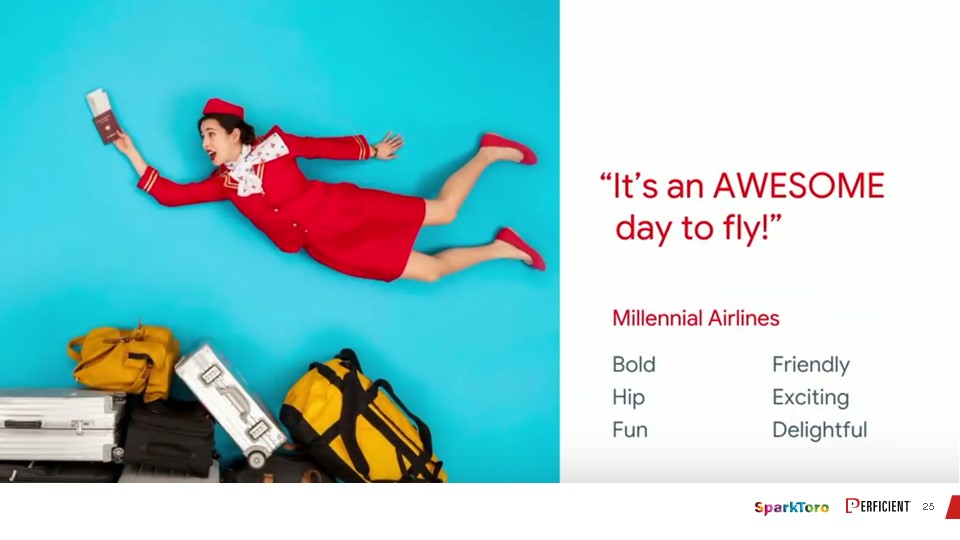

But in contrast, let’s look at a second airline. This one is Millennial Airlines.

The messaging is very different. It’s sort of a bold, hip, very active kind of brand. They’re friendly, you can expect to enjoy your flight. And the theme of this one is, “It’s an awesome day to fly.” It’s a very, very different kind of messaging.

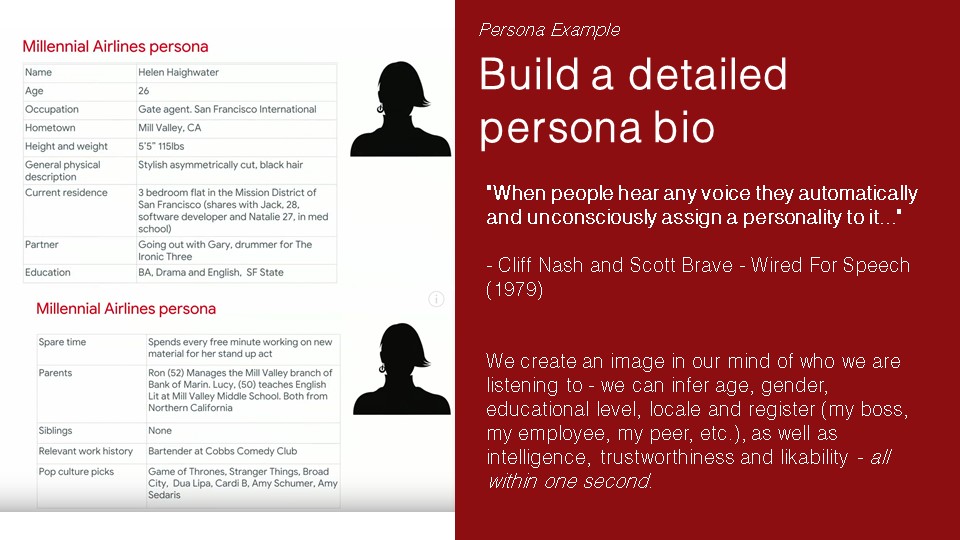

And the persona for that would be very different, too. This person is very fun-loving. You can see it in their fashion and their style and the way that they behave.

