Green Dot Corporation is on a mission to reinvent personal banking for the masses. Its market leading brand of prepaid debit cards and prepaid reload services are available to consumers at more than 60,000 retail locations nationwide and online. In early 2012, Green Dot made a move in the mobile space by purchasing Loopt, a location-based mobile application developer, for a reported $43.4 million. Analysts eluded to the possibilityof Green Dot becoming a more formiddable opponent for traditional banks with this deal.

On the tails of this acquisition the company hosted a live event today unveiling its new mobile bank account product called GoBank. With all the buzz in the financial services industry around prepaid , and other mobile banking innovators in the space like Simple and Movenbank, the Perficient Financial Services practice was excited to see what Green Dot had in store for its mobile solution. Would it be a game-changer for this prepaid card company and a threat for traditional banks and non-bank service providers? Based on the strategic initiatives outlined in the acquisition of Loopt, we expected to see Green Dot focus on mobile wallet capabilities, payments and location-based mobile marketing services…and let me just say – we were pleasantly surprised with what GoBank has to offer!

Green Dot kicked off the product launch with a consumer video talking about their dissatisfaction with banks and overdraft fees. This has traditionally been the approach for prepaid card providers to capture wallet share from consumers that don’t have an affinity towards their bank. Steve Streit, founder and CEO of Green Dot, talked a lot about the future of banking and referenced a recent survey they released called, “The State of the Bank” which summarizes supporting details around development of GoBank to meet today’s consumer needs.

What Makes GoBank Different?

As Streit stated, GoBank is an “easy, fast and fun” personal banking experience that distinguishes itself from competing online banking applications. It was apparent that Green Dot paid particular attention to the customer experience with the banking account specifically designed for smartphone users. The account opening process (done on your mobile device) takes minutes and provides users with the ability to take advantage of value-add services like a personalized Visa debit card using a Facebook photo. Streit also described GoBank as a “feature-rich” account that provides a lot of helpful banking services and access to more than 42,000 ATMS nationwide (twice that of Chase and Bank of America). Although there are some similarities to Simple, it is also very unique. Here’s a summary of some of the pretty innovative features available with GoBank:

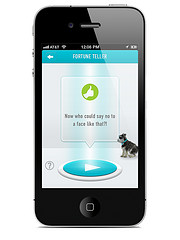

- Fortune Teller (a PFM tool similar to Banno) – pretty slick!

- P2P Social Payments from Facebook notifications, email or mobile numbers (GoBank customers or using PayPal)

- Online Checkbook and Bill Pay

- Direct Depost (using Remote Deposit Capture)

- Deposit Funds (at Walmart locations)

- Account Security settings with customizable push notifications (all managed from the app)

Pricing Structure

In addition to these pretty slick mobile banking features, two things I found pretty impressive were that there would be no overdraft fees and they had a voluntary monthly fee that users could chose to reward or penalize Green Dot based on how well they liked the GoBank service. I thought this was a nice touch by Green Dot to develop a better banking relationship with their customers.

Overall, I’m excited to use give GoBank a test drive! The social media integration, payment capabilities, PFM-like tools, and only 4 fees for their service, make GoBank look like a fun and affordable mobile-centric banking account alternative.

Room for Growth

The one surprise for me was there was limited social integration at this point with mobile checking accounts. Loopt was all about location-based offers and mobile marketing. GoBank didn’t include the ability to receive mobile deals for retailers based on a user’s location. Maybe that’s something that’s in the future for GoBank? I hope so. That’s the direction that traditional bank’s mobile applications and mobile payments are headed, and it would create even more added value with their mobile checking account.

How Will This Impact the Market?

Green Dot has positioned the GoBank product well in a competitive marketplace (in a very unique niche) up against banks, online banks, non-banks and prepaid cards. Although the product isn’t directly taking on Google Wallet, ISIS and similar mobile wallet solutions, it does add a considerable amount of “noise” to the mobile banking and payments landscape. The release of Bluebird as a prepaid product and bank replacement a few months back by American Express was seen by many as a threat to Green Dot in the space. GoBank is an FDIC member and operates as a bank, whereas Bluebird is not FDIC insured. Will this hurt the GoBank competitor? I think so.

The “bank like” features of GoBank’s mobile app are marketed well up against its checking/debit account alternative Bluebird. The overall design and user experience are also superior to Bluebird’s mobile app. The social banking appeal, easy-to-use features, large ATM network, accessibility to add funds, and of course the no overdraft fee promise, make GoBank a true player in banking. Green Dot has done a fine job of bridging qualities of both a bank and technology company to address consumers in this digital age.

Interested in learning more about GoBank? View the recording of the Green Dot event here.