A top-leading bank, grappling with business and regulatory challenges, faced scrutiny after failing the Federal Reserve’s annual stress test. Addressing these deficiencies required a comprehensive approach, leading to the establishment of critical programs like the US Bank Holding Company (BHC) regulatory and comprehensive capital analysis and review (CCAR) program. To bolster its capabilities and ensure […]

Posts Tagged ‘Financial Services’

Two Perficient Colleagues Quoted in Forrester Report on Emerging Insurance Technologies

Insurers are constantly striving to improve their operations, provide better experiences for customers, and minimize risks. Perficient insurance experts were interviewed for Forrester’s report, “The Top Emerging Technologies In Insurance, 2024,” and discussed technologies expected to emerge in the insurance industry over the next five years, considering them now, and in the short-term, medium-term, and […]

6 Emerging Trends in Wealth and Asset Management for 2024

Co-authored by Perficient’s Wealth and Asset Principal: Gerardo Montemayor Influenced by an array of factors spanning from the transfer of generational wealth to technological progressions, Gerardo Montemayor, Perficient’s Principal in Wealth and Asset Management, has offered valuable insights into the trends poised to reshape the industry in the approaching year. 1. Wealth Transfer As older […]

5 Tactics to Safeguard Institutions Against Senior-Level Embezzlement

Protecting financial institutions from the perils of high-level embezzlement requires a proactive approach rooted in ethical conduct and stringent compliance measures. To fortify defenses against such threats, financial entities must implement proactive measures aimed at ensuring ethical conduct and compliance within their organizations. This blog outlines five key strategies to safeguard your business and mitigate […]

Transforming Treasury Market Regulations

On December 13, 2023, the Securities and Exchange Commission (SEC) made a landmark decision by voting to adopt significant rule changes mandating central clearing of certain secondary market transactions within the U.S. Treasury market. These transactions include repurchases (repos), reverse repurchases (reverse repos) and U.S. Treasury securities. The rule change, one of the most substantial […]

Top 6 Trends for the Banking Industry in 2024

This blog was co-authored by Perficient banking expert: Scott Albahary A slowing global economy, coupled with a divergent economic landscape, poses challenges for the banking industry in 2024. Driven by technological advancements, regulatory changes, and shifting consumer preferences, the banking industry must evolve and respond accordingly. As institutions adapt, Perficient’s financial services expert, Scott Albahary, […]

Perficient Interviewed for Forrester: The Future Of Insurance

With new risks, shifting market dynamics, and the unstoppable march of technology, the insurance industry finds itself at a crossroads. The imperative for transformation has never been clearer, and this is highlighted in Forrester’s report, The Future Of Insurance. Embracing Change The report states, “The business of insurance is in a heightened state of transformation…,” […]

NYSDFS Part 500 Cyber Amendments Finalized: What You Need to Know

This blog was co-authored by Perficient Risk and Regulatory CoE Member: Alicia Lawrence The announcement of significant amendments to the New York State Department of Financial Services (NYSDFS) regulations on December 1, 2023, represents a pivotal moment for entities operating within New York’s financial sector. The NYSDFS Part 500 amendments signal a crucial shift in […]

Resolution Plan Submission Period Extended by Key Financial Agencies

In discussions with financial services executives, Perficient consultants consistently explore the extension of the submission deadline for resolution plans among certain large financial institutions with assets exceeding $250 billion. Moving forward, these institutions will need to submit their resolution plans by March 31, 2025. Guidance For Institutions This guidance applies to institutions with assets exceeding […]

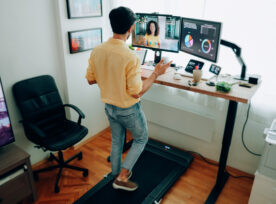

Future-Proofing Financial Services: Rule 3110 Updates Empower Brokers

This post has been updated to reflect FINRA Regulatory Notice 24-02, issued January 23, 2024. The COVID-19 pandemic prompted several unprecedented shifts in society, notably impacting the workplace and necessitating the adoption of innovative technologies that facilitate collaboration and efficiency in a work-from-home (WFH) environment. For brokers, in the financial services sector, remote work became […]

A Guide to Fortify Your Institution Against Senior-Level Embezzlement Risks

This blog, the first in a series by Perficient’s Risk and Regulatory Center of Excellence (CoE), provides actionable measures your company can adopt to safeguard against senior-level embezzlement risks and maintain the integrity of your institution’s financial transactions. Background On October 19th, 2023, the Office of the Comptroller of the Currency (OCC) published an article […]

Perficient Recognized in Forrester’s AI Services Landscape

As we step into 2024, the transformative impact of Artificial Intelligence (AI) and generative AI on enterprise-level organizations has reshaped the business landscape in profound ways. The continual evolution of these technologies has empowered businesses to leverage advanced algorithms, predictive modeling, and generative capabilities, driving unprecedented innovation and efficiency. From enhancing decision-making processes to revolutionizing […]