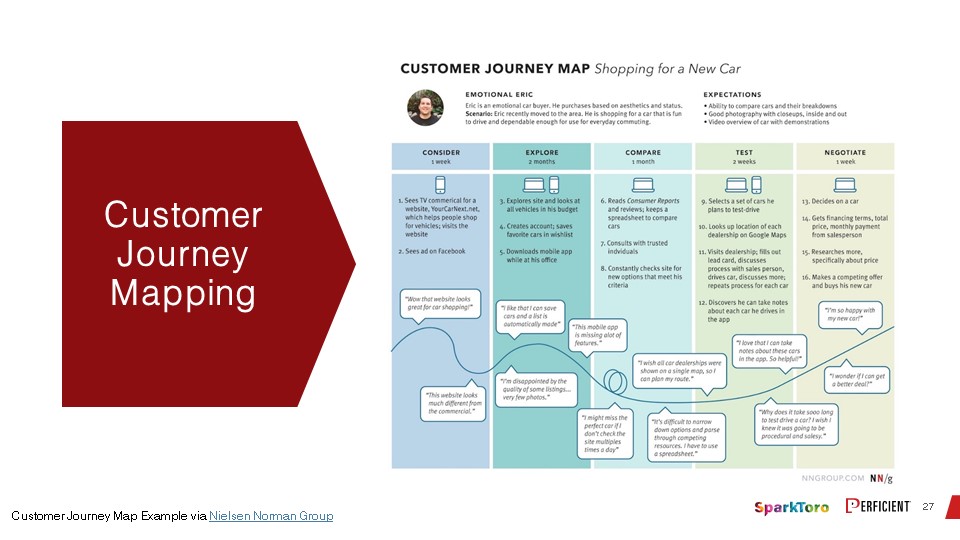

And so, this aspect, this persona, is looking at it from the company’s side. What they’re trying to with that, and what we’re trying to do with these examples, is to think about how we apply all this stuff that we talk about, and think about what we do with our business to reach our target audience. And that’s a big part of what we try to get to when we think about audience intelligence or persona modeling, or things of that kind. And then, people also talk about customer journey mapping. This is another common thing to talk about.

Rand talked about the funnel a little bit earlier, and you can imagine the progression that people have through the purchase funnel, from discovering your brand to learning more and considering it seriously, to conversion. There are different names that people give for these different steps. You need to understand what your audience is, and how they’re thinking in each of those stages in the funnel, so that you can target your content, your channels, and your messaging to each one of those segments. But I will mention this for fun before going on here. Rand has serious concerns about persona modeling. Maybe one or more of our clever audience members will ask a challenging question in that regard when we get there. Anyway, back to you, Rand.

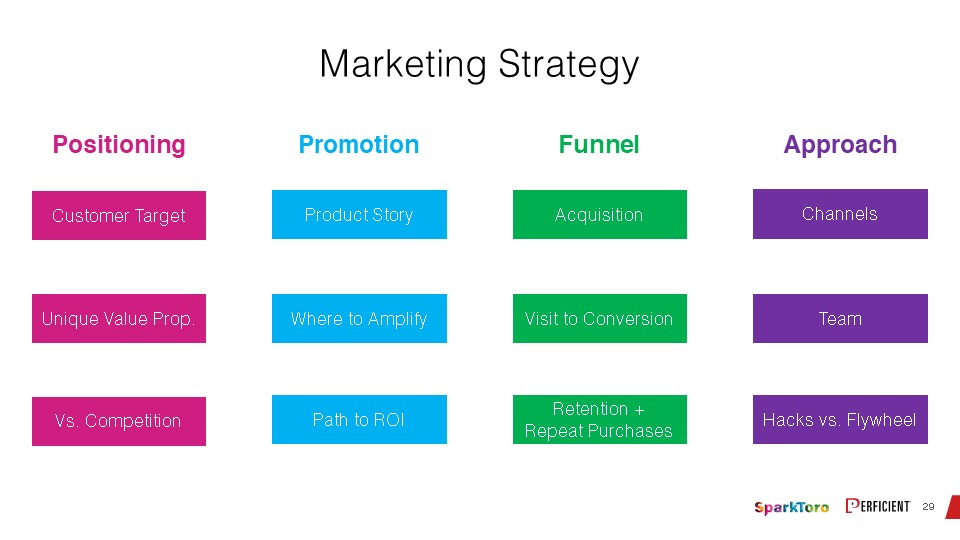

Rand: Thank you. So, we know that these forms of data — behavioral data, survey data, analytics data — all of it can be applied in two ways: to strategy and tactics. I want to spend a little time on that strategy and application piece.

