SWIFT MT (Message Type) messages are standardized financial messages used by financial institutions worldwide for secure communication and transaction processing. They follow a structured format, categorized by a three-digit code (e.g., MT103, MT202) that indicates the message type and its purpose within the financial transaction lifecycle. A generation of young wire room staff started their careers learning that the three-digit codes in SWIFT MT messages have the following meaning:

- The first digit represents the message category (e.g., 1 for customer payments, 2 for financial institution transfers)

- The second and third digits specify the specific message type within that category.

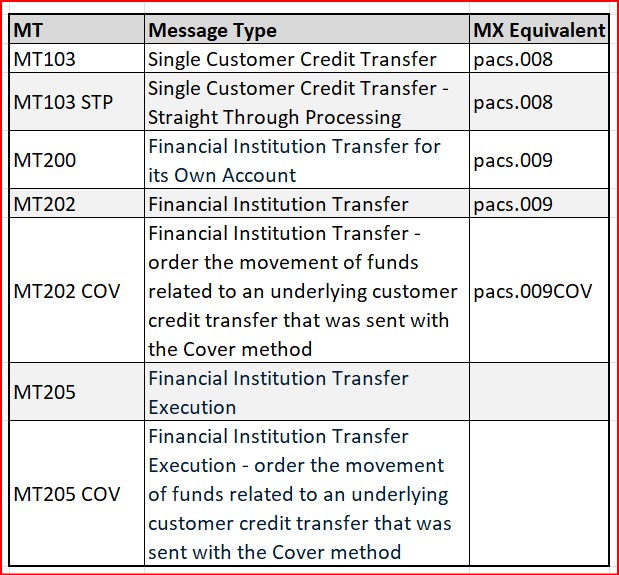

However, SWIFT has announced that effective November 22, 2025 Financial Institution to Financial Institution (FI to FI) instructions must be sent to SWIFT in ISO (MX) format. MT cash instruction message types will be disabled in SWIFT input. SWIFT will NAK (Not Acknowledge) MT cash instructions. Therefore, financial institutions need to completely update their messaging tables for the following:

The following message types will be discontinued, and therefore do not have an MX equivalent:

- MT102

- MT102 STP

- MT103 REMIT

- MT201

- MT203

SWIFT has not yet announced an end date for:

- MT version of non-cash instructions (reporting, statements)

- MT SCORE service (SWIFT for corporates)

- Market Infrastructure Closed User Group (MI-CUG)

- Corporate to FI Member Administered Closed User Group (MA-CUG)

Ready to explore your firm’s payments strategy?

Our financial services experts continuously monitor the regulatory landscape and deliver pragmatic, scalable solutions that meet the mandate and more. Reach out to Perficient’s Financial Services Managing Director David Weisel to discover why we’ve been trusted by 18 of the top 20 banks, 16 of the 20 largest wealth and asset management firms, and are regularly recognized by leading analyst firms.