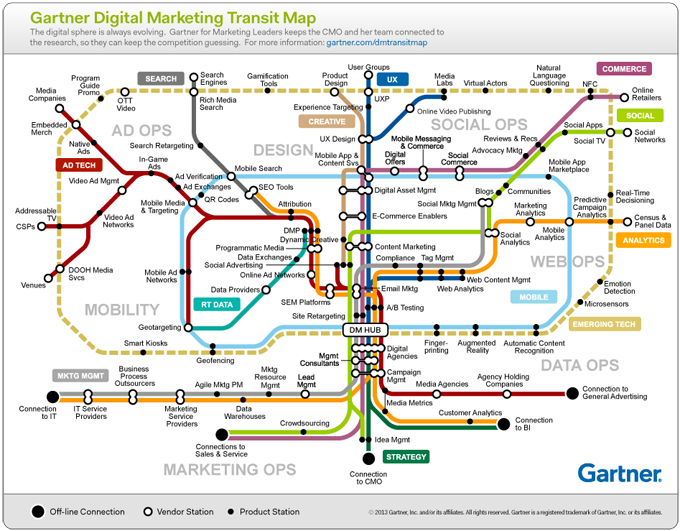

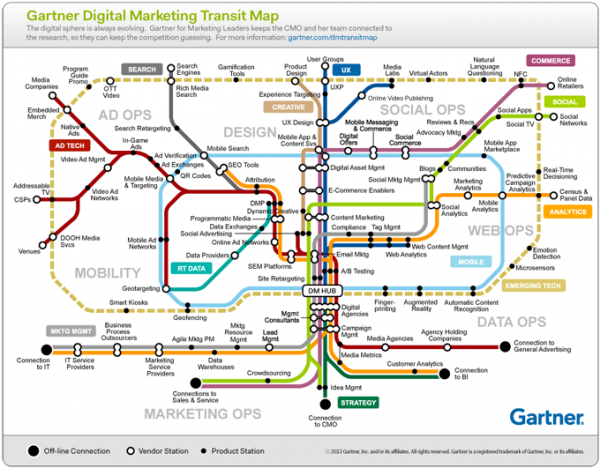

CMSWire and a peer from our Portals and Social Business practice both shared a pretty cool infographic from Gartner that illustrates the need for CMO and CIO collaboration to define an organization’s digital direction. I thought I’d put it into context though for the financial services industry with a brief post.

The topic of customer engagement will continue to be front and center in the financial services industry and marketing will be leading these priority objectives in 2014. To accomplish these goals, enterprise technologies like Customer Experience Platforms (CXP) and marketing automation tools will be critical to deliver more personalized banking experiences across channels and devices. But this is only one example of how the digital marketing landscape has evolved over the past few years. Gartner’s graphic really speaks to the complexity of and need to understand the inherent relationships between business functions, applications and technologies that exist today. There have been a lot of articles published as of late talking about how CMOs will be spending more on IT than CIOs. It is hard to disagree with this point of view as you examine this diagram.

2014 CMO Planning Initiatives

Here’s just a taste of what Banking CMOs will be faced with managing in 2014:

- Evolving strategies for Social and Emerging Technologies

- Executing on Marketing, Web and Customer Analytics strategies

- Managing the connection to Sales, Service and Commerce

- Maintaining Web and Content systems

- Integrating CRM systems and Enterprise Marketing Management tools for campaign management and cross-channel marketing

I really could go on and on…

The bottom line is this – the role of the CMO has changed as marketing departments now rely heavily on technology to do their jobs and continue to drive growth for a financial institution. CMOs that can embrace this challenge and collaborate with IT, be agents of change, and build digital strategies to reach and engage the customer will set the bar for others to follow. If banks are being forced to take an “outside-in” approach to understanding and serving their customers, doesn’t it make sense to have the CMO lead customer-driven business and technology decisions?