On the strategy side, Eric, you talked about this a little with your persona modeling, there’s positioning data. Who is our customer target, who are we going after? What is the unique value proposition that we have for them? And how do we position that versus competition?

If you haven’t read it already, I love April Dunford’s book on positioning called “Obviously Awesome.” In “Obviously Awesome,” she talks about how your competition is not just direct competitors, it’s any solution that solves the same problem for your customer target. And then, you’re positioning yourself against those. And obviously, the state is hugely helpful in determining how you should do that positioning, in informing that. It also helps on the promotion side. What’s our product story? Where are we going to amplify this message? What’s our path to return? It’s super helpful in your funnel, figuring out your acquisition process. Your visit to conversion, what does that experience look like?

How does the step-through work? Is it high touch, like we talked about, self-service versus full-service? How do we engage and enable retention and repeat purchases? And then, it’s also about your marketing approach — the channels you’re going to use for acquisition, for retention, for messaging and promotion. The team you need to build — in-house entirely, small, big, big budget, small budget, organic, paid. Outsourced — agencies and consultants versus completely in-house. And hacks and flywheels. What’s the flywheel we’re trying to build, the thing that scales with decreasing friction in our marketing? And what are the points of friction we encounter that we need to apply hacks to, to get over those barriers?

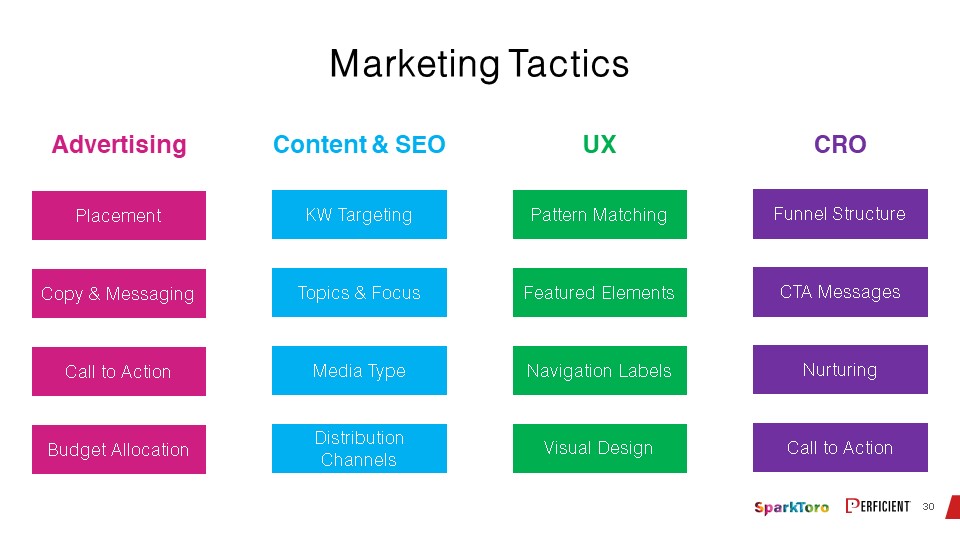

It’s also true that you need this for tactical stuff.

So if you are not a CMO, not a VP of marketing, not someone who’s setting strategy — but rather, you’re in the trenches doing the tactics, doing the work on the advertising side — this intelligence…audience intelligence, tells you where exactly, not just broadly, to do your placement. How to do your copy and messaging, how to refine that. If a message isn’t working, what should I attempt in order to reach people? Calls to action, budget allocation. On content and SEO, this is how you figure out your keyword targeting is a behavioral data source. It comes from Google or from a third-party SEO tool or from a clickstream data source. And it gives you exactly that insight. It helps tell you topics and focus, helps tell you media types you should use. Is video working with my audience? Is podcast working for my audience? Are webinars good for my audience? If you’re selling bone broth to consumers, webinar? Probably not. But video? Maybe. Gift recipes? Oh, heck yeah. Perfect, right? Same with distribution channels. User experience tells you which patterns people are familiar with, so that you can pattern-match in your product.

We experienced this a bunch when we were building SparkToro and trying to figure out, “What patterns are people familiar with and not familiar with?” “Can we show them a diagram like this?” “Will people understand a Venn diagram?” Okay, our audience is going to understand a Venn diagram, and that’s a great way to go. Other audiences, not so much. Featured elements, nav labels, visual design. This is, I think, why a lot of user experience and UI designers love persona model. And CRO — my funnel structure, my calls to action, and my nurturing, how do I get people through it? We’ll talk about a couple of tools and resources. Eric, I think you’re going to take a couple, and then I’ll take a couple.

