So, you’re the CEO of a national banking corporation or a national savings bank. Therefore, your primary federal bank regulator is the Office of the Controller of the Currency (OCC). The OCC conducts frequent on-site examinations as they investigate, prepare, and then issue its reports of examination. Not only do you and your staff get to experience the joy of hosting the OCC examination teams, but your financial institution also gets to pay for the examinations.

2022 Assessment Schedule

As of January 1, 2022:

- Assessments are due March 31 and September 30, based on call report information as of December 31 and June 30, respectively. The assessments cover the six-month periods beginning January 1 and July 1, respectively. For example, the assessment due March 31 covers the period January 1 through June 30.

- The OCC sends the assessment invoice, which includes the calculated assessment fee due, and drafts the fee amount on March 31 and September 30. The OCC provides at least seven business days’ notice of the amount to be drafted from an institution’s designated account. The institution is responsible for ensuring that the account is funded properly on the due dates.

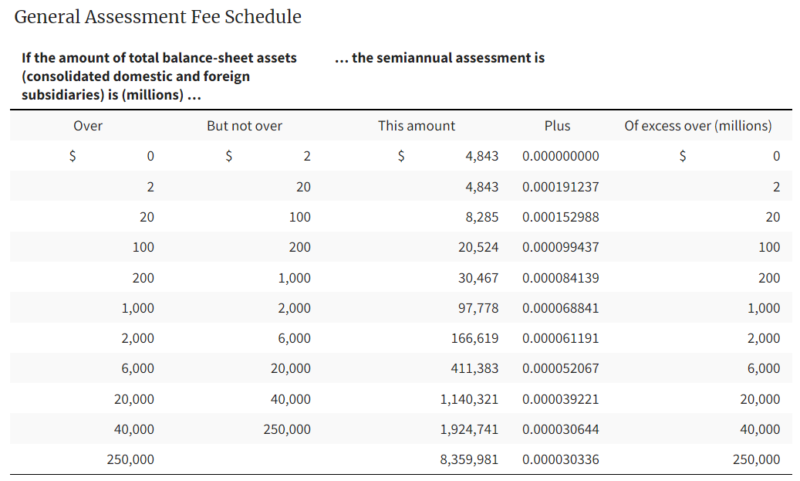

The general fee schedule is as follows:

Banks that are lower-rated and therefore have more frequent contact, are charged additional fees at the rate of $155 per hour.