The rise of digital-only banking is an international phenomenon. New digital-only banks, also known as neobanks, are being launched and fighting for market share in locations across the globe including the US, Canada, UK, Germany, Belgium, India, UAE, Israel, and Hong Kong.

To a customer, the advantage of a digital-only bank is the promise of superior financial returns. Without the cost of physical branch offices and the personnel costs to staff them, their expense base is greatly reduced. Digital-only banks can, therefore, offer customers lower fees and higher interest rates on deposits.

Digital-only banks are also leveraging the cloud to further reduce capital expenditures and gain agility over traditional banks with their on-premises data centers, networks, and legacy application infrastructure.

So why have neobanks not flourished? Currently, digital-only banks remain a niche market, as they have not yet realized their potential to create the necessary customer experience and offer the range of products, services, and support required to gain significant market share. Customers also worry about the security of their financial information given the limitations on the cybersecurity resources dictated by the financial constraints of some of the neobanks. In fact, Symantec, a leader in cybersecurity, stated that one major bank’s cybersecurity team would be bigger than the total headcount of all the neobanks combined.

Customer Experience

Since digital-only banks have no physical presence, their online customer experience needs to be exceptional in order to compete with traditional banks. Their mobile and web applications must provide for a complete range of transactions and customer support activities, whereas a traditional bank’s online presence is offered as an adjunct to their physical branches. As such, digital-only banks must not only provide for online account creation – including the capture of all forms, proof of identity, and signature verification, required by practice and regulation – they must also support the full range of banking services customers require. This is one area in which digital-only banks have thus far failed to meet their potential.

Many neobanks, for example, do not offer loan products, either by design or due to the immaturity of the platform. Their formula for achieving profitability is through the offering of chargeable premium accounts and services or cross-selling third-party products, such as insurance.

Since lending products, such as personal loans and mortgages, are the key income generator for traditional banks, the long-term business prospect for many of these startups is suspect.

Even if digital-only banks crack the code on providing the ultimate customer experience, they will be challenged to overcome the perceived shortcomings of the online presence of traditional banks. While the focus on providing an exceptional customer experience (CX) is not the exclusive purview of digital-only banks, traditional banks are lagging, forced to integrate their online presence with their legacy banking platforms, falling back on their physical branches to augment the customer service process where necessary.

Customers dissatisfied with the online experience of brick and mortar banks project their disappointment onto that offered by neobanks, sight unseen. Customers are unwilling to give up access to physical branch offices, no matter how much they disdain the concept, as it serves as a safety net should it be needed.

Although 70% of millennials stated they would rather visit the dentist than their bank branch, a 2019 study indicated that fewer than half of millennial respondents, ages 18 to 34, said they’d consider moving their accounts to a digital-only institution. One study found that, although 27% of US millennials felt that digital apps are the most important service their bank provides, another survey found that 43% of millennials had abandoned mobile banking activities because the process took too long or was too complicated.

Digital-only banks, therefore, need to actively promote the superiority of their customer experience to overcome the resistance to forego the security blanket of a physical bank branch. As many of the neobanks do not have the marketing resources to promote their CX, this leaves them subject to a range of preconceived, negative opinions.

Customer Demographics

Digital banking appeals to certain demographics, such as Millennials, while having little appeal to others, such as retirees. Consumers aged 18 to 24 are the heaviest users of mobile banking, with 82% of smartphone owners in this demographic segment using mobile banking as compared to only 29% of the 65+ age group. Millennials, as a demographic, have their own, unique financial issues for which they need guidance and assistance:

- Millennials are burdened with student loan debt that’s higher than ever

- Millennials have to save longer to buy a house

- Millennials are shelling out money for soaring rents

- Many millennials are struggling to build wealth

- More millennials are caring for aging parents – and spending more money doing so

- Many millennials rely on their parents for financial assistance

- Millennials need to save more money for retirement

Digital-only banks looking to differentiate themselves would be well advised to extend their customer experience plans to include advice, guidance, products, and services, to assist these customers in a strategy for managing their expenses and debt while investing for the future.

Coexistence

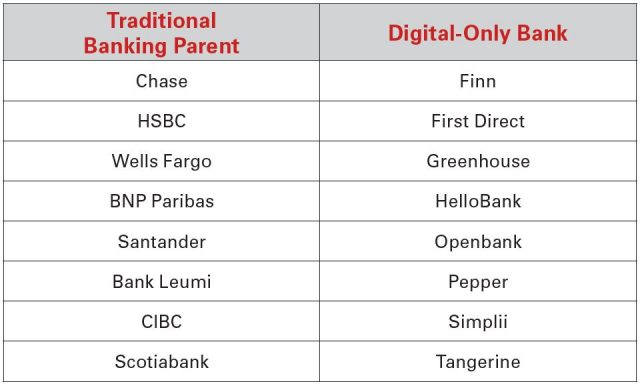

Launching digital-only banks with their own distinct branding have become a trend among established banks. JPMorgan Chase rolled out its digital-only challenger bank, Finn, in the summer of 2018, joining the likes of similar neobanks launched by HSBC, Santander, and Bank Leumi. It’s interesting that in January 2018 some of these banking ventures were noted as being among the 25 most important digital-only banks to watch in the future.

It’s equally interesting to note that by July of 2019, the Finn neobank was shuttered by JPMorgan Chase. This provides great post-mortem insight as to where these neobanks may flourish or why they may fail. In the year it was open, Finn only signed 47,000 customers. Industry analysts have numerous theories as to why Finn failed, but the common rationale is that the offering was not differentiated enough from Chase’s nationwide brick-and-mortar banking services. As there was no meaningful advantage for customers to sign-up for Finn over a traditional Chase account, it was not viable as its own entity.

The lesson is that traditional banks that want to launch an independent, digital-only offering must provide a unique incentive to attract clients. Regional brick-and-mortar banks could leverage a separate digital-only offering to expand their reach well beyond their current geography and potentially cater to a new demographic. National traditional banks will need to differentiate their spawned neobanks via favorable rates, lower fees, a superior CX, and millennial-specific products and services.

Conclusion

Industry analysts are lined up on both sides of the digital-only banking debate; some predict them to gain significant market share while others predict their demise over time. It must be understood that the success or failure of digital-only banking is not a singular question but rather a multifaceted issue dependent on each neobank’s range of products, services, customer experience, technological prowess, financial resources, and geographic and demographic target customers.

Even with a sound strategy and sufficient capital to support a comprehensive security program and marketing plan, a neobank must provide an unparalleled customer experience that is capable of supporting all required transactions.

Where Do You Stand?

No matter what type of bank, an independent assessment of your CX can reveal where it can be improved to gain a competitive edge. In order to be effective, this requires a comprehensive understanding of the financial services landscape, expertise in CX design, and deep knowledge across multiple technologies.

Our proprietary jumpstart tool, the CX IQ, can evaluate a company’s effectiveness in creating, delivering, and sustaining a compelling customer experience across 57 attributes/capabilities in seven CX dimensions: customer insight, strategy, design processes, enabling technologies, operations, measurement, and culture.

We offer a six-week jumpstart engagement as an effective way to engage the management team, create alignment, and guide decisions about where and how to improve CX. As part of your CX IQ engagement, you’ll receive a CX IQ scorecard, a summary of data and metrics to explain the CX score, and an action plan with a prioritized list of defined CX projects, and a full day CX workshop event.