Eric: You’ve got it. First, we’re going to talk about SurveyMonkey. It’s a great tool. Well, Typeform, SurveyMonkey and Google Forms, all three.

So, there’s this idea of real querying and getting real user information that Rand spoke about earlier. Survey 100 customers, great. Can you do 1,000? Great. Even 10, just so you can get some information and real dialogue. These are three great tools. Here at Perficient, we’re fans of all three.

Rand: I do have one suggestion here. What I love about Typeform is, if I have simple questions, I tend to have a higher response rate when I use Typeform versus the other two. I think it’s just a user experience thing. It’s easier and more fun to get through. And so, I tend to get about 20% higher response rate on Typeform. I don’t know if you’ve seen similar.

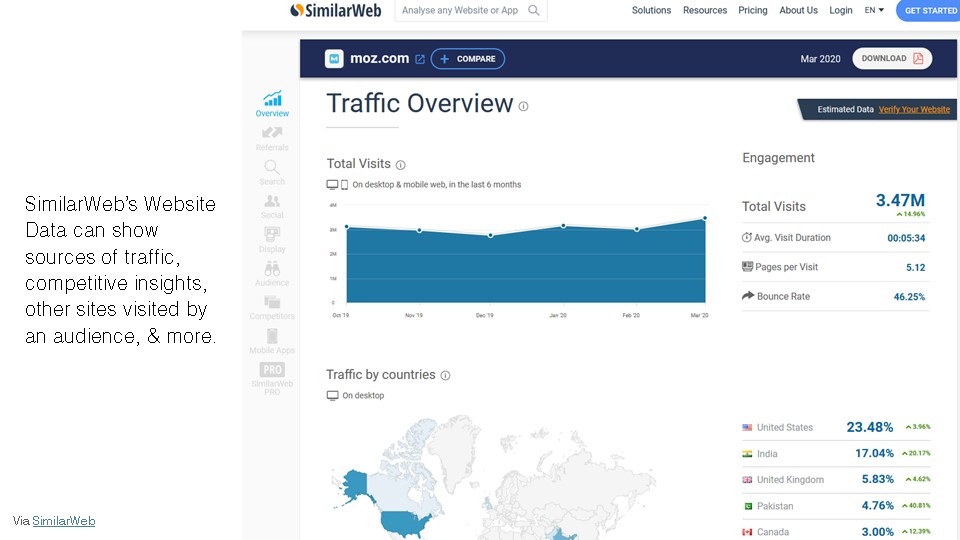

Eric: That’s good input. And then, I also want to talk a little bit about SimilarWeb.

So, we love SimilarWeb as a tool. It’s something that we use very actively here, within Perficient. You get really great insights on competitive marketplace data, competitive data, user engagement data that you can get.

I think one of the things that makes SimilarWeb particularly unique is the size of the audience sample they have, which is a relatively large sample. In fact, last I knew, it’s the largest sample of the tools available.

Rand: I’m a big fan of SimilarWeb as well. I really like being able to see, specifically, the sources of referral.

