This session was full of mobile and online banking statistics, strategic direction and insights from two of the top retail banks in the U.S. Accompanied by Fiserv and Backbase, banking leaders from U.S. Bank and USAA shared stories of customer adoption and penetration of mobile, tablet and online channels. USAA has been in the news a lot as of late ranking at the top of recent surveys for their mobile app and customer service.

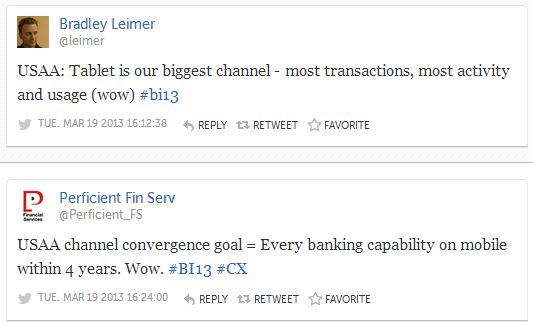

On social media, there were a couple “wows” coming from the audience as we heard about the commitment to channel convergence at these institutions. For me, one of the biggest statements of the session came from USAA’s Steven Armstrong when he told Bank Innovation attendees that it was their CEO’s strategic objective to have every capability on mobile in the next four years – yes FOUR years. That’s a lot to think about, and functionality to address, across their mobile and tablet platforms!

On social media, there were a couple “wows” coming from the audience as we heard about the commitment to channel convergence at these institutions. For me, one of the biggest statements of the session came from USAA’s Steven Armstrong when he told Bank Innovation attendees that it was their CEO’s strategic objective to have every capability on mobile in the next four years – yes FOUR years. That’s a lot to think about, and functionality to address, across their mobile and tablet platforms!

One of the more amusing comments was hearing Armstrong refer to USAA’s website as a “legacy” platform for them. For many banks, they’re still trying to make online banking a comprehensive service delivering a positive experience for their customers. Check out some of the top tweets from this session.

Some key takeaways from this session:

1. Digital disruption caused by technology innovators and behavioral changes in consumers have caused a big change in bank models today.

2. The bank customer experience today is siloed and needs to be brought together across platforms.

3. As Jelmer de Jong of Backbase stated, the Internet can be more personal. Focusing on enabling digital relationship marketing across channels will be the future of the customer experience in banking. This can be achieved through contextual targeting and customer segmentation using mobile, web and content management tools.

It will be interesting to see what adoption and penetration for some of these channels looks like in the years to come. Will I submit a mortgage application on my smartphone someday soon? Instead of calling a contact center, will I video chat with a bank customer service representative on my tablet? Will my bank have an online interface for Facebook? Probably.