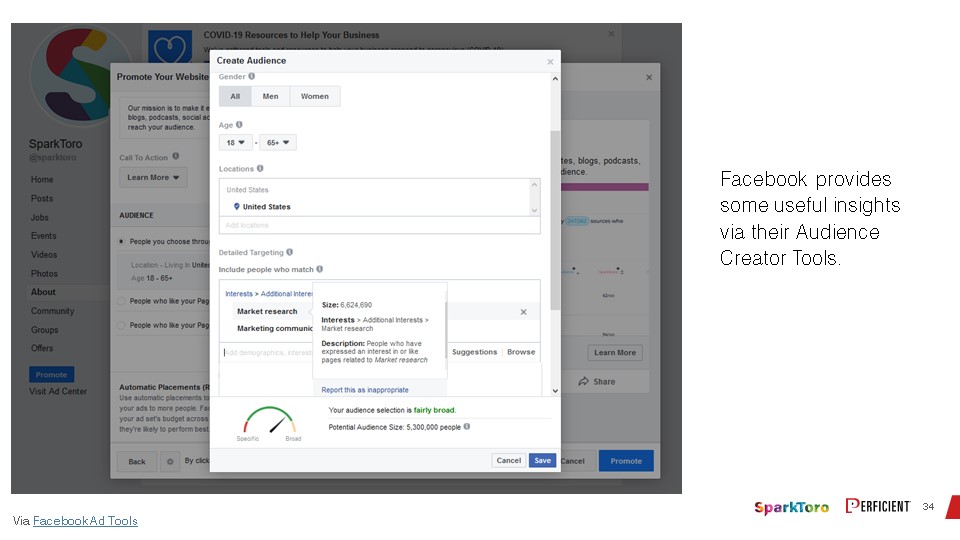

So, if you scroll down on this page. This is free, by the way. If you go to SimilarWeb’s site, you can see this data. And they have a pro version, as well. But I also find — it’s not as useful as it used to be — Facebook Audience Insights for your pages.

When you use Facebook’s Audience Builder inside the Facebook ad system, you can get some data on sizes of different audiences relative to one another.

I find Facebook’s numbers around these a little frustrating. I don’t actually think there are 6.6 million American users of Facebook who care about market research. That’s way, way, way too high. However, comparing market research versus search engine optimization can give me a sense of the sizes of those two different audiences. That’s what I like using the audience builder for. And you can get some basic demographics — geography, gender, etc.

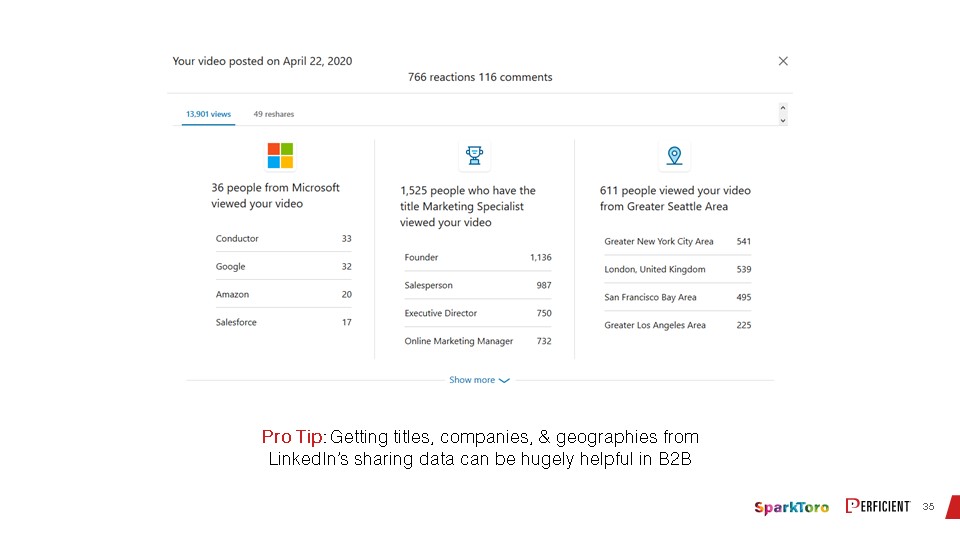

LinkedIn also has this really cool feature.

I don’t know if folks have seen this, but when you share content on LinkedIn, you can’t see this competitively — although, you are welcome to ask your friends and colleagues when they share content for this data.

But when you share content on your LinkedIn, you can see data about the people who viewed it and shared it, like this. It’ll show you the companies that they work for, it’ll show you the titles that they have, it’ll show you location and a few other data points. If you click, that’ll show more. This is super useful if you are in B2B audience intelligence gathering. Remember, I showed the blue, tiny circle of your current customers, but then that bigger circle of potential customers, and an even bigger circle of audience.

Eric: Okay. We are close to the end here. You want to just give a quick wrap-up before we take a couple of questions here?

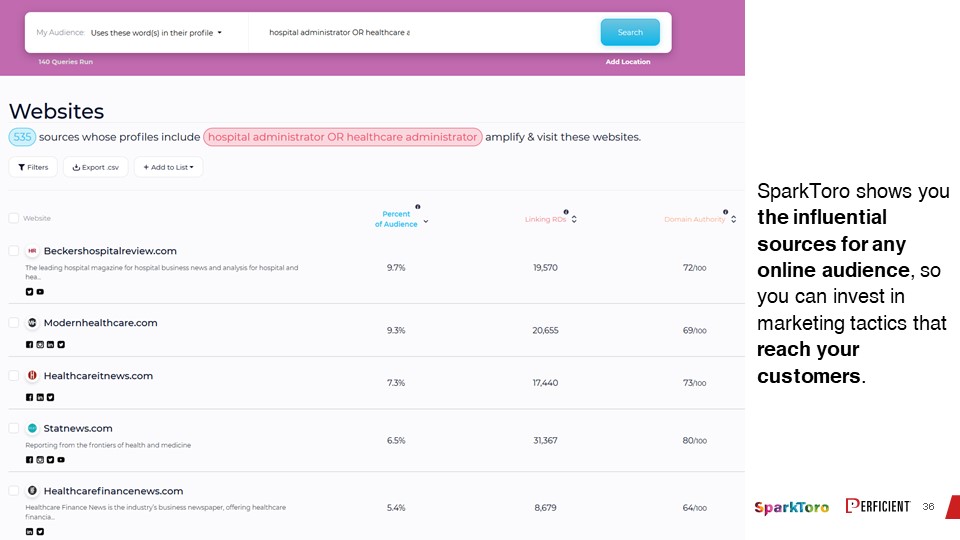

Rand: The final tool that we’re going to mention here and talk about is SparkToro, which obviously, I have a vested interest in.

I won’t be overly promotional, but you can run free searches. The idea with SparkToro is that you can get behavioral data at scale across tens of millions of profiles, similar to what SimilarWeb does, but not clickstream data. SimilarWeb is essentially behavioral across what people click, where they visit on the web, and where they go next and previously. And SparkToro is more about behavioral data gathered from social and web profiles —looking at, what do people share, engage with, talk about, follow.

So, we can show things like, what are the influential sources of influence for hospital administrators — an audience many people are trying to reach right now, are healthcare administrators. And then, you can see the websites they visit, the social accounts they follow, the YouTube channels they pay attention to. And it provides a sort of detailed behavioral data at scale.

This is a unique data type. I’m not actually aware of another company that provides this, so I don’t have a good competitive source of this intelligence. The best I could offer is what we saw some people substituting, which is the cyber-stalking at scale, where you go collect a large number of your audience’s social and web profiles.

Then you go crawl those, and manually build big spreadsheets to get this type of data about how they describe themselves, and what they visit, what they follow, what they engage with. So, with that said, I think you’ve got some great questions.

Eric: Before we take the questions, I just want to mention that I’ve got a completely uncompensated comment. I’ve been playing with SparkToro and see some really great, interesting insights from it. We had some things that we were trying to do, exploring an opportunity with clients around media in local markets, and were able to rapidly to get some really interesting and cool insights on the best places to extend that media. Lots of interesting applications for it. So, I’m very excited about the tool, Rand. Looking forward to doing much, much more with it.

Rand: It’s been exciting to see how people are using it.

Eric: So, question here from Kate Thomas, “What are your favorite tools or methods for measuring friction in the funnel that Rand showed in his slide?”

Rand: Great, great question, Kate. So, let’s see. There are two kinds of funnel friction. The one that I talked about is friction in your marketing funnel, meaning you’re having challenges getting from earning initial attention to getting a repeat visit, or from getting a repeat visit to getting someone to actually convert. And when you see those types of challenges — the best process that I’ve found is to try and segment the audiences that are performing well versus the ones that are not performing well. Sometimes, that’s based on source. Sometimes, it’s based on content they have or have not seen or engaged with. And sometimes, it’s based on who they are, or profile data.

And that last one is really tricky to come up with, but I do have an awesome tool for you. I just talked to the team yesterday at FullContact. They have this remarkable profile-connecting identity platform, so you can connect up data from banks and credit cards, from mobile user IDs, from social profiles, from email, all those things. And if you have any one of those data points, you can give it to FullContact. They’ll fill out all the rest and help you view this holistic view of visitors or email database or social followers, or whatever you’ve got for them. That can help you to segment that. That’s been a really good one.

Eric: And there’s actually a way to use simple analytics to do some of this too, right? So, you can see what pages people are bouncing off of, and I can actually tie it back to campaign sources. If you ran a campaign with one target audience of your segment, and then tried it on a different target audience, and ran it through the same funnel, you could see who is engaging better with that messaging versus not. So, there are things that you could do that are fairly straightforward.

Rand: The 90-day COVID thing has really frustrated a ton of those efforts, because you have much faster firing cookies than you used to, and privacy issues and stuff. But one thing I really like doing is nudging people to log in, somehow. Because if you capture an email address or a login, now, you don’t have to just rely on the visitor analytics, and you can see that longer lifespan. At Moz, people logged in to leave comments, or they logged in to give a thumbs up on a post, or whatever it was. Thus, we could see a bunch more about them, like — hey, it was highly predictive of, if you visited three or more of these blog posts that you would eventually become a customer. So, great funnel analysis tip there.

Eric: Yes. And then, this one looks like it’s for you. “Out of all the feedback and usage you’ve monitored so far…” — this is from Jeremy Galante — “…what has been the most surprising to your team?”

Rand: This is going to be slightly depressing, but I think very indicative of something that’s probably going on for a lot of people. I like to be very transparent about this stuff. So, at the end of February, we sent our first early access group — I think I mentioned this to you, Eric — that we had about 20,000 people on our early access email list. We sent the first group of those, about 3,000, at the end of February, and we had a very high conversion rate. Casey and I were celebrating. We were like, “Wow, we’re going to have a great launch.” And then, of course, March hit, and the pandemic hit.

And our conversion rates of the same group, that same group of 20,000 people, just another random set of 3,000 emails, performed at about 40% of that conversion rate two weeks later. and then about 10% of that conversion rate by the end of March. So, it was pretty frustrating to see that impact. But I know that’s true for many, many folks. If you’re in B2B, a ton of people have had their corporate cards pulled. A ton of people have had their finance teams come to them and basically say, “Hey, all new spending is frozen or has to get approved.” So, that was one of the most surprising things we saw.

Eric: I’ve got one last question here. Megan Jensen wants to know, “How important is at least a rudimentary understanding of psychology and/or behavioral economics in determining the nudges that will affect your audience’s online behavior? Any books or talks you recommend?” You’re about to get some books.

Rand: I’m pulling up my books, because what a great question. Happy to look at the bookshelf.

Eric: He wasn’t ignoring the question, Megan. He actually had already read it.

Rand: Exactly. So I really like both of these. Dan Ariely’s “Predictably Rational.” He also wrote another one called “The Upside of Irrationality” that I’ve got over there that I liked a lot. And then, “Nudge” is another brilliant book for that psychology of persuasion. There’s also a book by Professor Robert Cialdini, called “Influence: The Psychology of Persuasion.” I highly recommend that.

Eric: I’ve seen Robert Cialdini speak before. He’s a great speaker, very educational. So, there was a lot of insight there. I’m going to sneak one more question in here. And I apologize, Ester, if I mispronounce your last name, Ester Liquori. And the question is, “What is your experience with AI-based platforms for audience intelligence?”

Rand: Okay. So, I did a little bit of competitive research when we were starting SparkToro into this space. And I found two things to be true. One, almost no one who says they’re an AI-based platform is actually using any form of artificial intelligence. Some are using machine learning, in an attempt to build in missing components or predict things like sentiment or attributes of an audience. I think big consumer brands probably find those pretty valuable. But my market, at least for SparkToro, tends to be more SMB, more mid-market, more agencies and consultants, and more detailed, tactical types of applications versus Louis Vuitton, Moet, or Hennessy trying to figure out, “Where should we launch our next big liquor brand in South America,” right?

And so, my use cases for that, they didn’t resonate with me as much. But I think if you are a big brand attempting to get those consumer insights from some of the ones that call themselves AI, but are mostly machine learning, it can be useful.

Eric: Just be careful. Things like “AI” and even “machine learning” are both phrases that people like to use out there. And “artificial intelligence” is a phrase that people like to use for anything, almost, that involves the computer. And machine learning is what most people are actually doing, which is a very powerful and useful sort of thing. But it’s just a way of trying to train equations, if you will — and I’m being liberal here, which is what it does. It trains the equation to fit the existing data, so that you can predict where other data points will fit along the curve. And that’s effectively what you’re doing with machine learning. It could be very, very useful, but you still need to feed it real, hardcore information. And the more you give it, the better.